Answered step by step

Verified Expert Solution

Question

1 Approved Answer

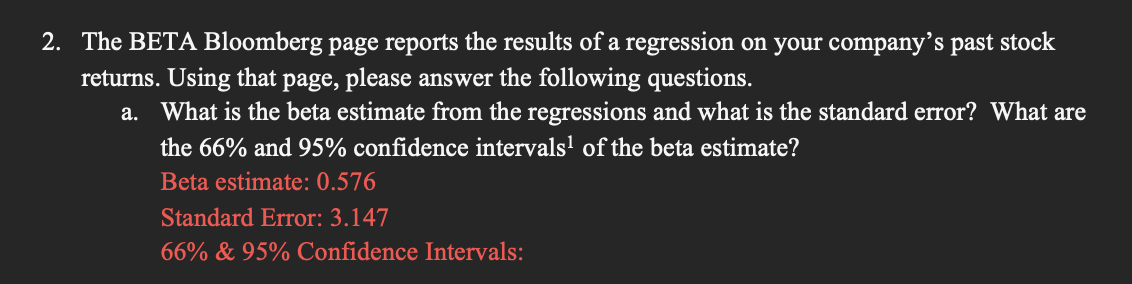

2. The BETA Bloomberg page reports the results of a regression on your company's past stock returns. Using that page, please answer the following

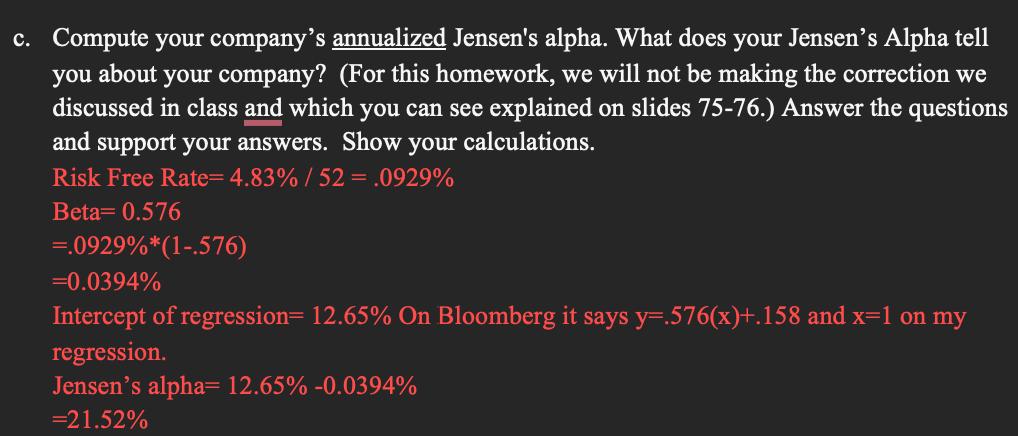

2. The BETA Bloomberg page reports the results of a regression on your company's past stock returns. Using that page, please answer the following questions. a. What is the beta estimate from the regressions and what is the standard error? What are the 66% and 95% confidence intervals of the beta estimate? Beta estimate: 0.576 Standard Error: 3.147 66% & 95% Confidence Intervals: c. Compute your company's annualized Jensen's alpha. What does your Jensen's Alpha tell you about your company? (For this homework, we will not be making the correction we discussed in class and which you can see explained on slides 75-76.) Answer the questions and support your answers. Show your calculations. Risk Free Rate= 4.83% / 52 = .0929% Beta=0.576 =.0929%*(1-.576) =0.0394% Intercept of regression= 12.65% On Bloomberg it says y=.576(x)+.158 and x=1 on my regression. Jensen's alpha= 12.65% -0.0394% =21.52%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started