Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. There are two identical firms EQT Corp and DBT Corp except for their capital structure. For example none of the firms pay taxes, and

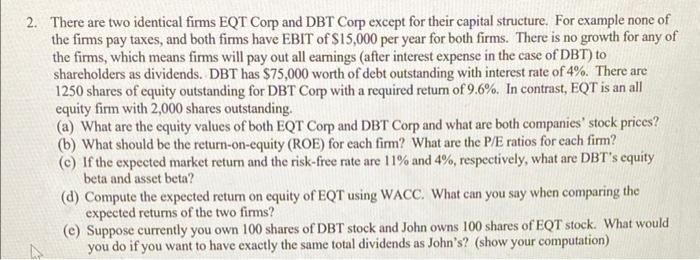

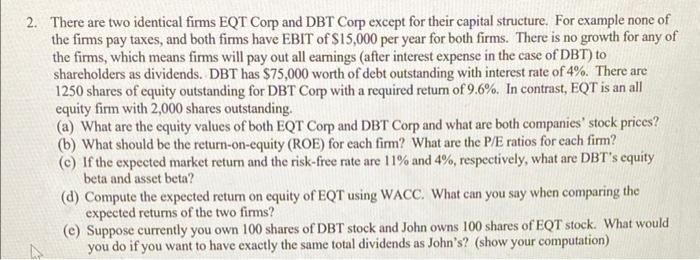

2. There are two identical firms EQT Corp and DBT Corp except for their capital structure. For example none of the firms pay taxes, and both firms have EBIT of $15,000 per year for both firms. There is no growth for any of the firms, which means firms will pay out all earnings (after interest expense in the case of DBT) to shareholders as dividends. DBT has $75,000 worth of debt outstanding with interest rate of 4%. There are 1250 shares of equity outstanding for DBT Corp with a required return of 9.6%. In contrast, EQT is an all equity firm with 2,000 shares outstanding. (a) What are the equity values of both EQT Corp and DBT Corp and what are both companies' stock prices? (b) What should be the return-on-equity (ROE) for each firm? What are the P/E ratios for each firm? (c) If the expected market return and the risk-free rate are 11% and 4%, respectively, what are DBT's equity beta and asset beta? (d) Compute the expected retum on equity of EQT using WACC. What can you say when comparing the expected returns of the two firms? (C) Suppose currently you own 100 shares of DBT stock and John owns 100 shares of EQT stock. What would you do if you want to have exactly the same total dividends as John's? (show your computation) 2. There are two identical firms EQT Corp and DBT Corp except for their capital structure. For example none of the firms pay taxes, and both firms have EBIT of $15,000 per year for both firms. There is no growth for any of the firms, which means firms will pay out all earnings (after interest expense in the case of DBT) to shareholders as dividends. DBT has $75,000 worth of debt outstanding with interest rate of 4%. There are 1250 shares of equity outstanding for DBT Corp with a required return of 9.6%. In contrast, EQT is an all equity firm with 2,000 shares outstanding. (a) What are the equity values of both EQT Corp and DBT Corp and what are both companies' stock prices? (b) What should be the return-on-equity (ROE) for each firm? What are the P/E ratios for each firm? (c) If the expected market return and the risk-free rate are 11% and 4%, respectively, what are DBT's equity beta and asset beta? (d) Compute the expected retum on equity of EQT using WACC. What can you say when comparing the expected returns of the two firms? (C) Suppose currently you own 100 shares of DBT stock and John owns 100 shares of EQT stock. What would you do if you want to have exactly the same total dividends as John's? (show your computation)

2. There are two identical firms EQT Corp and DBT Corp except for their capital structure. For example none of the firms pay taxes, and both firms have EBIT of $15,000 per year for both firms. There is no growth for any of the firms, which means firms will pay out all earnings (after interest expense in the case of DBT) to shareholders as dividends. DBT has $75,000 worth of debt outstanding with interest rate of 4%. There are 1250 shares of equity outstanding for DBT Corp with a required return of 9.6%. In contrast, EQT is an all equity firm with 2,000 shares outstanding. (a) What are the equity values of both EQT Corp and DBT Corp and what are both companies' stock prices? (b) What should be the return-on-equity (ROE) for each firm? What are the P/E ratios for each firm? (c) If the expected market return and the risk-free rate are 11% and 4%, respectively, what are DBT's equity beta and asset beta? (d) Compute the expected retum on equity of EQT using WACC. What can you say when comparing the expected returns of the two firms? (C) Suppose currently you own 100 shares of DBT stock and John owns 100 shares of EQT stock. What would you do if you want to have exactly the same total dividends as John's? (show your computation) 2. There are two identical firms EQT Corp and DBT Corp except for their capital structure. For example none of the firms pay taxes, and both firms have EBIT of $15,000 per year for both firms. There is no growth for any of the firms, which means firms will pay out all earnings (after interest expense in the case of DBT) to shareholders as dividends. DBT has $75,000 worth of debt outstanding with interest rate of 4%. There are 1250 shares of equity outstanding for DBT Corp with a required return of 9.6%. In contrast, EQT is an all equity firm with 2,000 shares outstanding. (a) What are the equity values of both EQT Corp and DBT Corp and what are both companies' stock prices? (b) What should be the return-on-equity (ROE) for each firm? What are the P/E ratios for each firm? (c) If the expected market return and the risk-free rate are 11% and 4%, respectively, what are DBT's equity beta and asset beta? (d) Compute the expected retum on equity of EQT using WACC. What can you say when comparing the expected returns of the two firms? (C) Suppose currently you own 100 shares of DBT stock and John owns 100 shares of EQT stock. What would you do if you want to have exactly the same total dividends as John's? (show your computation)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started