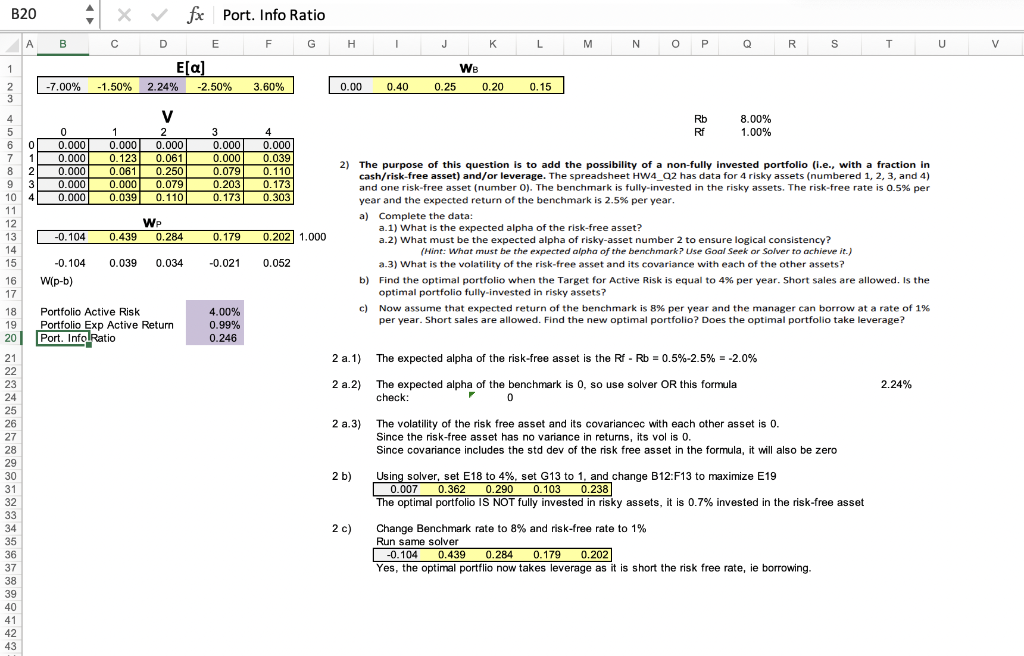

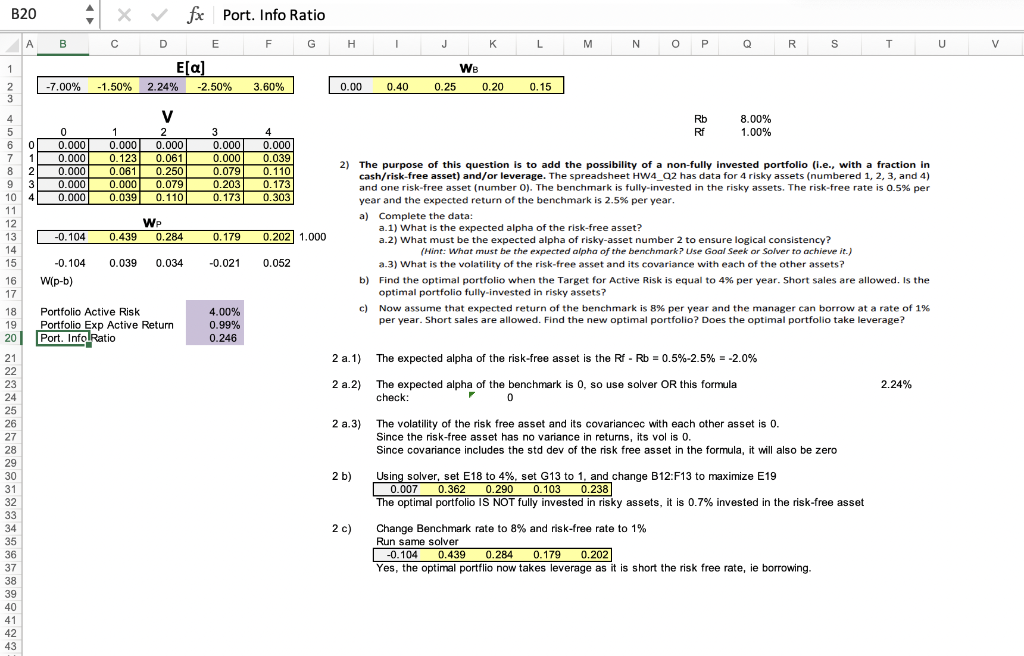

2) The purpose of this question is to add the possibility of a non-fully invested portfolio (i.e., with a fraction in cash/risk-free asset) and/or leverage. The spreadsheet HW4_Q2 has data for 4 risky assets (numbered 1, 2, 3, and 4) and one risk-free asset (number 0). The benchmark is fully-invested in the risky assets. The risk-free rate is 0.5% per year and the expected return of the benchmark is 2.5% per year. a) Complete the data: a.1) What is the expected alpha of the risk-free asset? a.2) What must be the expected alpha of risky-asset number 2 to ensure logical consistency? (Hint: What must be the expected alpha of the benchmark? Use Goal Seek or Solver to achieve it.) a.3) What is the volatility of the risk-free asset and its covariance with each of the other assets? b) Find the optimal portfolio when the Target for Active Risk is equal to 4% per year. Short sales are allowed. Is the optimal portfolio fully-invested in risky assets? c) Now assume that expected return of the benchmark is 8% per year and the manager can borrow at a rate of 1% per year. Short sales are allowed. Find the new optimal portfolio? Does the optimal portfolio take leverage? 2 a.1) The expected alpha of the risk-free asset is the RfRb=0.5%2.5%=2.0% 2 a.2) The expected alpha of the benchmark is 0 , so use solver OR this formula 2.24% check: 0 2 a.3) The volatility of the risk free asset and its covariancec with each other asset is 0 . Since the risk-free asset has no variance in returns, its vol is 0 . Since covariance includes the std dev of the risk free asset in the formula, it will also be zero The spreadsheet Q13_Q15 in the EXAM 3 (421) DATA file has daily returns for two stocks (Tootsie Rolls and Bed, Bath, and Beyond) for a one-year period, and returns for the Fama-French Five Factor Model (Market, Size, Value, Quality, and Investment Risk Factors). The correlation between Tootsie Roll and Bed, Bath, Beyond stocks in the sample is closest