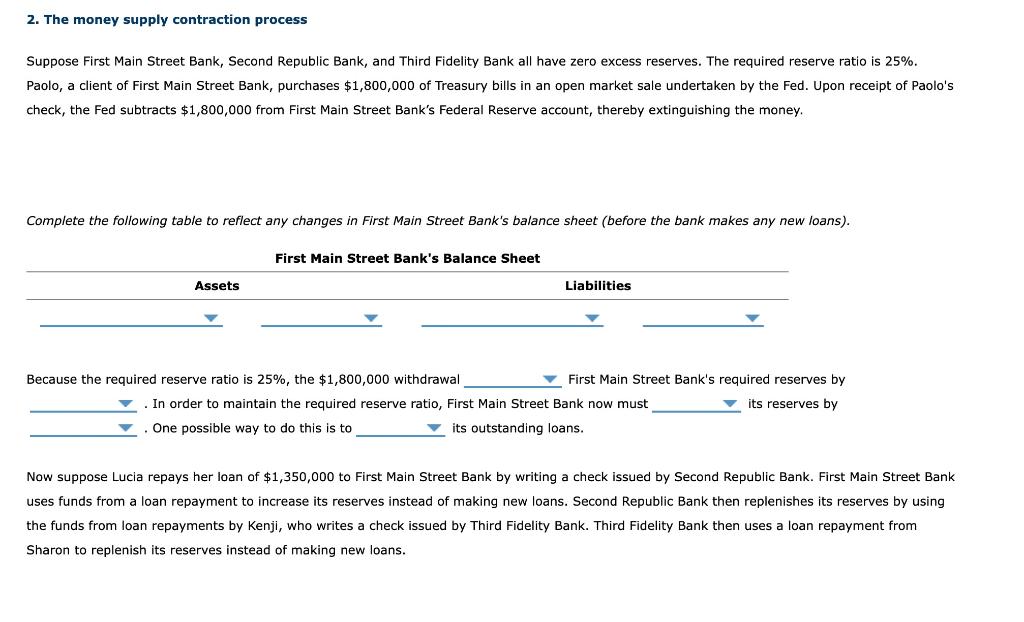

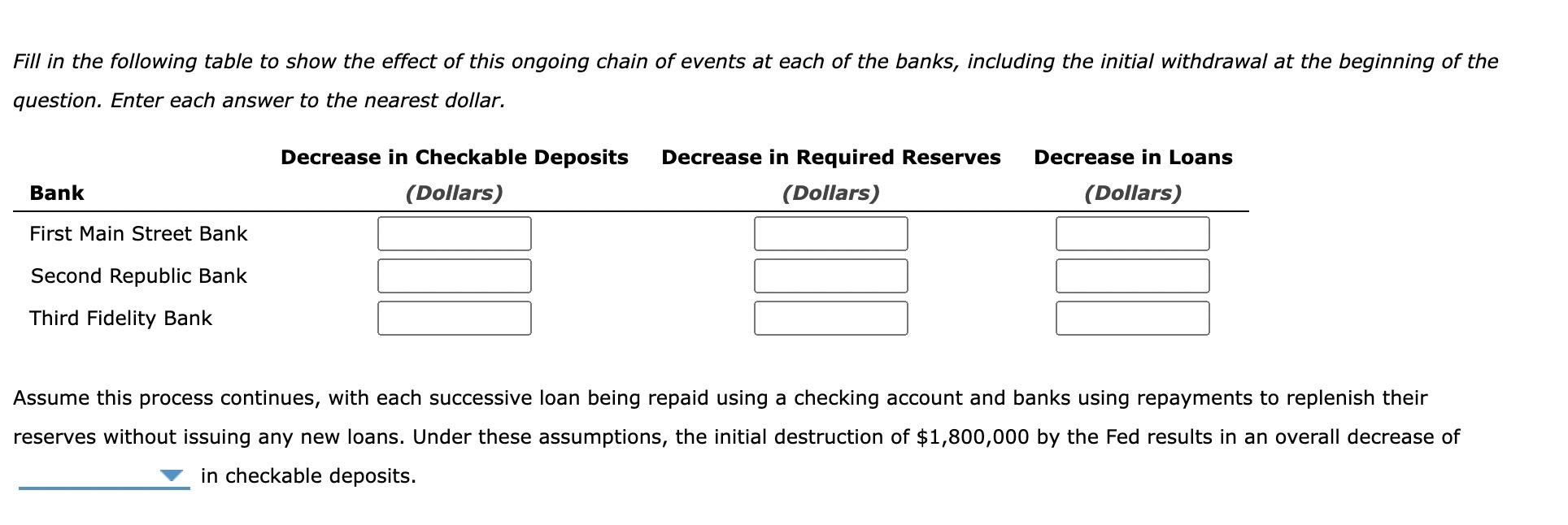

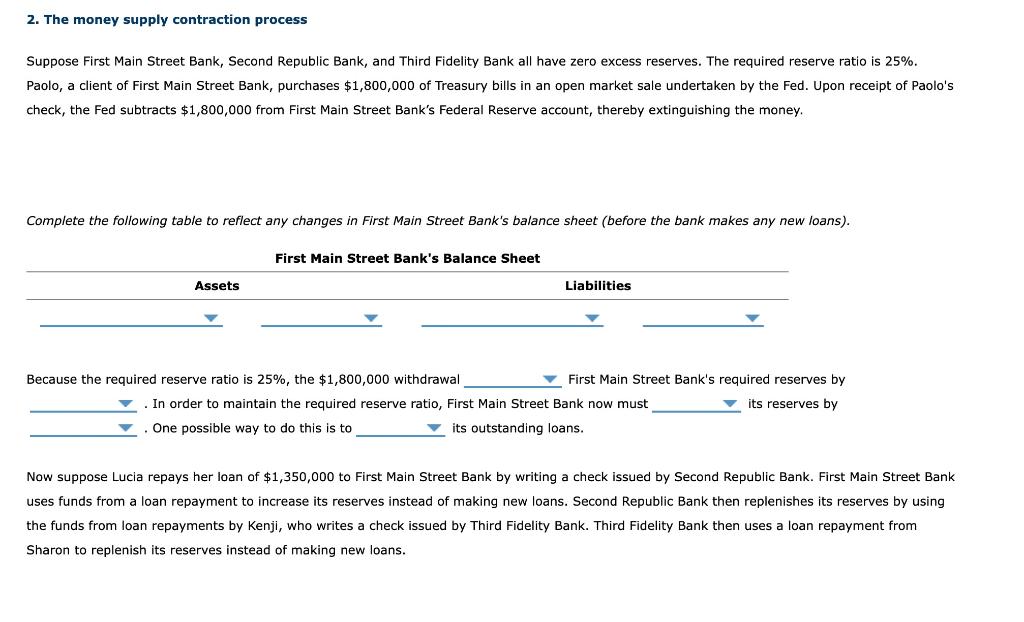

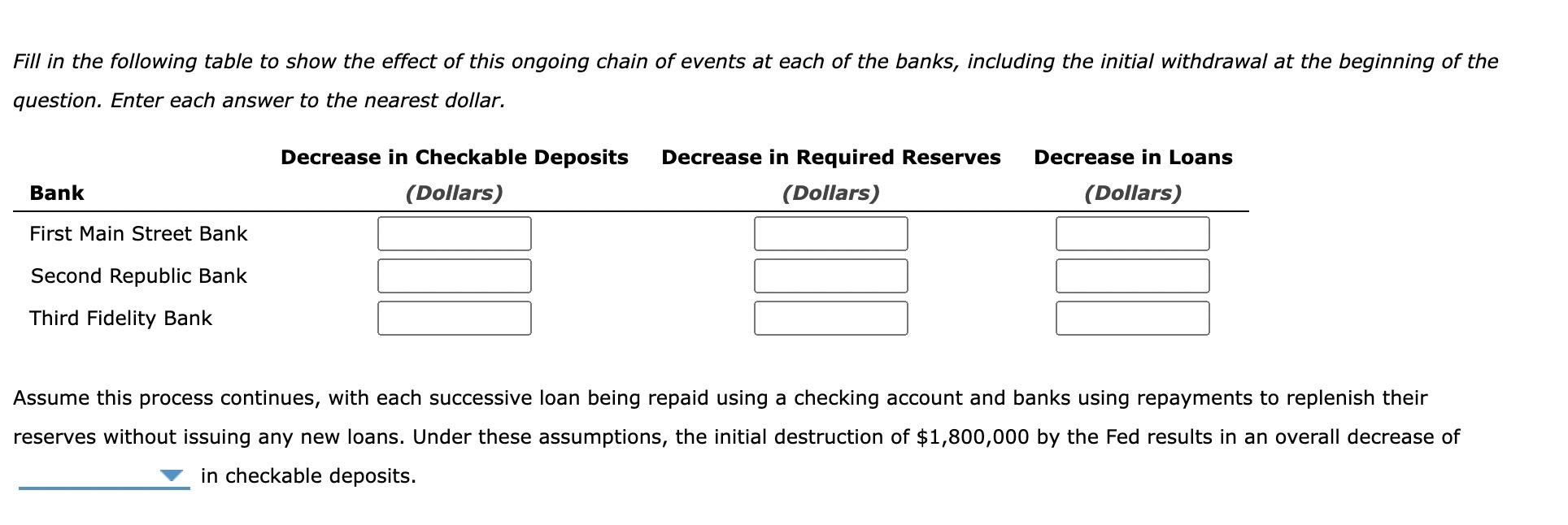

2. The money supply contraction process Suppose First Main Street Bank, Second Republic Bank, and Third Fidelity Bank all have zero excess reserves is 25% check, the Fed subtracts $1,800,000 from First Main Street Bank's Federal Reserve account, thereby extinguishing the money. Complete the following table to reflect any changes in First Main Street Bank's balance sheet (before the bank makes any new I Now suppose Lucia repays her loan of $1,350,000 to First Main Street Bank by writing a check issued by Second Republic Bank. First Main Street Bank the funds from loan repayments by Kenji, who writes a check issued by Third Fidelity