Answered step by step

Verified Expert Solution

Question

1 Approved Answer

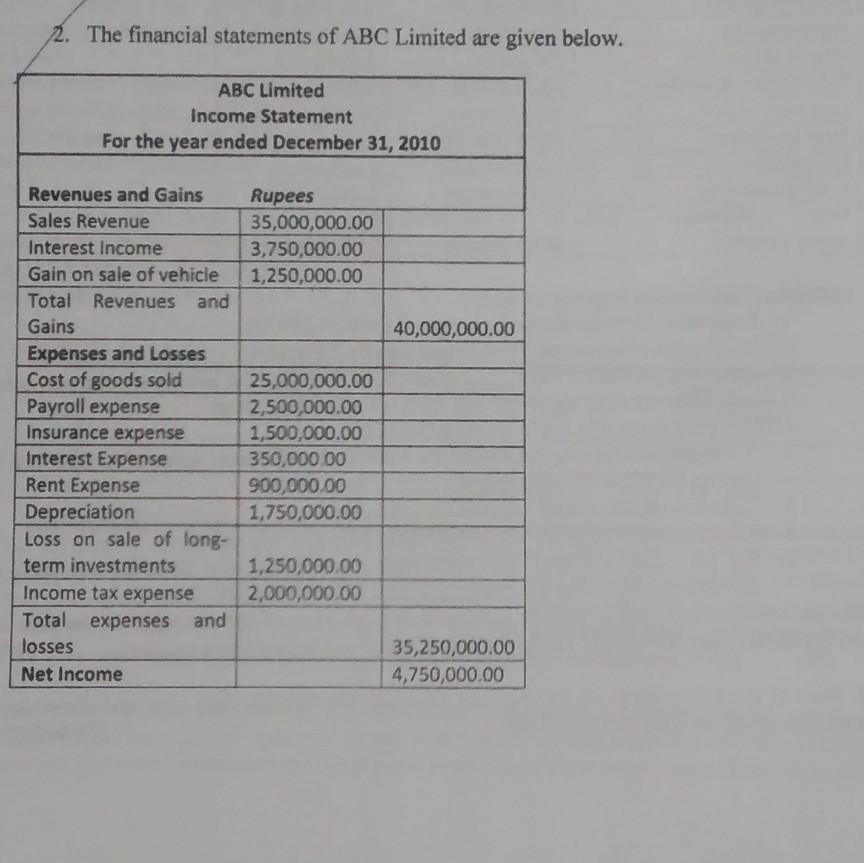

2. The financial statements of ABC Limited are given below. ABC Limited Income Statement For the year ended December 31, 2010 Revenues and Gains

