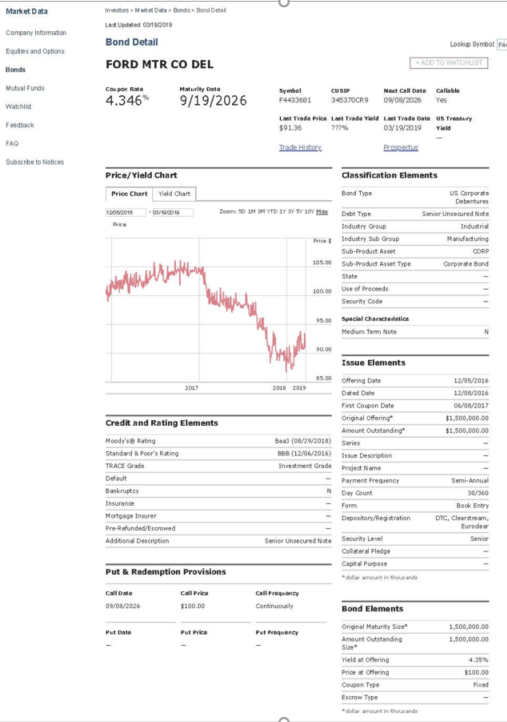

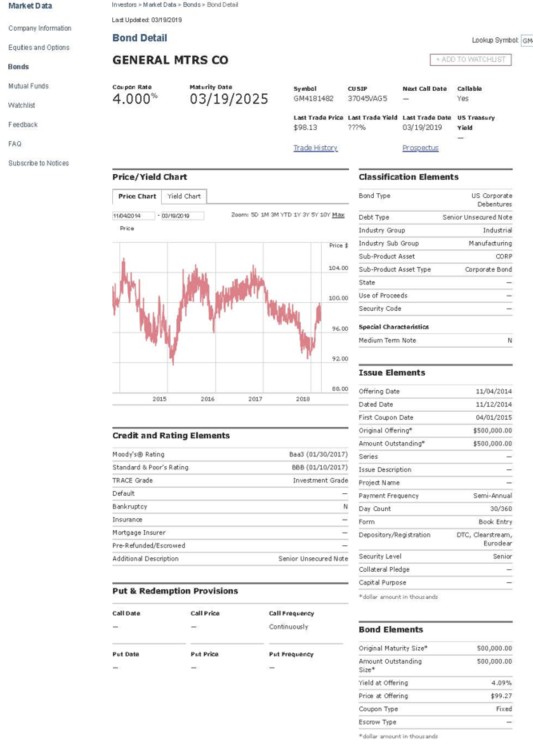

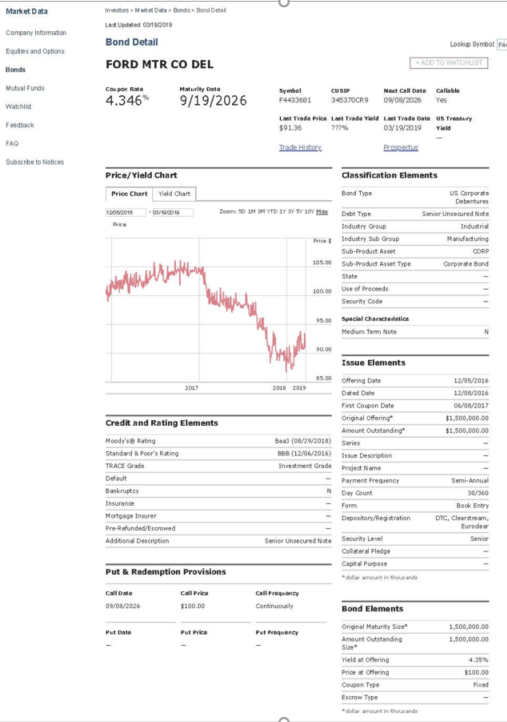

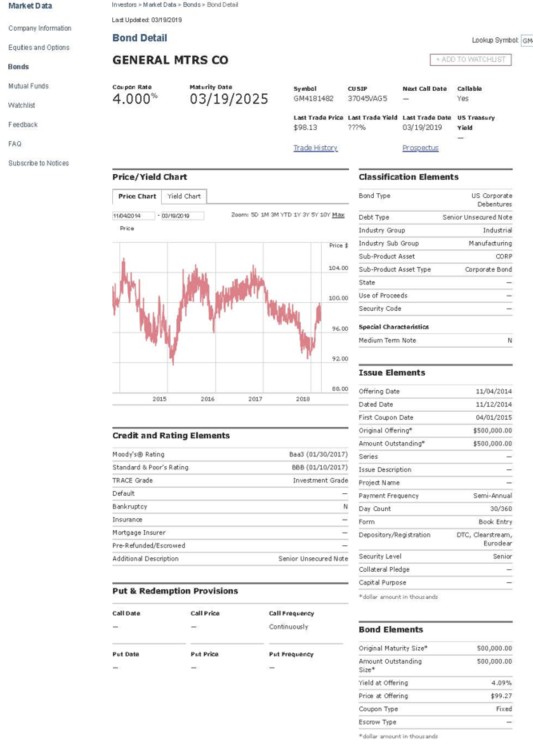

2. There are two bonds, one is a 4% coupon bond issued by General Motors, and the other is a 4.346% coupon bond issued by Ford. Please use this information to complete the following tasks. PART A: Compute the YTM for both bonds. YTM GM Ford PART B: What is the after-tax cost of debt for Ford given its effective tax rate for 2018 was 15%? After-Tax cost of debt= PART C: Compare the YTM for Ford and General Motors. Why are they different, given they both have the same bond rating? Please list a minimum of two reasons that might have caused this difference. Answer: Market Data LO Congr ation Bond Detail End One FORD MTR CO DEL 4.346 9/19/2026 NG 305100900225 Yes 5935 ON2019 TAO beto Price/Yield Chart Classification Elements Price Chart Yiddhart US Cargo Unsere De Type Industry industry Sub Sub-Product Asset Sub-Product As Type M aturing Corporate Bond 100.00 Use of proceeds Security Code Special Chart s Medium Team Note Issue Elements Offering te Date First Coupon Date Original Offeng amount Outstanding 12/05/2016 12/01/2018 06/06/2017 $1.500,000.00 Credit and Rating Elements Baad (08/29/2013 (13/06/2016) Issue Description Moody's Rating Standard & Poor's Rating TRACE Deut de Bankruptcy D OC, Cert deco Senior U red Not G Cod Pose Put & Redemption Provisions Bond Elements Prior Type Market Data 09 Comm on Bond Detail Eutando L e Gratist a ATOLICE GENERAL MTRS CO M unds Com My Data 4.000* 03/19/2025 Symbol GM418148237045AGS Lada Lada Ladeus S 13 OVI/2019 TAO Price/Yield Chart Classification Elements Price Chart Yield Chart Bond Type US Oport Senior U red Note Indus Toe Industry Group Industry Sub vodi Asset rodet Asset Type Manufacturing 10400 Corporate Bond State 300.00 Use of Proceeds Security Code Special Character Medium Tom Note Issue Elements 11/04/2014 Offering Date Date First Coupon Date Original Offering Amount Outstanding Series Credit and Rating Elements 04/01/2015 3500.000.00 500 000.00 bo Moody's Rating Standard Poor's Rating TRACE Grade (01/30/2017) 01/10/2017) Destion Project Name Payment Frequency Darunt Bry r, der Dec o Hartener Predsed Additional Description Senior Unsere Note Se College Cot Purpose Put & Redemption Provisions Gallery Bond Elements Amount Outstanding YO Prio ring Cute Es Type 2. There are two bonds, one is a 4% coupon bond issued by General Motors, and the other is a 4.346% coupon bond issued by Ford. Please use this information to complete the following tasks. PART A: Compute the YTM for both bonds. YTM GM Ford PART B: What is the after-tax cost of debt for Ford given its effective tax rate for 2018 was 15%? After-Tax cost of debt= PART C: Compare the YTM for Ford and General Motors. Why are they different, given they both have the same bond rating? Please list a minimum of two reasons that might have caused this difference. Answer: Market Data LO Congr ation Bond Detail End One FORD MTR CO DEL 4.346 9/19/2026 NG 305100900225 Yes 5935 ON2019 TAO beto Price/Yield Chart Classification Elements Price Chart Yiddhart US Cargo Unsere De Type Industry industry Sub Sub-Product Asset Sub-Product As Type M aturing Corporate Bond 100.00 Use of proceeds Security Code Special Chart s Medium Team Note Issue Elements Offering te Date First Coupon Date Original Offeng amount Outstanding 12/05/2016 12/01/2018 06/06/2017 $1.500,000.00 Credit and Rating Elements Baad (08/29/2013 (13/06/2016) Issue Description Moody's Rating Standard & Poor's Rating TRACE Deut de Bankruptcy D OC, Cert deco Senior U red Not G Cod Pose Put & Redemption Provisions Bond Elements Prior Type Market Data 09 Comm on Bond Detail Eutando L e Gratist a ATOLICE GENERAL MTRS CO M unds Com My Data 4.000* 03/19/2025 Symbol GM418148237045AGS Lada Lada Ladeus S 13 OVI/2019 TAO Price/Yield Chart Classification Elements Price Chart Yield Chart Bond Type US Oport Senior U red Note Indus Toe Industry Group Industry Sub vodi Asset rodet Asset Type Manufacturing 10400 Corporate Bond State 300.00 Use of Proceeds Security Code Special Character Medium Tom Note Issue Elements 11/04/2014 Offering Date Date First Coupon Date Original Offering Amount Outstanding Series Credit and Rating Elements 04/01/2015 3500.000.00 500 000.00 bo Moody's Rating Standard Poor's Rating TRACE Grade (01/30/2017) 01/10/2017) Destion Project Name Payment Frequency Darunt Bry r, der Dec o Hartener Predsed Additional Description Senior Unsere Note Se College Cot Purpose Put & Redemption Provisions Gallery Bond Elements Amount Outstanding YO Prio ring Cute Es Type