Answered step by step

Verified Expert Solution

Question

1 Approved Answer

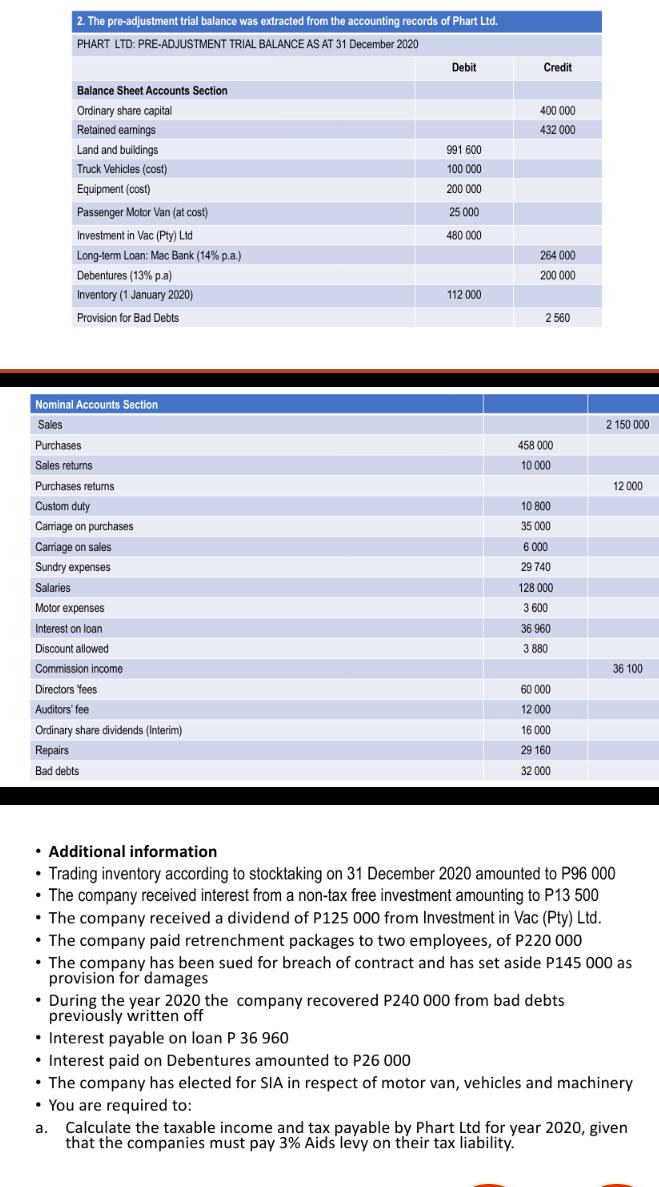

2. The pre-adjustment trial balance was extracted from the accounting records of Phart Ltd. PHART LTD: PRE-ADJUSTMENT TRIAL BALANCE AS AT 31 December 2020

2. The pre-adjustment trial balance was extracted from the accounting records of Phart Ltd. PHART LTD: PRE-ADJUSTMENT TRIAL BALANCE AS AT 31 December 2020 Balance Sheet Accounts Section Ordinary share capital Retained earnings Land and buildings Truck Vehicles (cost) Equipment (cost) Passenger Motor Van (at cost) Investment in Vac (Pty) Ltd Long-term Loan: Mac Bank (14% p.a.) Debentures ( 13% p.a) Inventory (1 January 2020) Provision for Bad Debts Nominal Accounts Section Sales Purchases Sales returns Purchases returns Custom duty Carriage on purchases Carriage on sales Sundry expenses Salaries Motor expenses Interest on loan Discount allowed Commission income Directors fees Auditors' fee Ordinary share dividends (Interim) Repairs Bad debts Debit 991 600 100 000 200 000 25 000 480 000 Interest payable on loan P 36 960 Interest paid on Debentures amounted to P26 000 112 000 Credit 400 000 432 000 264 000 200 000 2 560 458 000 10 000 10 800 35 000 6 000 29 740 128 000 3 600 36 960 3 880 60 000 12 000 16 000 29 160 32 000 . During the year 2020 the company recovered P240 000 from bad debts previously written off 2 150 000 12 000 Additional information Trading inventory according to stocktaking on 31 December 2020 amounted to P96 000 The company received interest from a non-tax free investment amounting to P13 500 The company received a dividend of P125 000 from Investment in Vac (Pty) Ltd. The company paid retrenchment packages to two employees, of P220 000 The company has been sued for breach of contract and has set aside P145 000 as provision for damages 36 100 The company has elected for SIA in respect of motor van, vehicles and machinery You are required to: a. Calculate the taxable income and tax payable by Phart Ltd for year 2020, given that the companies must pay 3% Aids levy on their tax liability.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculate the taxable income and tax payable for Phart Ltd for the year 2020 Step 1 Adjustments to N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started