Question

2. Suppose that: (i) The spread on a 5-year par floater bond issued by company X is 3% (ii) A 5-year credit default swap

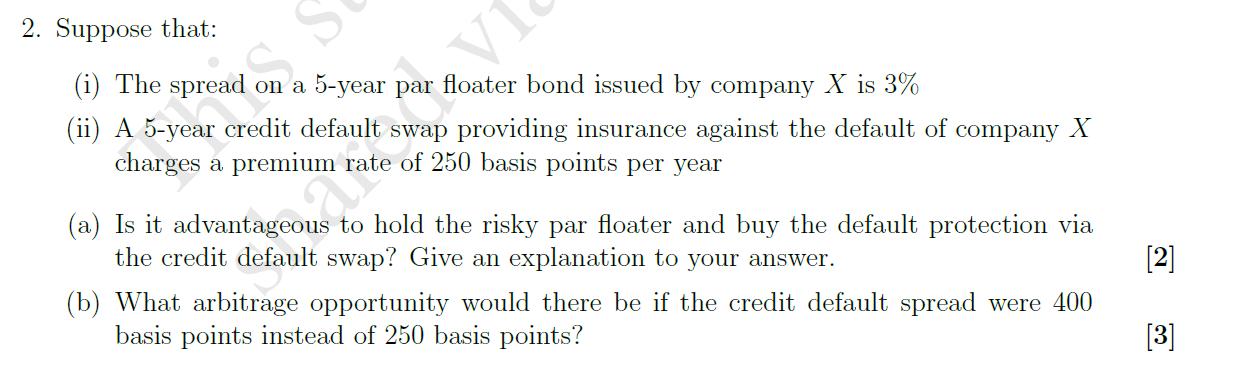

2. Suppose that: (i) The spread on a 5-year par floater bond issued by company X is 3% (ii) A 5-year credit default swap providing insurance against the default of company X charges a premium rate of 250 basis points per year (a) Is it advantageous to hold the risky par floater and buy the default protection via the credit default swap? Give an explanation to your answer. (b) What arbitrage opportunity would there be if the credit default spread were 400 basis points instead of 250 basis points? [2] [3]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a It is advantageous to hold the risky par floater and buy th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Options Futures and Other Derivatives

Authors: John C. Hull

10th edition

013447208X, 978-0134472089

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App