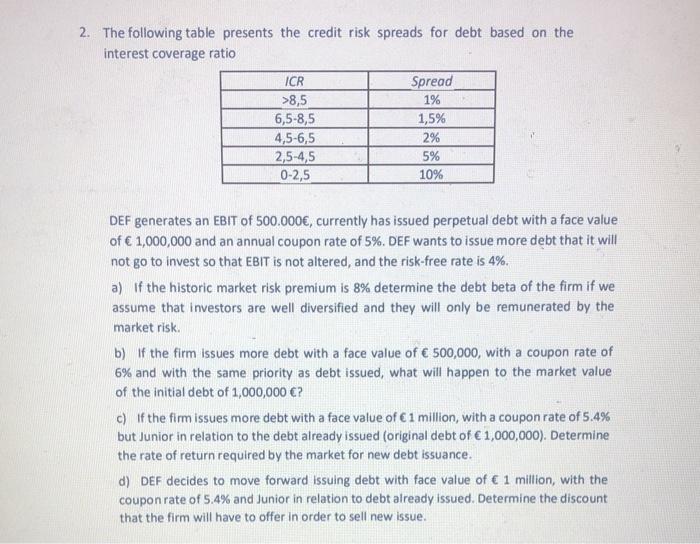

2. The following table presents the credit risk spreads for debt based on the interest coverage ratio ICR Spread 1% 6,5-8,5 1,5% 4,5-6,5 2% 2,5-4,5 5% 0-2,5 10% >8,5 DEF generates an EBIT of 500.000, currently has issued perpetual debt with a face value of 1,000,000 and an annual coupon rate of 5%. DEF wants to issue more debt that it will not go to invest so that EBIT is not altered, and the risk-free rate is 4%. a) If the historic market risk premium is 8% determine the debt beta of the firm if we assume that investors are well diversified and they will only be remunerated by the market risk. b) If the firm Issues more debt with a face value of 500,000, with a coupon rate of 6% and with the same priority as debt issued, what will happen to the market value of the initial debt of 1,000,000 ? c) If the firm issues more debt with a face value of 1 million, with a coupon rate of 5.4% but Junior in relation to the debt already issued (original debt of 1,000,000). Determine the rate of return required by the market for new debt issuance. d) DEF decides to move forward issuing debt with face value of 1 million, with the coupon rate of 5.4% and Junior in relation to debt already issued. Determine the discount that the firm will have to offer in order to sell new issue. 2. The following table presents the credit risk spreads for debt based on the interest coverage ratio ICR Spread 1% 6,5-8,5 1,5% 4,5-6,5 2% 2,5-4,5 5% 0-2,5 10% >8,5 DEF generates an EBIT of 500.000, currently has issued perpetual debt with a face value of 1,000,000 and an annual coupon rate of 5%. DEF wants to issue more debt that it will not go to invest so that EBIT is not altered, and the risk-free rate is 4%. a) If the historic market risk premium is 8% determine the debt beta of the firm if we assume that investors are well diversified and they will only be remunerated by the market risk. b) If the firm Issues more debt with a face value of 500,000, with a coupon rate of 6% and with the same priority as debt issued, what will happen to the market value of the initial debt of 1,000,000 ? c) If the firm issues more debt with a face value of 1 million, with a coupon rate of 5.4% but Junior in relation to the debt already issued (original debt of 1,000,000). Determine the rate of return required by the market for new debt issuance. d) DEF decides to move forward issuing debt with face value of 1 million, with the coupon rate of 5.4% and Junior in relation to debt already issued. Determine the discount that the firm will have to offer in order to sell new issue