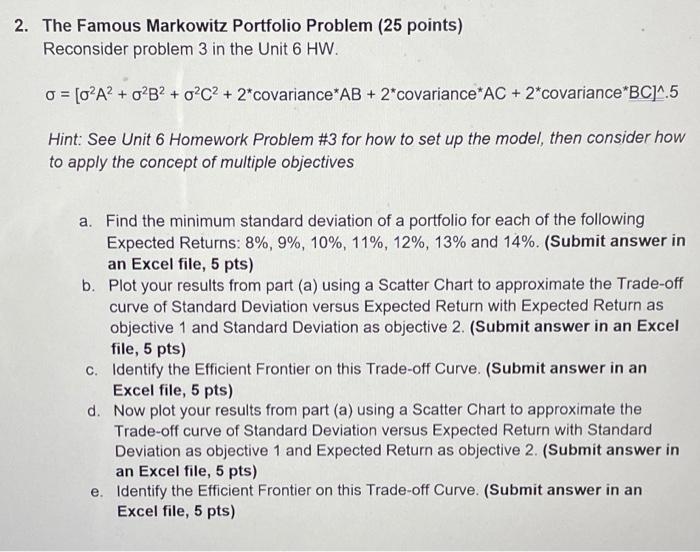

2. The Famous Markowitz Portfolio Problem (25 points) Reconsider problem 3 in the Unit 6 HW. o = [oA? + o?B? + oC2 + 2*covariance AB + 2*covariance*AC + 2*covariance*BCJ^.5 Hint: See Unit 6 Homework Problem #3 for how to set up the model, then consider how to apply the concept of multiple objectives a. Find the minimum standard deviation of a portfolio for each of the following Expected Returns: 8%, 9%, 10%, 11%, 12%, 13% and 14%. (Submit answer in an Excel file, 5 pts) b. Plot your results from part (a) using a Scatter Chart to approximate the Trade-off curve of Standard Deviation versus Expected Return with Expected Return as objective 1 and Standard Deviation as objective 2. (Submit answer in an Excel file, 5 pts) c. Identify the Efficient Frontier on this Trade-off Curve. (Submit answer in an Excel file, 5 pts) d. Now plot your results from part (a) using a Scatter Chart to approximate the Trade-off curve of Standard Deviation versus Expected Return with Standard Deviation as objective 1 and Expected Return as objective 2. (Submit answer in an Excel file, 5 pts) e. Identify the Efficient Frontier on this Trade-off Curve. (Submit answer in an Excel file, 5 pts) 2. The Famous Markowitz Portfolio Problem (25 points) Reconsider problem 3 in the Unit 6 HW. o = [oA? + o?B? + oC2 + 2*covariance AB + 2*covariance*AC + 2*covariance*BCJ^.5 Hint: See Unit 6 Homework Problem #3 for how to set up the model, then consider how to apply the concept of multiple objectives a. Find the minimum standard deviation of a portfolio for each of the following Expected Returns: 8%, 9%, 10%, 11%, 12%, 13% and 14%. (Submit answer in an Excel file, 5 pts) b. Plot your results from part (a) using a Scatter Chart to approximate the Trade-off curve of Standard Deviation versus Expected Return with Expected Return as objective 1 and Standard Deviation as objective 2. (Submit answer in an Excel file, 5 pts) c. Identify the Efficient Frontier on this Trade-off Curve. (Submit answer in an Excel file, 5 pts) d. Now plot your results from part (a) using a Scatter Chart to approximate the Trade-off curve of Standard Deviation versus Expected Return with Standard Deviation as objective 1 and Expected Return as objective 2. (Submit answer in an Excel file, 5 pts) e. Identify the Efficient Frontier on this Trade-off Curve. (Submit answer in an Excel file, 5 pts)