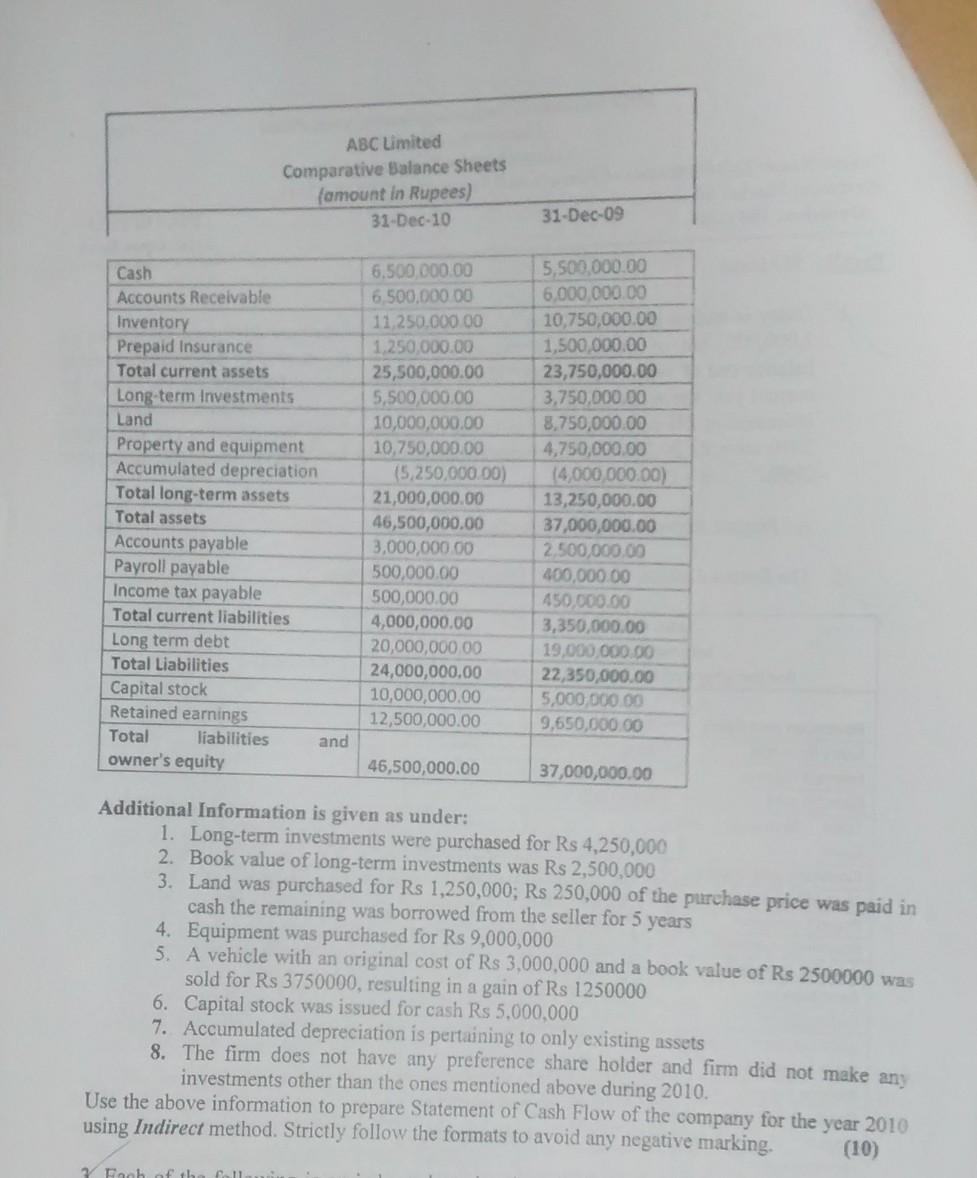

2. The financial statements of ABC Limited are given below. ABC Limited Income Statement For the year ended December 31, 2010 Revenues and Gains Rupees Sales Revenue 35,000,000.00 Interest Income Gain on sale of vehicle Total Revenues and 3,750,000.00 1,250,000.00 Gains 40,000,000.00 Expenses and Losses Cost of goods sold 25,000,000.00 Payroll expense 2,500,000.00 Insurance expense 1,500,000.00 Interest Expense 350,000.00 Rent Expense 900,000.00 Depreciation 1,750,000.00 Loss on sale of long- term investments 1,250,000.00 Income tax expense 2,000,000.00 Total expenses and losses 35,250,000.00 Net Income 4,750,000.00 ABC Limited Comparative Balance Sheets (amount in Rupees) 31-Dec-10 31-Dec-09 Cash 6,500,000.00 5,500,000.00 Accounts Receivable 6,500,000.00 6,000,000.00 Inventory Prepaid Insurance Total current assets Long-term Investments Land 11,250,000.00 10,750,000.00 1,250,000.00 1,500,000.00 25,500,000.00 23,750,000.00 5,500,000.00 3,750,000.00 10,000,000.00 8,750,000.00 Property and equipment 10,750,000.00 4,750,000.00 Accumulated depreciation (5,250,000.00) (4,000,000.00) Total long-term assets 21,000,000.00 13,250,000.00 Total assets 46,500,000.00 37,000,000.00 Accounts payable 3,000,000.00 2,500,000.00 Payroll payable 500,000.00 400,000.00 Income tax payable 500,000.00 450,000.00 Total current liabilities 4,000,000.00 3,350,000.00 Long term debt 20,000,000,00 19,000,000.00 Total Liabilities 24,000,000,00 22,350,000.00 Capital stock 10,000,000.00 5,000,000.00 Retained earnings 12,500,000.00 9,650,000.00 Total liabilities and owner's equity 46,500,000.00 37,000,000.00 Additional Information is given as under: 1. Long-term investments were purchased for Rs 4,250,000 2. Book value of long-term investments was Rs 2,500,000 3. Land was purchased for Rs 1,250,000; Rs 250,000 of the purchase price was paid in cash the remaining was borrowed from the seller for 5 years 4. Equipment was purchased for Rs 9,000,000 5. A vehicle with an original cost of Rs 3,000,000 and a book value of Rs 2500000 was sold for Rs 3750000, resulting in a gain of Rs 1250000 6. Capital stock was issued for cash Rs 5,000,000 7. Accumulated depreciation is pertaining to only existing assets 8. The firm does not have any preference share holder and firm did not make any investments other than the ones mentioned above during 2010. Use the above information to prepare Statement of Cash Flow of the company for the year 2010 using Indirect method. Strictly follow the formats to avoid any negative marking. 3 Fach of the fall (10)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started