Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Susan and Jeff each makes deposits of 100 at the end of each year for 40 years. Starting at the end of th 41st

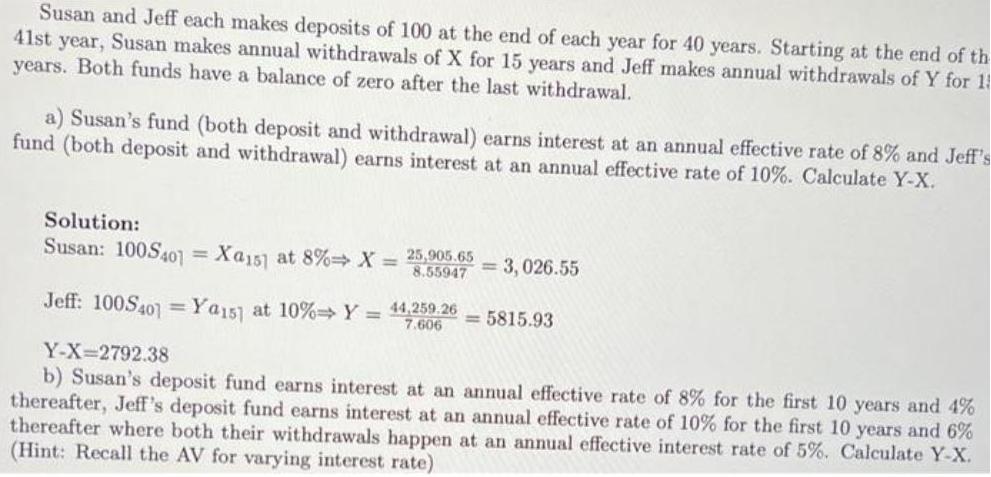

Susan and Jeff each makes deposits of 100 at the end of each year for 40 years. Starting at the end of th 41st year, Susan makes annual withdrawals of X for 15 years and Jeff makes annual withdrawals of Y for 1 years. Both funds have a balance of zero after the last withdrawal. a) Susan's fund (both deposit and withdrawal) earns interest at an annual effective rate of 8% and Jeff's fund (both deposit and withdrawal) earns interest at an annual effective rate of 10%. Calculate Y-X. Solution: Susan: 100S401 Xa151 at 8% X = 25,905.65 8.55947 = 3, 026.55 %3D Jeff: 100S401 =Ya15] at 10% Y = 44,259.26 7.606 = 5815.93 %3D Y-X=2792.38 b) Susan's deposit fund earns interest at an annual effective rate of 8% for the first 10 years and 4% thereafter, Jeff's deposit fund earns interest at an annual effective rate of 10% for the first 10 years and 6% thereafter where both their withdrawals happen at an annual effective interest rate of 5%. Calculate Y-X. (Hint: Recall the AV for varying interest rate)

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution Given Data FV of the deposits is p 11r Susa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started