Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. [This question is optional. If you decide not to work on it, please assume that the optimal capital structure is ND* /(ND+E)=23.4%.] A careful

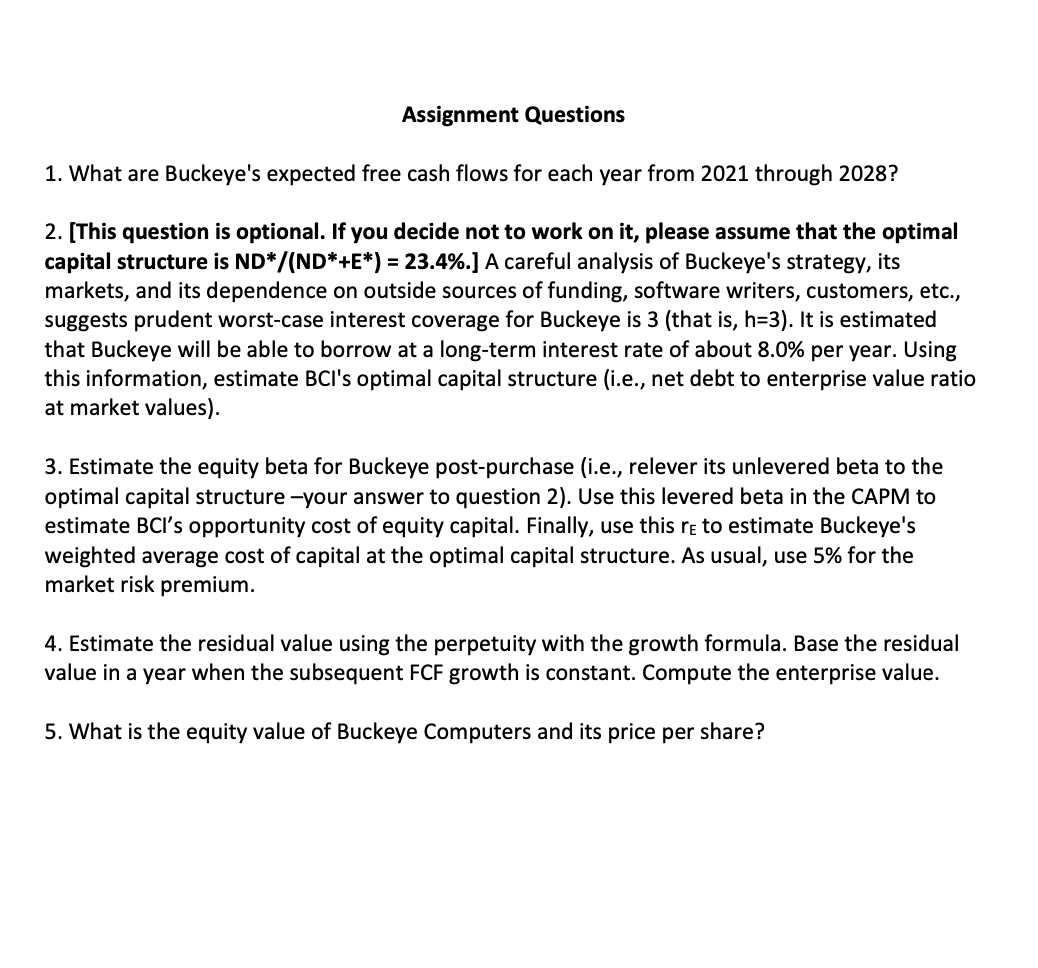

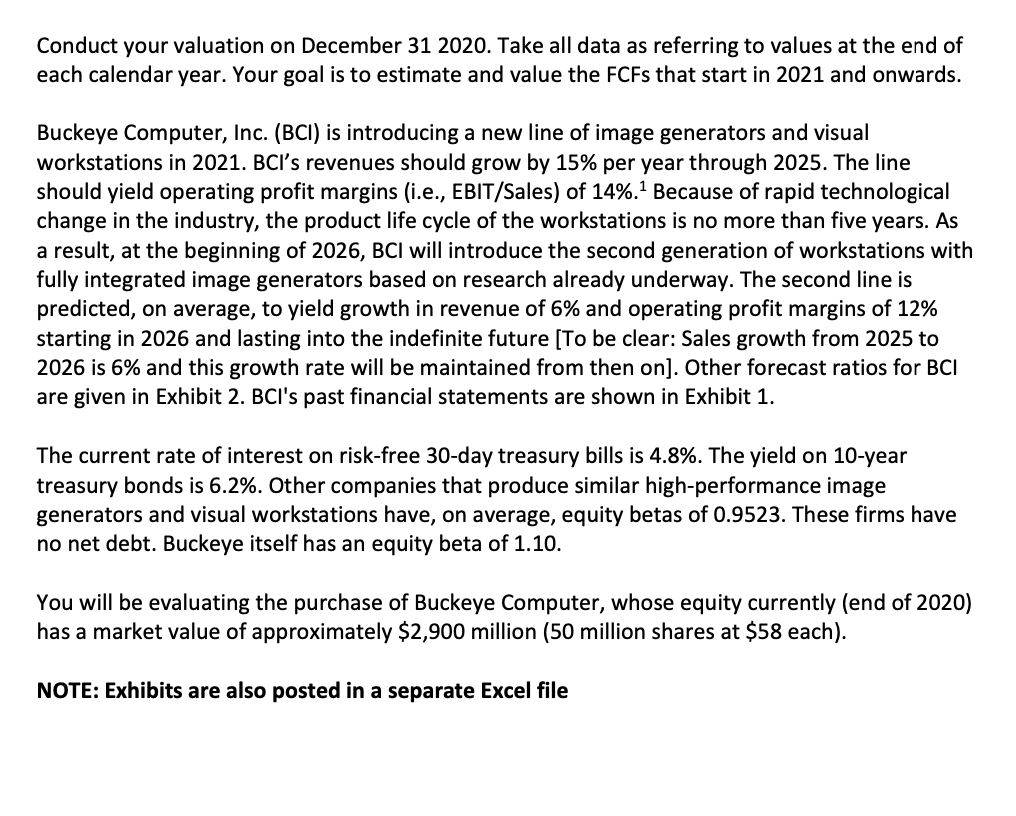

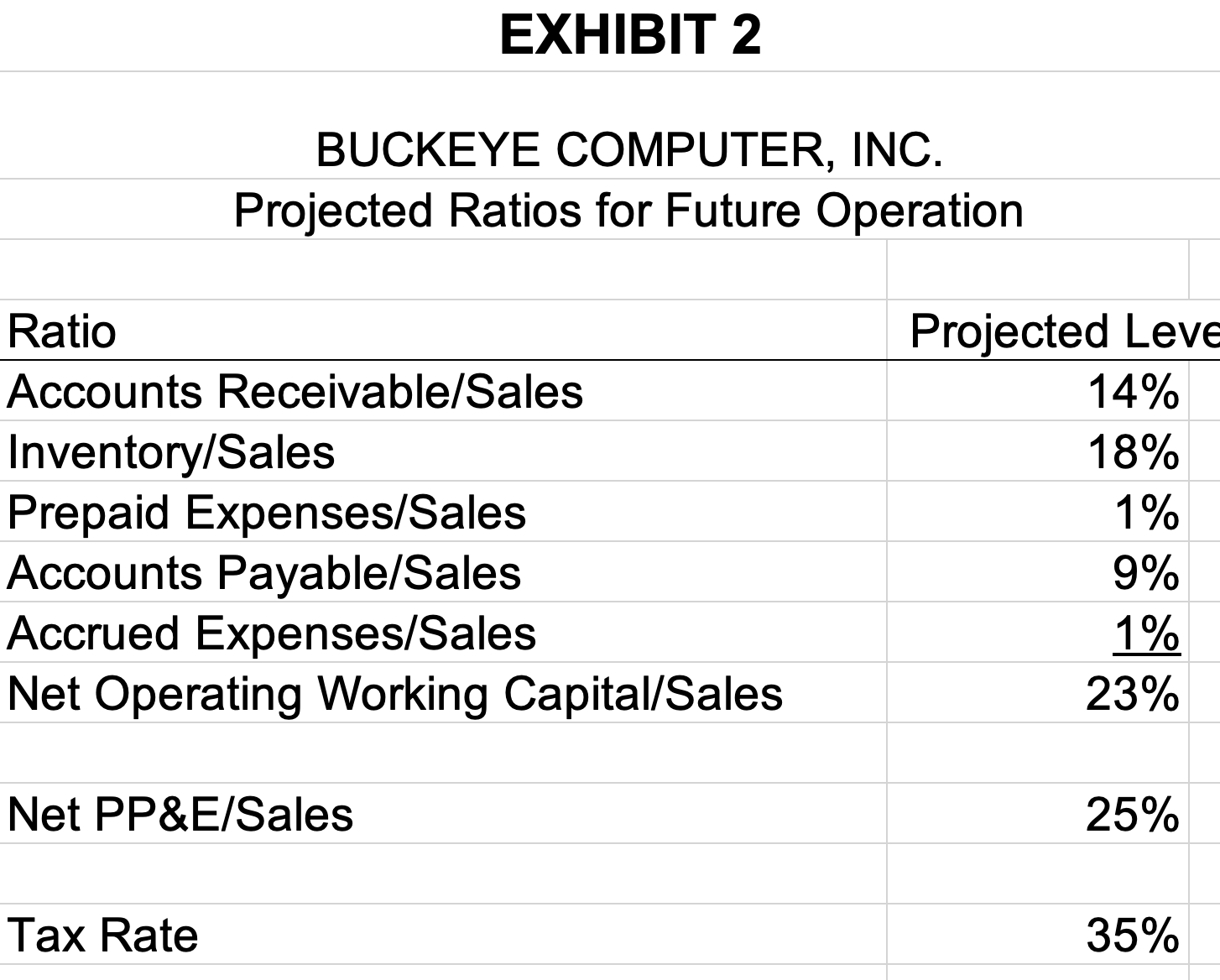

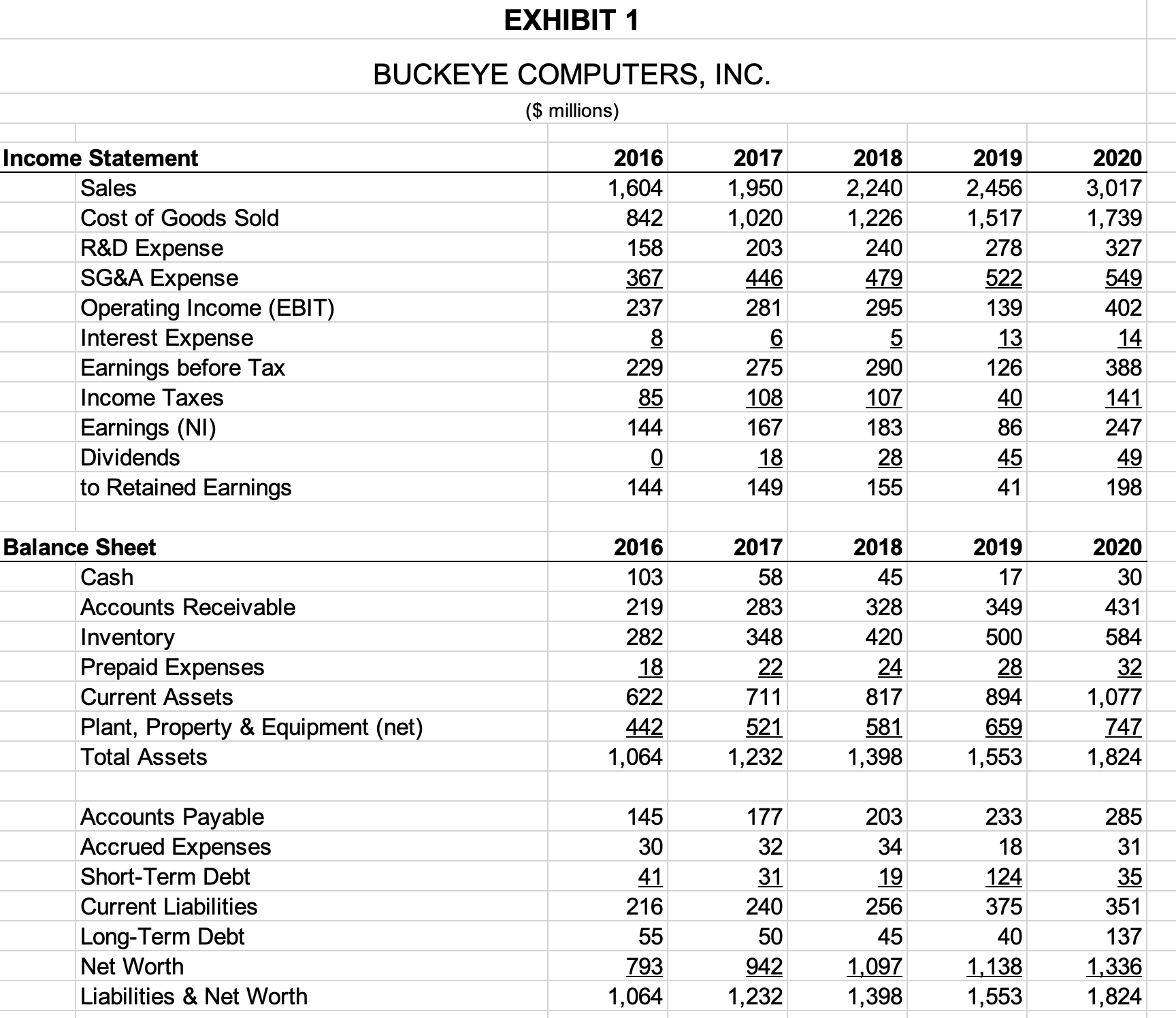

2. [This question is optional. If you decide not to work on it, please assume that the optimal capital structure is ND* /(ND+E)=23.4%.] A careful analysis of Buckeye's strategy, its markets, and its dependence on outside sources of funding, software writers, customers, etc., suggests prudent worst-case interest coverage for Buckeye is 3 (that is, h=3 ). It is estimated that Buckeye will be able to borrow at a long-term interest rate of about 8.0% per year. Using this information, estimate BCI's optimal capital structure (i.e., net debt to enterprise value ratio at market values). 