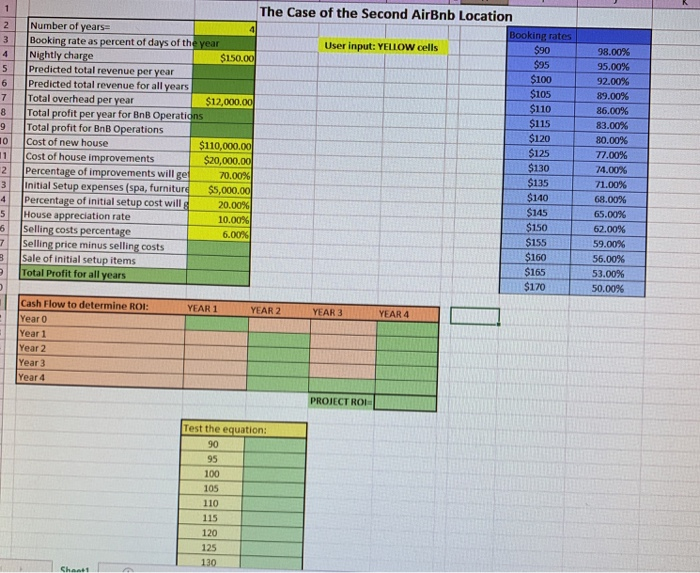

2 The Case of the Second AirBnb Location 2 Number of years- 3 Booking rate as percent of days of th 4 Nightly charge 5 Predicted total revenue per year 6 Predicted total revenue for all years 7 Total overhead per year 8 Total profit per year for BnB Operations 9 Total profit for BnB Operations 0 Cost of new house 1 Cost of house improvements 98.00% 95.00% 92.00% 89.00% 86.00% 83.00% 80.00% User input: YELIOW cells $150.00 $105 $110 $115 $120 $125 $130 $12,000.00 $110,000.00 $20,000.00 70.00% 74.0)% 71.00% 68.00% 65.00% 62.00% 59.00% 55.00% 53.00% 50.00% Percentage of improvements will ge 70, 3 Initial Setup expenses (spa, furniture $5,000.00 $140 Percentage of initial setup cost willg 5 House appreciation rate 6 Selling costs percentage 7 Selling price minus selling costs BSale of initial setup items 20.00% 10.00% 6.00% $155 $165 $170 Total Profit for all years YEAR 1 YEAR 2 YEAR 4 Cash Flow to determine ROI ear 0 Year 1 Year 2 Year 3 Year 4 YEAR 3 PROJECT ROI Test the equation 95 100 105 110 115 125 le this projet you will create a tool to analyse a property to determine if the property is a goad investmest to wse as an AirBNBe The user of the tool will put values in the yellow cells and the tool will calculate the prefit and ROl for the investment wants to buy a fiserpper, resoval. ie, aad pet itea AirBaB for four yean A..he ead of four yeartbe property and its costeats will be sold. The user can cents, initial set up costs, and percentages to estimate how much of those espenes will eater as appreciatios rate fer the property and estimates for house improvemest be recovered whes the house is sold is four years Your task is to ligure out formulas for all the greea cell. Having other Air BaB properties in the area, the investor has data concerning booking rates versus price charged per nigkt. The higher the price, the lower the booking uue this equation to create a formula in cell C3. faaction ofprice. Vou will then and baking rates and so your fin. task " to fud the equation that describe. Ehe booking rat What is ROI? What is the optimal nightly charge for maximum protit? What is the profit in this case? What is RO!? 2 The Case of the Second AirBnb Location 2 Number of years- 3 Booking rate as percent of days of th 4 Nightly charge 5 Predicted total revenue per year 6 Predicted total revenue for all years 7 Total overhead per year 8 Total profit per year for BnB Operations 9 Total profit for BnB Operations 0 Cost of new house 1 Cost of house improvements 98.00% 95.00% 92.00% 89.00% 86.00% 83.00% 80.00% User input: YELIOW cells $150.00 $105 $110 $115 $120 $125 $130 $12,000.00 $110,000.00 $20,000.00 70.00% 74.0)% 71.00% 68.00% 65.00% 62.00% 59.00% 55.00% 53.00% 50.00% Percentage of improvements will ge 70, 3 Initial Setup expenses (spa, furniture $5,000.00 $140 Percentage of initial setup cost willg 5 House appreciation rate 6 Selling costs percentage 7 Selling price minus selling costs BSale of initial setup items 20.00% 10.00% 6.00% $155 $165 $170 Total Profit for all years YEAR 1 YEAR 2 YEAR 4 Cash Flow to determine ROI ear 0 Year 1 Year 2 Year 3 Year 4 YEAR 3 PROJECT ROI Test the equation 95 100 105 110 115 125 le this projet you will create a tool to analyse a property to determine if the property is a goad investmest to wse as an AirBNBe The user of the tool will put values in the yellow cells and the tool will calculate the prefit and ROl for the investment wants to buy a fiserpper, resoval. ie, aad pet itea AirBaB for four yean A..he ead of four yeartbe property and its costeats will be sold. The user can cents, initial set up costs, and percentages to estimate how much of those espenes will eater as appreciatios rate fer the property and estimates for house improvemest be recovered whes the house is sold is four years Your task is to ligure out formulas for all the greea cell. Having other Air BaB properties in the area, the investor has data concerning booking rates versus price charged per nigkt. The higher the price, the lower the booking uue this equation to create a formula in cell C3. faaction ofprice. Vou will then and baking rates and so your fin. task " to fud the equation that describe. Ehe booking rat What is ROI? What is the optimal nightly charge for maximum protit? What is the profit in this case? What is RO