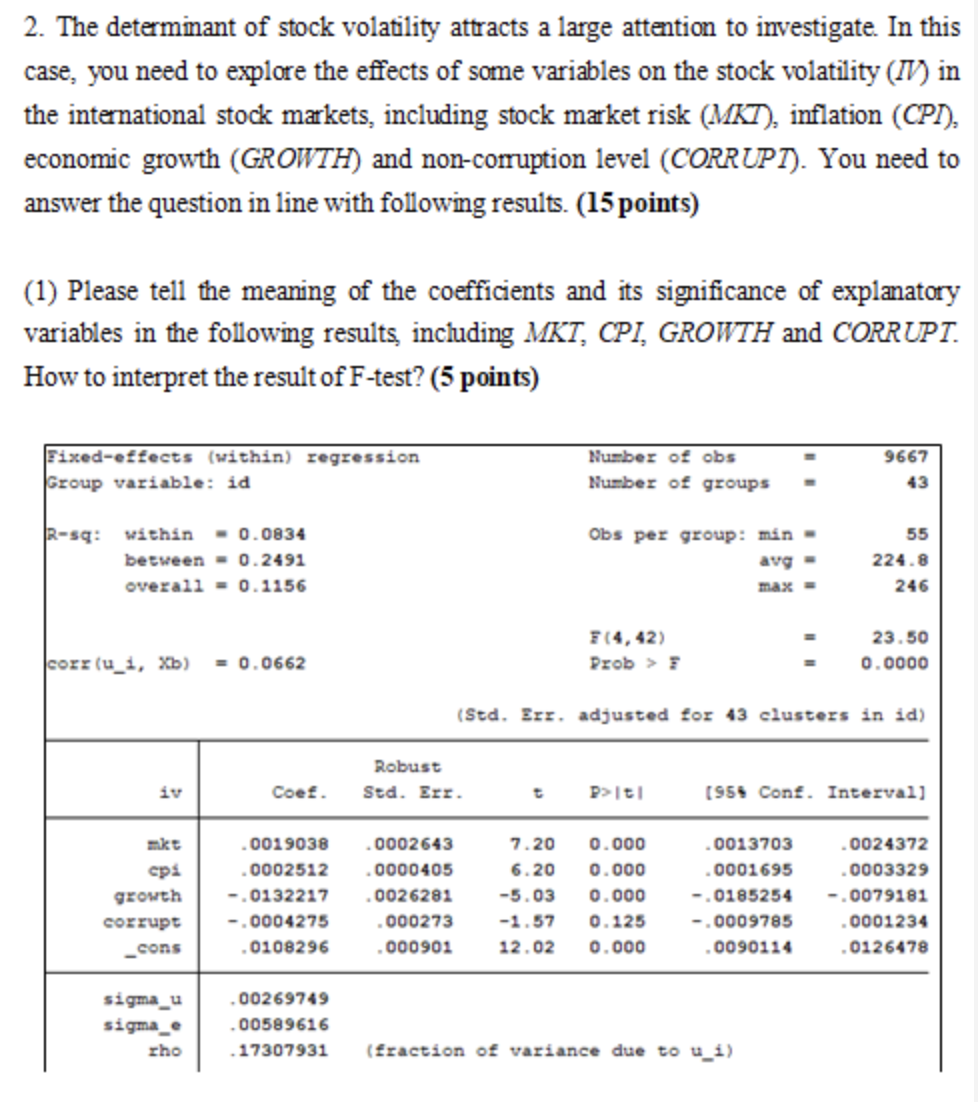

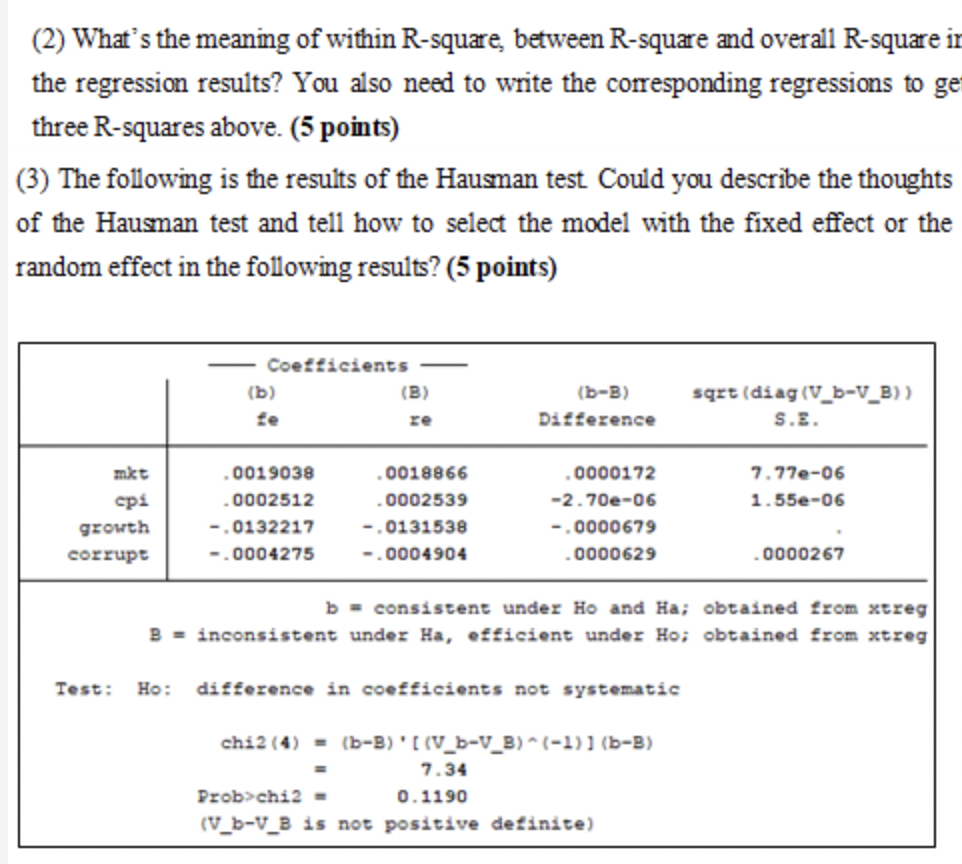

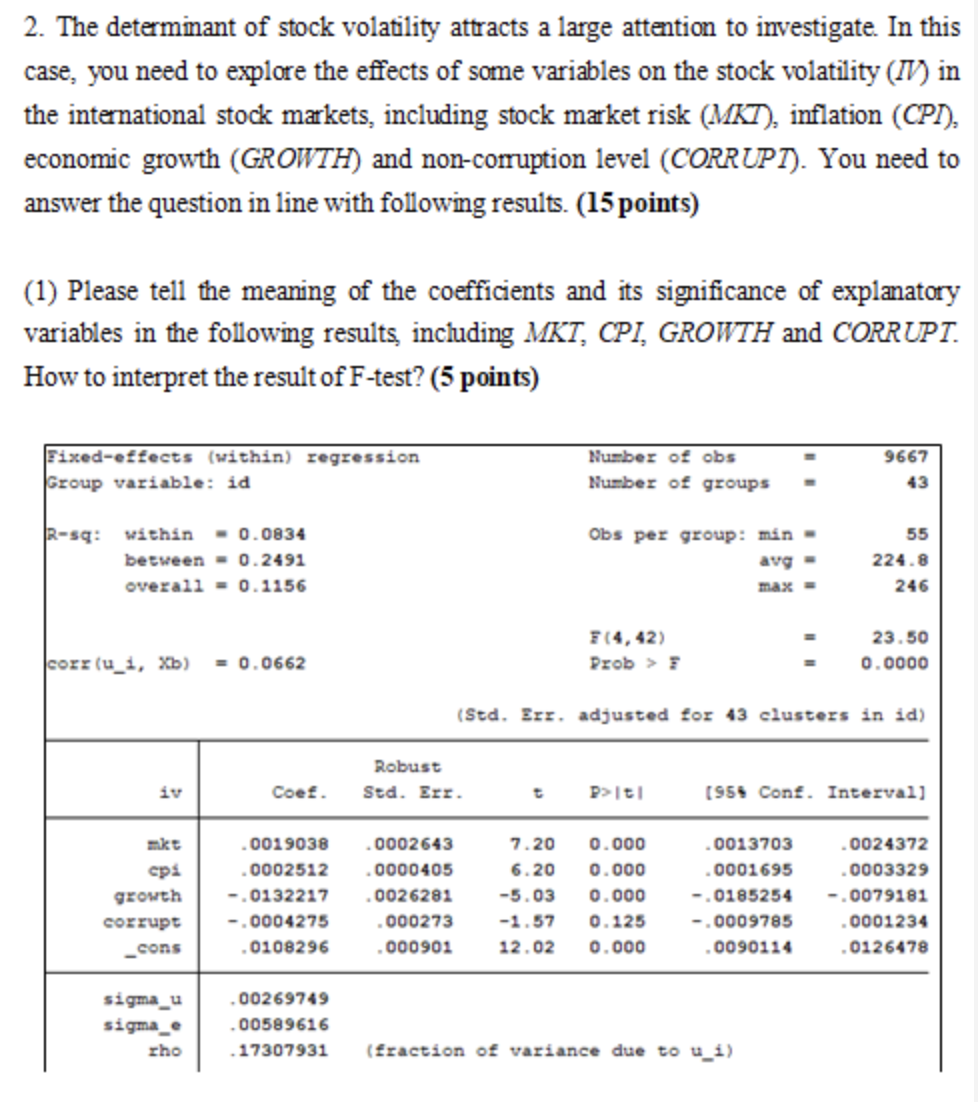

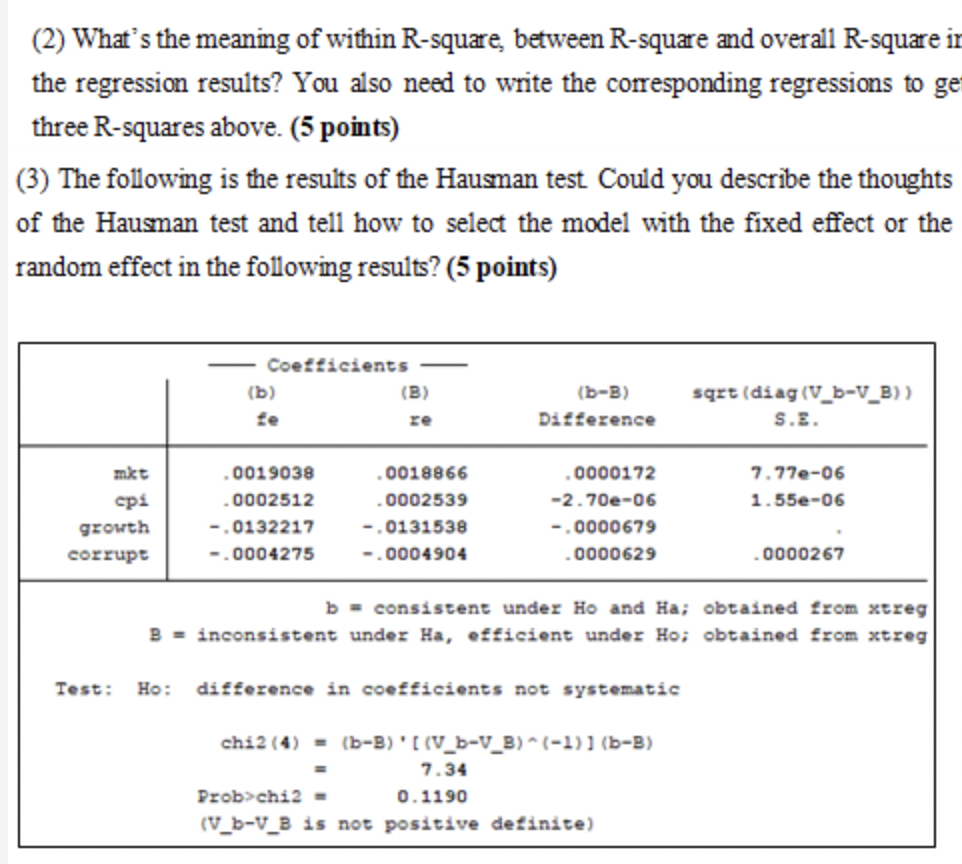

2. The determinant of stock volatility attracts a large attention to investigate. In this case, you need to explore the effects of some variables on the stock volatility (IV) in the international stock markets, including stock market risk (MKT), inflation (CPT), economic growth (GROWTH) and non-corruption level (CORRUPT). You need to answer the question in line with following results. (15 points) (1) Please tell the meaning of the coefficients and its significance of explanatory variables in the following results, including MKT, CPI, GROWTH and CORRUPT. How to interpret the result of F-test? (5 points) 9667 Pixed-effects (within) regression Group variable: id Number of obs Number of groups 43 R-s: Obs per group: min- 55 within -0.0834 between -0.2491 overall = 0.1156 avg - 224.8 max = 246 23.50 corr(u_1, Xb) 764, 42) Prob > = 0.0662 0.0000 (Std. Err. adjusted for 43 clusters in id) Robust iv Coef Std. Err. Pit! (956 Cont. Intervall .001 9038 0002643 7.20 0.000 