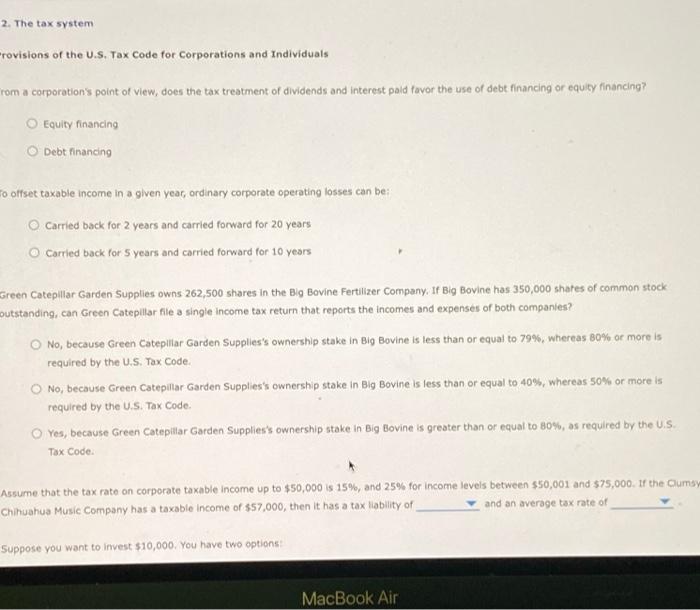

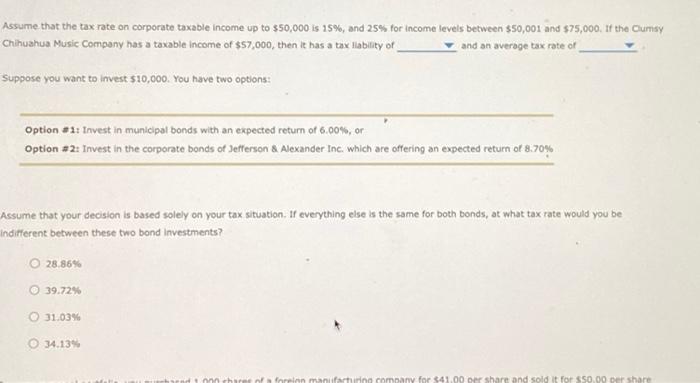

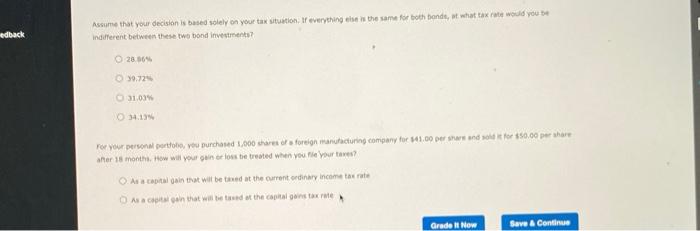

2. The tax system rovisions of the U.S. Tax Code for Corporations and Individuals rom a corporation's point of view, does the tax treatment of dividends and interest paid favor the use of debt financing or equity financing? Equity financing O Debt financing To offset taxable income in a given year, ordinary corporate operating losses can be Carried back for 2 years and carried forward for 20 years O Carried back for 5 years and carried forward for 10 years Green Catepillar Garden Supplies owns 262,500 shares in the Big Bovine Fertilizer Company. If Big Bovine has 350,000 shares of common stock outstanding, can Green Catepillar file a single income tax return that reports the incomes and expenses of both companies? No, because Green Catepillar Garden Supplles's ownership stake in Big Bovine is less than or equal to 79%, whereas 80% or more is required by the U.S. Tax Code No, because Green Catepillar Garden Supplies's ownership stake in Big Bovine is less than or equal to 40%, whereas 50% or more is required by the U.S. Tax Code: Yes, because Green Catepillar Garden Supplies's ownership stake in Big Bovine is greater than or equal to 80%, as required by the U.S. Tax Code. Assume that the tax rate on corporate taxable income up to $50,000 is 15%, and 25% for income levels between $50,001 and $75,000. If the Cumsy Chihuahua Music Company has a taxable income of $57,000, then it has a tax liability of and an average tax rate of Suppose you want to invest $10,000. You have two options MacBook Air Assume that the tax rate on corporate taxable income up to $50,000 is 15%, and 25% for income levels between $50,001 and $75,000. If the Clumsy Chihuahua Music Company has a taxable income of $57,000, then it has a tax lability of and an average tax rate of Suppose you want to invest $10,000. You have two options: Option #1: Invest in municipal bonds with an expected return of 6.00%, or Option #2: Invest in the corporate bonds of Jefferson & Alexander Inc. which are offering an expected return of 8.70% Assume that your decision is based solely on your tax situation. If everything else is the same for both bonds, at what tax rate would you be indifferent between these two bond Investments? 28.86% 39.7296 31.03% 0 34.13% chien frein no company for $41.00 per share and sold it for $50.00 Der share edback Assume that your decision is based solely on your tax situation. If everything else is the same for both bonds, what tax rate would you be indifferent between these two tond investments? 28.569 30.72 31.03 For your persona pot v Durchased 1,000 of foreign manufacturing company for 141.00 perando for $50.00 per share aer 18 months. How will your generos be treated when you leyourtres? As capital gain that will be that the current ordinary income tax rate Al con that will be at the capital gains tax rate Grade i New Save & Continue