Answered step by step

Verified Expert Solution

Question

1 Approved Answer

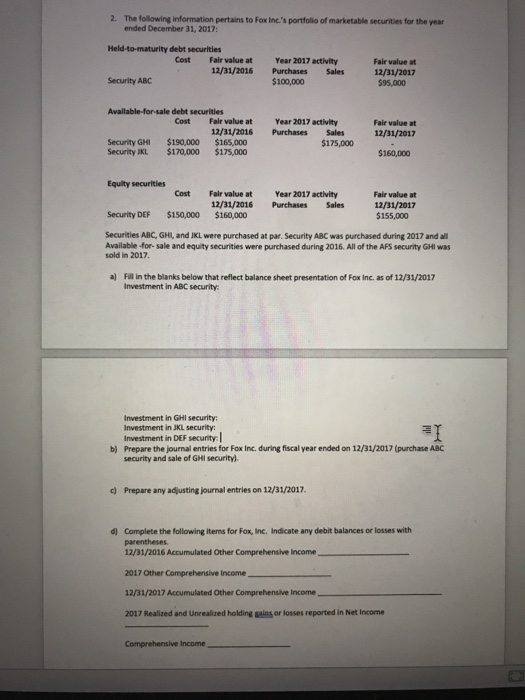

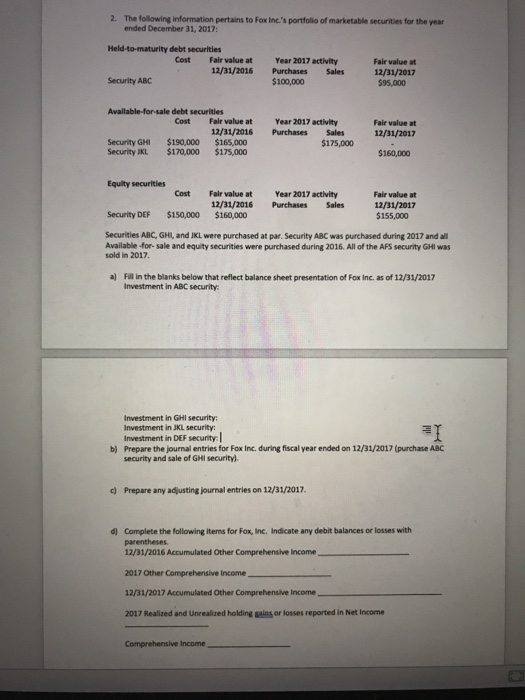

2. The following information pertains to Fox Inc.'s portfolio of marketable securities for the year ended December 31, 2017: Held-to-maturity debt securities Cost Fair value

2. The following information pertains to Fox Inc.'s portfolio of marketable securities for the year ended December 31, 2017: Held-to-maturity debt securities Cost Fair value at 12/31/2016 Purchases Sales Year 2017 activity Fair value at 12/31/2017 595,000 Security ABC $100,000 Available-for-sale debt securities Cost Fair value at 12/31/2016 Purchases Sales Year 2017 activity Fair value at 12/31/2017 Security GHI $190,000 $165,000 Security JKL $170,000 $175,000 $175,000 $160,000 Equity securities Cost Fair value at 12/31/2016 Year 2017 activity Purchases Fair value at 12/31/2017 $155,000 Sales Security DEF $150,000 $160,000 Securities ABC, GHL, and JKL were purchased at par. Security ABC was purchased during 2017 and all Available -for- sale and equity securities were purchased during 2016. All of the AFS security GHI was sold in 2017. a) Fill in the blanks below that reflect balance sheet presentation of Fox Inc. as of 12/31/2017 Investment in ABC security Investment in GHI security: Investment in JKL security: Investment in DEF security Prepare the journal entries for Fox Inc. during fiscal year ended on 12/31/2017 (purchase ABC security and sale of GHI security) b) c) Prepare any adjusting journal entries on 12/31/2017 Complete the following items for Fax, Inc. Indicate any debit balances or losses with 12/31/2016 Accumulated Other Comprehensive Income 2017 Other Comprehensive Income 12/31/2017 Accumulated Other Comprehensive Income 2017 Realized and Unrealized holding sains or losses reported in Net Income d) Comprehensive Income

2. The following information pertains to Fox Inc.'s portfolio of marketable securities for the year ended December 31, 2017: Held-to-maturity debt securities Cost Fair value at 12/31/2016 Purchases Sales Year 2017 activity Fair value at 12/31/2017 595,000 Security ABC $100,000 Available-for-sale debt securities Cost Fair value at 12/31/2016 Purchases Sales Year 2017 activity Fair value at 12/31/2017 Security GHI $190,000 $165,000 Security JKL $170,000 $175,000 $175,000 $160,000 Equity securities Cost Fair value at 12/31/2016 Year 2017 activity Purchases Fair value at 12/31/2017 $155,000 Sales Security DEF $150,000 $160,000 Securities ABC, GHL, and JKL were purchased at par. Security ABC was purchased during 2017 and all Available -for- sale and equity securities were purchased during 2016. All of the AFS security GHI was sold in 2017. a) Fill in the blanks below that reflect balance sheet presentation of Fox Inc. as of 12/31/2017 Investment in ABC security Investment in GHI security: Investment in JKL security: Investment in DEF security Prepare the journal entries for Fox Inc. during fiscal year ended on 12/31/2017 (purchase ABC security and sale of GHI security) b) c) Prepare any adjusting journal entries on 12/31/2017 Complete the following items for Fax, Inc. Indicate any debit balances or losses with 12/31/2016 Accumulated Other Comprehensive Income 2017 Other Comprehensive Income 12/31/2017 Accumulated Other Comprehensive Income 2017 Realized and Unrealized holding sains or losses reported in Net Income d) Comprehensive Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started