to: a. 0.12 b. 0.48 c. -0.22 d. 7.5 e. 0.29 2) The purpose of this question is to add the possibility of a non-fully invested portfolio (i.e., with a fraction in cash/risk-free asset) and/or leverage. The spreadsheet HW4_Q2 has data for 4 risky assets (numbered 1, 2, 3, and 4) and one risk-free asset (number 0). The benchmark is fully-invested in the risky assets. The risk-free rate is 0.5% per year and the expected return of the benchmark is 2.5% per year. a) Complete the data: a.1) What is the expected alpha of the risk-free asset? a.2) What must be the expected alpha of risky-asset number 2 to ensure logical consistency? (Hint: What must be the expected alpha of the benchmark? Use Goal Seek or Solver to achieve it.) a.3) What is the volatility of the risk-free asset and its covariance with each of the other assets? b) Find the optimal portfolio when the Target for Active Risk is equal to 4% per year. Short sales are allowed. Is the optimal portfolio fully-invested in risky assets? c) Now assume that expected return of the benchmark is 8% per year and the manager can borrow at a rate of 1% per year. Short sales are allowed. Find the new optimal portfolio? Does the optimal portfolio take leverage? 2 a.1) The expected alpha of the risk-free asset is the RfRb=0.5%2.5%=2.0% 2 a.2) The expected alpha of the benchmark is 0 , so use solver OR this formula 2.24% check: 0 2 a.3) The volatility of the risk free asset and its covariancec with each other asset is 0 . Since the risk-free asset has no variance in returns, its vol is 0 . Since covariance includes the std dev of the risk free asset in the formula, it will also be zero The spreadsheet Q13_Q15 in the EXAM 3 (421) DATA file has daily returns for two stocks (Tootsie Rolls and Bed, Bath, and Beyond) for a one-year period, and returns for the Fama-French Five Factor Model (Market, Size, Value, Quality, and Investment Risk Factors). The correlation between Tootsie Roll and Bed, Bath, Beyond stocks in the sample is closest to: a. 0.12 b. 0.48 c. -0.22 d. 7.5 e. 0.29