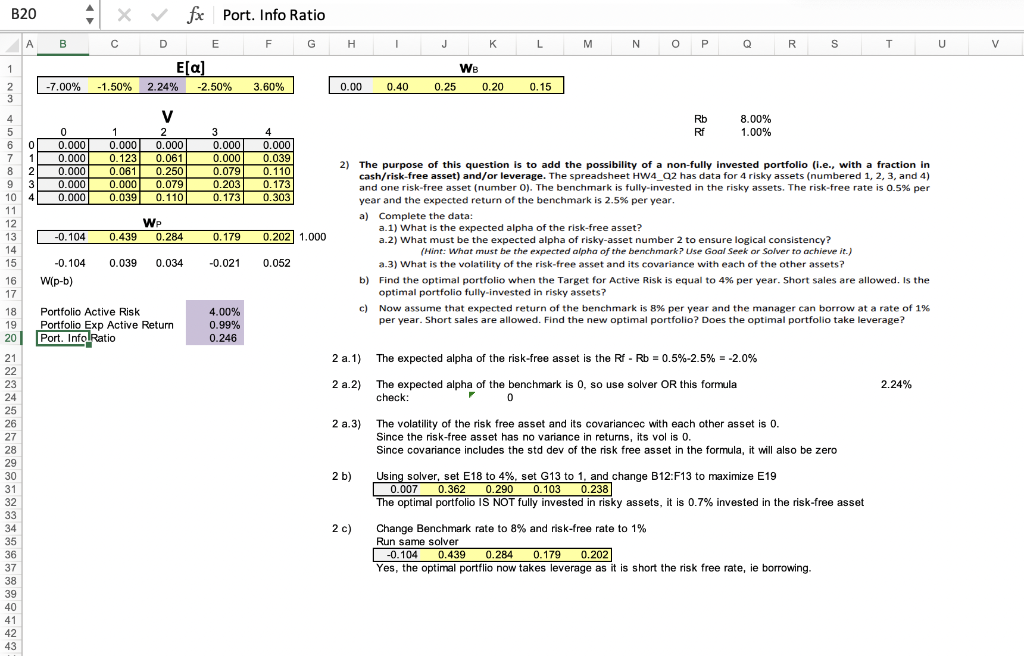

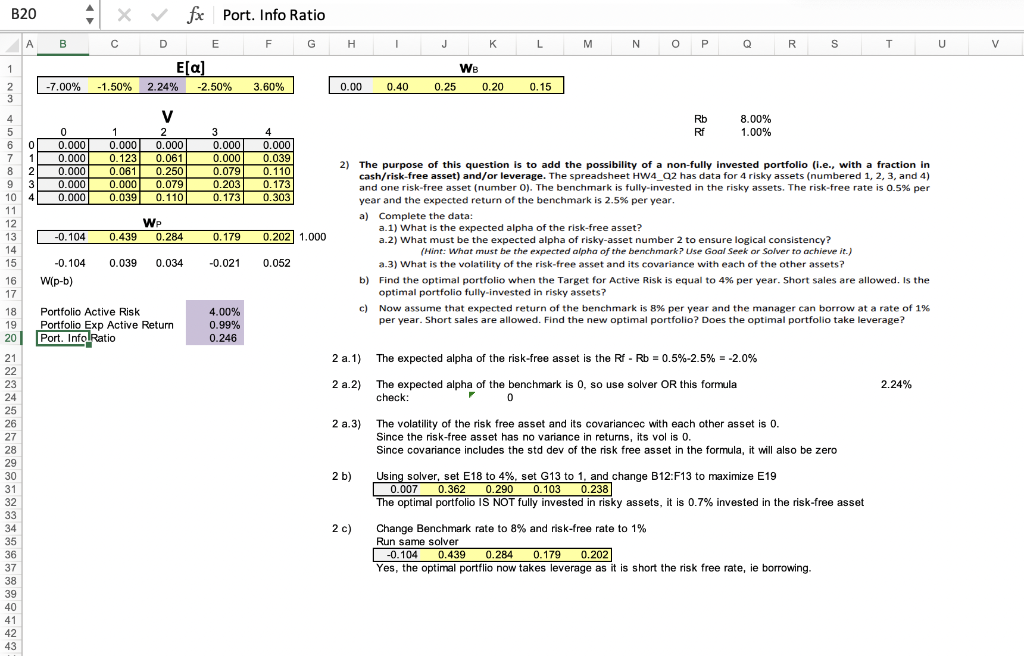

2) The purpose of this question is to add the possibility of a non-fully invested portfolio (i.e., with a fraction in cash/risk-free asset) and/or leverage. The spreadsheet HW4_Q2 has data for 4 risky assets (numbered 1, 2, 3, and 4) and one risk-free asset (number 0). The benchmark is fully-invested in the risky assets. The risk-free rate is 0.5% per year and the expected return of the benchmark is 2.5% per year. a) Complete the data: a.1) What is the expected alpha of the risk-free asset? a.2) What must be the expected alpha of risky-asset number 2 to ensure logical consistency? (Hint: What must be the expected alpha of the benchmark? Use Goal Seek or Solver to achieve it.) a.3) What is the volatility of the risk-free asset and its covariance with each of the other assets? b) Find the optimal portfolio when the Target for Active Risk is equal to 4% per year. Short sales are allowed. Is the optimal portfolio fully-invested in risky assets? c) Now assume that expected return of the benchmark is 8% per year and the manager can borrow at a rate of 1% per year. Short sales are allowed. Find the new optimal portfolio? Does the optimal portfolio take leverage? 2 a.1) The expected alpha of the risk-free asset is the RfRb=0.5%2.5%=2.0% 2 a.2) The expected alpha of the benchmark is 0 , so use solver OR this formula 2.24% check: 0 2 a.3) The volatility of the risk free asset and its covariancec with each other asset is 0 . Since the risk-free asset has no variance in returns, its vol is 0 . Since covariance includes the std dev of the risk free asset in the formula, it will also be zero The spreadsheet Q1_Q12 in the EXAM 3 (421) DATA file has data for nine assets, more specifically, nine U.S. Equity Sector ETFs. The spreadsheet has your estimates for the annual expected alpha E(alpha) and covariance matrix V. Your benchmark weights are given in the spreadsheet. The annualized volatility/standard deviation of returns of the Tech+Tcom ETF is closest to: a. 23% b. 16% c. 2.4% d. 6% e. 14% QUESTION 3 The spreadsheet Q1_Q12 in the EXAM 3 (421) DATA file has data for nine assets, more specifically, nine U.S. Equity Sector ETFs. The spreadsheet has your estimates for the annual expected alpha E( alpha) and covariance matrix V. Your benchmark weights are given in the spreadsheet. The Expected Return (not Expected Alpha!) of the benchmark is closest to: a. There is not enough information