Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2) The Big Hair Company (which had been incorporated in 2007) experienced the events listed below during the year ended December 31, 2016: 1. Issued

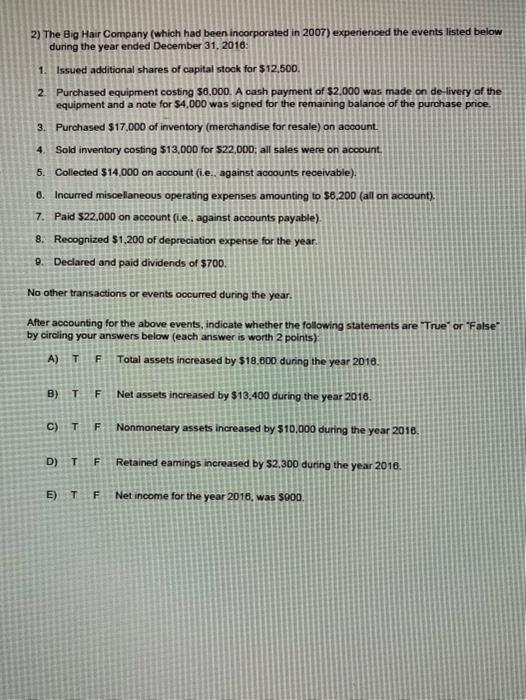

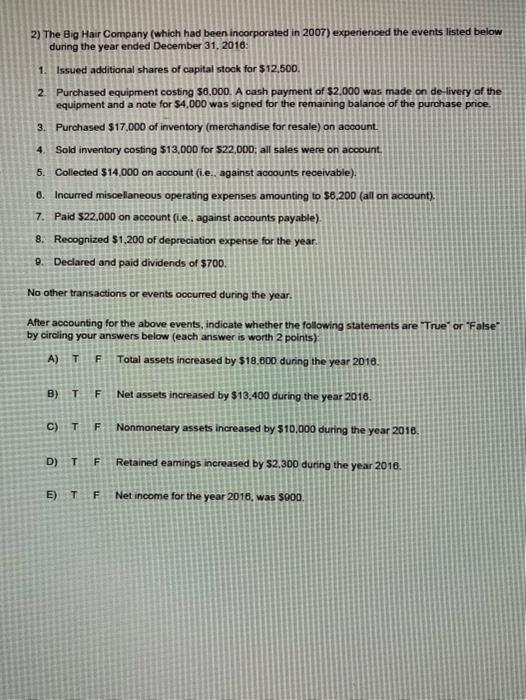

2) The Big Hair Company (which had been incorporated in 2007) experienced the events listed below during the year ended December 31, 2016: 1. Issued additional shares of capital stock for $12,500. 2. Purchased equipment costing $6,000. A cash payment of $2,000 was made on de-livery of the equipment and a note for $4,000 was signed for the remaining balance of the purchase price. 3. Purchased $17.000 of inventory (merchandise for resale) on acoount. 4. Sold inventory costing $13,000 for $22,000; all sales were on account. 5. Collected $14.000 on aocount (i.e., against acoounts receivable). 6. Incurred miscellaneous operating expenses amounting to 56.200 (all on account). 7. Paid $22.000 on account (te., against accounts payable). 8. Recognized $1,200 of depreciation expense for the year. 9. Declared and paid dividends of $700. No other transactions or events occurred during the year. After accounting for the above events, indicate whether the following statements are "True or "False" by circling your answers below (each answer is worth 2 points): A) T F Total assets increased by $18,600 during the year 2016 . B) T F Net assets increased by $13,400 during the year 2016 . C) T F Nonmonetary assets increased by $10.000 during the year 2016 . D) T F Retained eamings increased by $2,300 during the year 2016 . E) T F Net income for the year 2016, was $900

2) The Big Hair Company (which had been incorporated in 2007) experienced the events listed below during the year ended December 31, 2016: 1. Issued additional shares of capital stock for $12,500. 2. Purchased equipment costing $6,000. A cash payment of $2,000 was made on de-livery of the equipment and a note for $4,000 was signed for the remaining balance of the purchase price. 3. Purchased $17.000 of inventory (merchandise for resale) on acoount. 4. Sold inventory costing $13,000 for $22,000; all sales were on account. 5. Collected $14.000 on aocount (i.e., against acoounts receivable). 6. Incurred miscellaneous operating expenses amounting to 56.200 (all on account). 7. Paid $22.000 on account (te., against accounts payable). 8. Recognized $1,200 of depreciation expense for the year. 9. Declared and paid dividends of $700. No other transactions or events occurred during the year. After accounting for the above events, indicate whether the following statements are "True or "False" by circling your answers below (each answer is worth 2 points): A) T F Total assets increased by $18,600 during the year 2016 . B) T F Net assets increased by $13,400 during the year 2016 . C) T F Nonmonetary assets increased by $10.000 during the year 2016 . D) T F Retained eamings increased by $2,300 during the year 2016 . E) T F Net income for the year 2016, was $900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started