Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Taylor is thinking of purchasing Ithaca Tower 3 for $2,000,000 and selling it in 5 years. She expects the price of the hotel

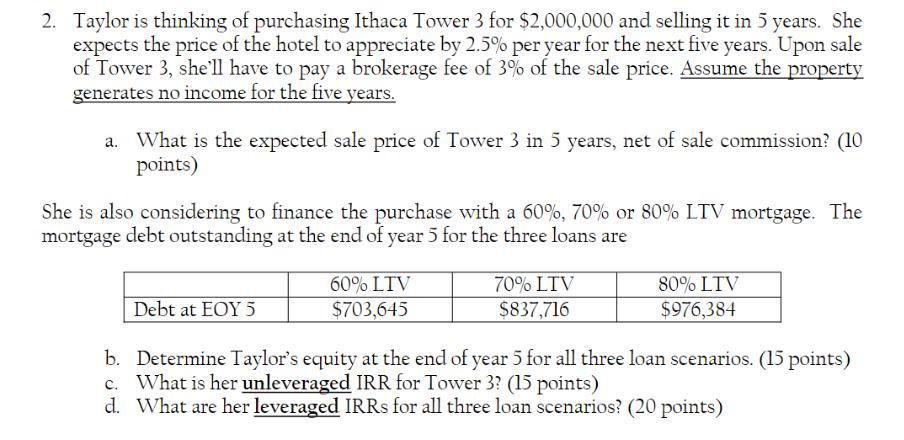

2. Taylor is thinking of purchasing Ithaca Tower 3 for $2,000,000 and selling it in 5 years. She expects the price of the hotel to appreciate by 2.5% per year for the next five years. Upon sale of Tower 3, she'll have to pay a brokerage fee of 3% of the sale price. Assume the property generates no income for the five years. What is the expected sale price of Tower 3 in 5 years, net of sale commission? (10 points) She is also considering to finance the purchase with a 60%, 70% or 80% LTV mortgage. The mortgage debt outstanding at the end of year 5 for the three loans are Debt at EOY 5 60% LTV $703,645 70% LTV $837,716 80% LTV $976,384 b. Determine Taylor's equity at the end of year 5 for all three loan scenarios. (15 points) c. What is her unleveraged IRR for Tower 3? (15 points) d. What are her leveraged IRRs for all three loan scenarios? (20 points)

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a The expected sale price of Tower 3 in 5 years net of sale commission is 2841564 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started