0013703 0024372 .0002512 0000405 6.20 0.000 .0001695 .0003329 cps growth -.0132217 0026281 -5.03 0.000 -.0079181 -.0185254 -.0009785 corrupt -.0004275 .000273 -1.57 0.125 0001234 cons .0108296 .000901 12.02 0.000 .0090114 .0126478 00269749 sigma_u sigma_ cho 00589616 .17307931 (fraction of variance due to u_i) (2) What's the meaning of within R-square between R-square and overall R-square ir the regression results? You also need to write the corresponding regressions to ge three R-squares above. (5 points) (3) The following is the results of the Hauman test Could you describe the thoughts of the Hausman test and tell how to select the model with the fixed effect or the random effect in the following results? (5 points) Coefficients (b) (B) (b-B) sqrt (diag (V_b-V_B)) Difference S.E. mkt .0019038 .0018866 .0000172 7.77e-06 .0002512 .0002539 -2.70e-06 1.55e-06 cpi growth -.0132217 -.0131538 -.0000679 corrupt -.0004275 -.0004904 .0000629 0000267 b = consistent under Ho and Ha; obtained from streg B = inconsistent under Ha, efficient undez Ho; obtained from streg Test: Ho: difference in coefficients not systematic chi2(4) - (b-B) [(V_b-V_B)*(-1)] (b-B) 7.34 Prob>chi2 - 0.1190 (V_b-V_B is not positive definite) 2. The determinant of stock volatility attracts a large attention to investigate. In this case, you need to explore the effects of some variables on the stock volatility (IV) in the international stock markets, including stock market risk (MKT), inflation (CPT), economic growth (GROWTH) and non-corruption level (CORRUPT). You need to answer the question in line with following results. (15 points) (1) Please tell the meaning of the coefficients and its significance of explanatory variables in the following results, including MKT, CPI, GROWTH and CORRUPT. How to interpret the result of F-test? (5 points) 9667 Pixed-effects (within) regression Group variable: id Number of obs Number of groups 43 R-s: Obs per group: min- 55 within -0.0834 between -0.2491 overall = 0.1156 avg - 224.8 max = 246 23.50 corr(u_1, Xb) 764, 42) Prob > = 0.0662 0.0000 (Std. Err. adjusted for 43 clusters in id) Robust iv Coef Std. Err. Pit! (956 Cont. Intervall .001 9038 0002643 7.20 0.000 0013703 0024372 .0002512 0000405 6.20 0.000 .0001695 .0003329 cps growth -.0132217 