Answered step by step

Verified Expert Solution

Question

1 Approved Answer

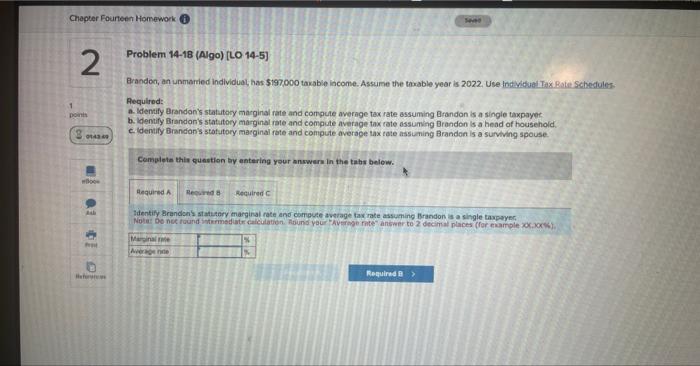

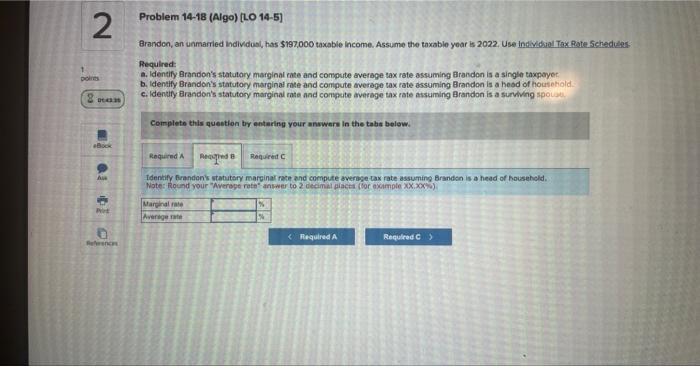

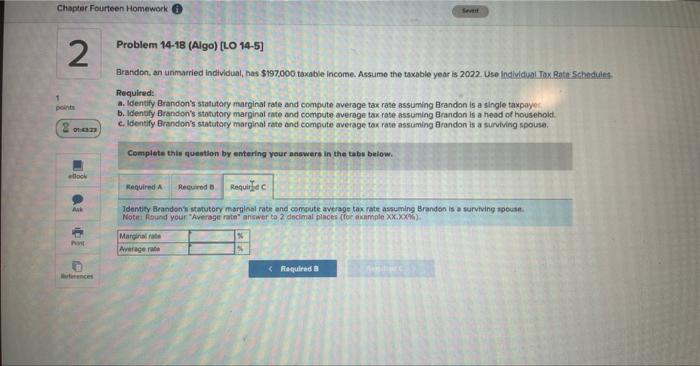

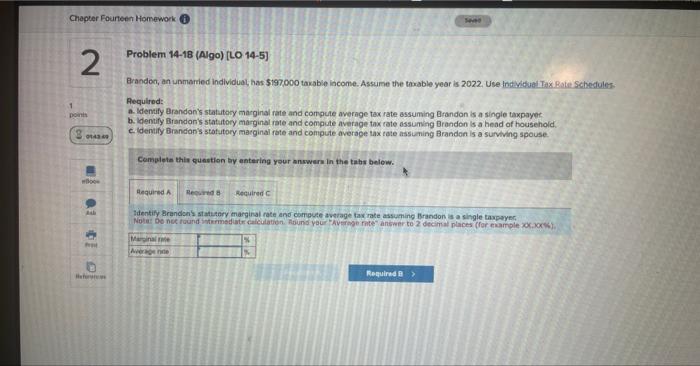

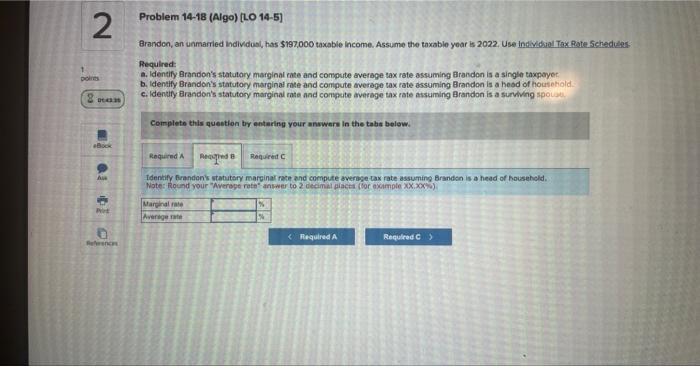

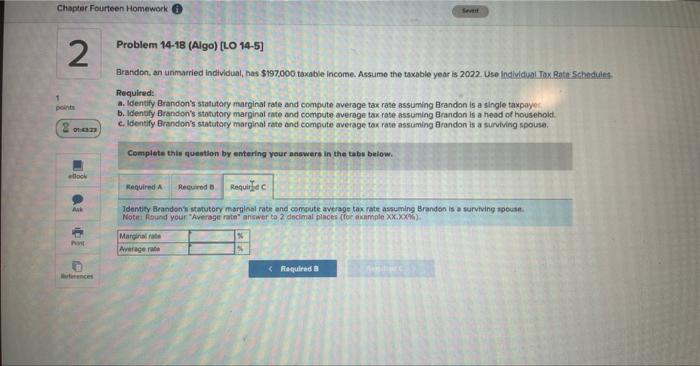

#2 There is 3 requirements, please respond to all Brandon, an unmarried indlyiduat, has 5197000 taxable income. Assume the taxable year is 2022. Use totivitual

#2

Brandon, an unmarried indlyiduat, has 5197000 taxable income. Assume the taxable year is 2022. Use totivitual Tax. Rate Schedic Pequired: a. Identify Brandon's statutory marginal rate and compute average tax rate assuming Brandon is a single taxpayec b. Identify Brandan's statutory marginal rate and compute average tax rate assuming Brandon is a head of househoid. cidentify Brandan's stafutory marginal rate and compute average tax tate assuming Brandon is a surviving spouse. Cembiets this question by entering your answers in the tabs belew. Tdentify Zrandions statstery marginal rate and campute average tax rate assuming Brandon is a single taxpyer; Branden, an unmarried individusi, has $197.000 taxable income. Assume the taxable yoar is 2.022, Use indlivititiol Tax Pate 5 chedu Required: a. Identify Brandon's statutary marginal rate and compute average tax rate assuming Brandon is a single taxpayet. b. Identify Brandon's statutory marginal mate and compute werege tax rate assuming Brandon is a heod of hous ehold. c. Identify Brandon's statutory marginal rate and compate tyerage tax rate assuming Brandon is a surviving spousti. Complete this question ty entering your anwwers in the tabs below. Tdentify Brandonis statutary marginal race and compute sverese tax rate assuming Brandon is a head of househcld. Brandon, an unmaeried individual, has $197.000 taxable income. Assume the taxable year is 2022 . Use lndluldual Tox Ratit Sctherdul Requited: A. Identify Brandon's statutory marginal rate and compute average tax rate assuming Brandon is a single taxpoye: b. Identify Brandon's statutory marginal rate and compute twerage tax rate assuming Brandon is a head of householct. c. Identify Brandon's statutory marginal rate and compute average tax rate assuming Brandon is a surviving spouse. Complets this question by entering your anawers in the tabs beiow. Identify Fieandons statutory marginat rate and comsete average tax rate assuming Brandon is a surviving spouse There is 3 requirements, please respond to all

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started