Bank. Third Fidelity Bank then uses a loan repayment from Sharon to replenish its reserves instead of making new loans. Fill in the following table to show the effect of this ongoing chain of events at each of the banks, including the initial withdrawal the beginning question. Enter each answer to the nearest dollar. reserves without issuing any new loans. Under these assumptions, the initial destruction of $1,800,000 by the Fed in an overall decrease of in checkable deposits. 2. The money supply contraction process Suppose First Main Street Bank, Second Republic Bank, and Third Fidelity Bank all have zero excess reserves is 25% check, the Fed subtracts $1,800,000 from First Main Street Bank's Federal Reserve account, thereby extinguishing the money. Complete the following table to reflect any changes in First Main Street Bank's balance sheet (before the bank makes any new I Now suppose Lucia repays her loan of $1,350,000 to First Main Street Bank by writing a check issued by Second Republic Bank. First Main Street Bank the funds from loan repayments by Kenji, who writes a check issued by Third Fidelity Bank. Third Fidelity Bank then uses a loan repayment from Sharon to replenish its reserves instead of making new loans. Fill in the following table to show the effect of this ongoing chain of events at each of the banks, including the initial withdrawal the beginning question. Enter each answer to the nearest dollar. reserves without issuing any new loans. Under these assumptions, the initial destruction of $1,800,000 by the Fed in an overall decrease of in checkable deposits