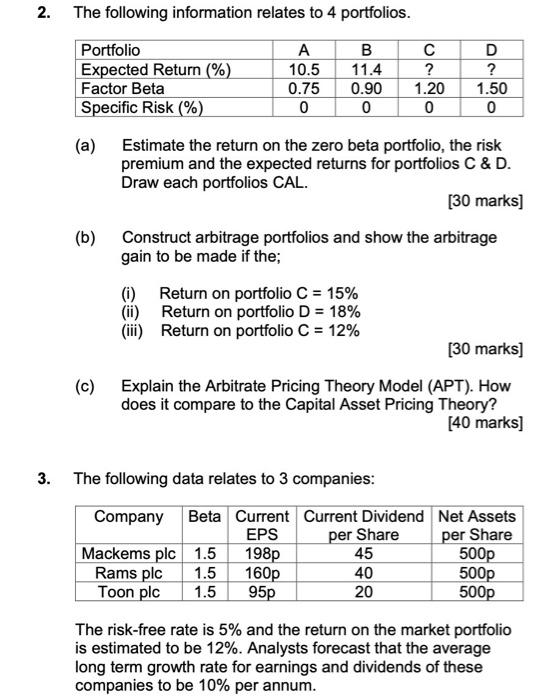

2. The following information relates to 4 portfolios. ole Portfolio A B D Expected Return (%) 10.5 11.4 ? ? Factor Beta 0.75 0.90 1.20 1.50 Specific Risk (%) 0 0 0 0 (a) Estimate the return on the zero beta portfolio, the risk premium and the expected returns for portfolios C&D. Draw each portfolios CAL. [30 marks] (b) Construct arbitrage portfolios and show the arbitrage gain to be made if the; (1) Return on portfolio C = 15% (ii) Return on portfolio D = 18% (ii) Return on portfolio C = 12% [30 marks] (c) Explain the Arbitrate Pricing Theory Model (APT). How does it compare to the Capital Asset Pricing Theory? [40 marks] 3. The following data relates to 3 companies: Company Beta Current Current Dividend Net Assets EPS per Share per Share Mackems plc 1.5 198p 45 500p Rams plc 1.5 160p 40 500p Toon plc 1.5 95p 20 500p The risk-free rate is 5% and the return on the market portfolio is estimated to be 12%. Analysts forecast that the average long term growth rate for earnings and dividends of these companies to be 10% per annum. 2. The following information relates to 4 portfolios. ole Portfolio A B D Expected Return (%) 10.5 11.4 ? ? Factor Beta 0.75 0.90 1.20 1.50 Specific Risk (%) 0 0 0 0 (a) Estimate the return on the zero beta portfolio, the risk premium and the expected returns for portfolios C&D. Draw each portfolios CAL. [30 marks] (b) Construct arbitrage portfolios and show the arbitrage gain to be made if the; (1) Return on portfolio C = 15% (ii) Return on portfolio D = 18% (ii) Return on portfolio C = 12% [30 marks] (c) Explain the Arbitrate Pricing Theory Model (APT). How does it compare to the Capital Asset Pricing Theory? [40 marks] 3. The following data relates to 3 companies: Company Beta Current Current Dividend Net Assets EPS per Share per Share Mackems plc 1.5 198p 45 500p Rams plc 1.5 160p 40 500p Toon plc 1.5 95p 20 500p The risk-free rate is 5% and the return on the market portfolio is estimated to be 12%. Analysts forecast that the average long term growth rate for earnings and dividends of these companies to be 10% per annum