Answered step by step

Verified Expert Solution

Question

1 Approved Answer

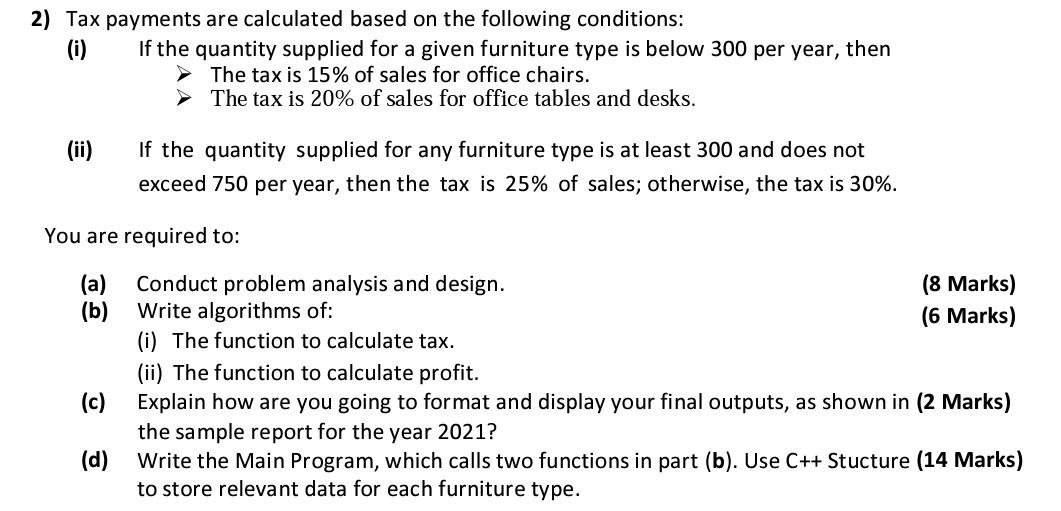

2) Tax payments are calculated based on the following conditions: (i) If the quantity supplied for a given furniture type is below 300 per year,

2) Tax payments are calculated based on the following conditions: (i) If the quantity supplied for a given furniture type is below 300 per year, then The tax is 15% of sales for office chairs. The tax is 20% of sales for office tables and desks. (ii) If the quantity supplied for any furniture type is at least 300 and does not exceed 750 per year, then the tax is 25% of sales; otherwise, the tax is 30%. You are required to: (a) Conduct problem analysis and design. (8 Marks) (b) Write algorithms of: (6 Marks) (i) The function to calculate tax. (ii) The function to calculate profit. (c) Explain how are you going to format and display your final outputs, as shown in (2 Marks) the sample report for the year 2021? (d) Write the Main Program, which calls two functions in part (b). Use C++ Stucture (14 Marks) to store relevant data for each furniture type

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started