to calculate it. b. 2% c. 0% d. 3% e. 4% 2) The purpose of this question is to add the possibility of a non-fully invested portfolio (i.e., with a fraction in cash/risk-free asset) and/or leverage. The spreadsheet HW4_Q2 has data for 4 risky assets (numbered 1, 2, 3, and 4) and one risk-free asset (number 0). The benchmark is fully-invested in the risky assets. The risk-free rate is 0.5% per year and the expected return of the benchmark is 2.5% per year. a) Complete the data: a.1) What is the expected alpha of the risk-free asset? a.2) What must be the expected alpha of risky-asset number 2 to ensure logical consistency? (Hint: What must be the expected alpha of the benchmark? Use Goal Seek or Solver to achieve it.) a.3) What is the volatility of the risk-free asset and its covariance with each of the other assets? b) Find the optimal portfolio when the Target for Active Risk is equal to 4% per year. Short sales are allowed. Is the optimal portfolio fully-invested in risky assets? c) Now assume that expected return of the benchmark is 8% per year and the manager can borrow at a rate of 1% per year. Short sales are allowed. Find the new optimal portfolio? Does the optimal portfolio take leverage? 2 a.1) The expected alpha of the risk-free asset is the RfRb=0.5%2.5%=2.0% 2 a.2) The expected alpha of the benchmark is 0 , so use solver OR this formula 2.24% check: 0 2 a.3) The volatility of the risk free asset and its covariancec with each other asset is 0 . Since the risk-free asset has no variance in returns, its vol is 0 . Since covariance includes the std dev of the risk free asset in the formula, it will also be zero The spreadsheet Q1_Q12 in the EXAM 3 (421) DATA file has data for nine assets, more specifically, nine U.S. Equity Sector ETFs. The spreadsheet has your estimates for the annual expected alpha E(alpha) and covariance matrix V. Your benchmark weights are given in the spreadsheet. The annualized volatility/standard deviation of returns of the Tech+Tcom ETF is closest to: a. 23% b. 16% c. 2.4% d. 6% e. 14% QUESTION 3 The spreadsheet Q1_Q12 in the EXAM 3 (421) DATA file has data for nine assets, more specifically, nine U.S. Equity Sector ETFs. The spreadsheet has your estimates for the annual expected alpha E( alpha) and covariance matrix V. Your benchmark weights are given in the spreadsheet. The Expected Return (not Expected Alpha!) of the benchmark is closest to: a. There is not enough information to calculate it. b. 2% c. 0% d. 3% e. 4%