0026281 -5.03 0.000 -.0079181 -.0185254 -.0009785 corrupt -.0004275 .000273 -1.57 0.125 0001234 cons .0108296 .000901 12.02 0.000 .0090114 .0126478 00269749 sigma_u sigma_ cho 00589616 .17307931 (fraction of variance due to u_i) (2) What's the meaning of within R-square between R-square and overall R-square ir the regression results? You also need to write the corresponding regressions to ge three R-squares above. (5 points) (3) The following is the results of the Hauman test Could you describe the thoughts of the Hausman test and tell how to select the model with the fixed effect or the random effect in the following results? (5 points) Coefficients (b) (B) (b-B) sqrt (diag (V_b-V_B)) Difference S.E. mkt .0019038 .0018866 .0000172 7.77e-06 .0002512 .0002539 -2.70e-06 1.55e-06 cpi growth -.0132217 -.0131538 -.0000679 corrupt -.0004275 -.0004904 .0000629 0000267 b = consistent under Ho and Ha; obtained from streg B = inconsistent under Ha, efficient undez Ho; obtained from streg Test: Ho: difference in coefficients not systematic chi2(4) - (b-B) [(V_b-V_B)*(-1)] (b-B) 7.34 Prob>chi2 - 0.1190 (V_b-V_B is not positive definite)