3. Estimate the equity beta for Buckeye post-purchase (i.e., relever its unlevered beta to the optimal capital structure -your answer to question 2). Use this levered beta in the CAPM to estimate BCl opportunity cost of equity capital. Finally, use this rE to estimate Buckeye's weighted average cost of capital at the optimal capital structure. As usual, use 5% for the market risk premium. 4. Estimate the residual value using the perpetuity with the growth formula. Base the residual value in a year when the subsequent FCF growth is constant. Compute the enterprise value. 5. What is the equity value of Buckeye Computers and its price per share? Conduct your valuation on December 312020 . Take all data as referring to values at the end of each calendar year. Your goal is to estimate and value the FCFs that start in 2021 and onwards. Buckeye Computer, Inc. (BCl) is introducing a new line of image generators and visual workstations in 2021 . BCl's revenues should grow by 15% per year through 2025 . The line should yield operating profit margins (i.e., EBIT/Sales) of 14%.1 Because of rapid technological change in the industry, the product life cycle of the workstations is no more than five years. As a result, at the beginning of 2026,BCl will introduce the second generation of workstations with fully integrated image generators based on research already underway. The second line is predicted, on average, to yield growth in revenue of 6% and operating profit margins of 12% starting in 2026 and lasting into the indefinite future [To be clear: Sales growth from 2025 to 2026 is 6% and this growth rate will be maintained from then on]. Other forecast ratios for BCl are given in Exhibit 2. BCI's past financial statements are shown in Exhibit 1. The current rate of interest on risk-free 30-day treasury bills is 4.8%. The yield on 10 -year treasury bonds is 6.2%. Other companies that produce similar high-performance image generators and visual workstations have, on average, equity betas of 0.9523 . These firms have no net debt. Buckeye itself has an equity beta of 1.10 . You will be evaluating the purchase of Buckeye Computer, whose equity currently (end of 2020) has a market value of approximately $2,900 million ( 50 million shares at $58 each). NOTE: Exhibits are also posted in a separate Excel file EXHIBIT 2 BUCKEYE COMPUTER, INC. Projected Ratios for Future Operation Ratio Projected Leve Accounts Receivable/Sales 14% Inventory/Sales 18% Prepaid Expenses/Sales Accounts Payable/Sales 9% Accrued Expenses/Sales Net Operating Working Capital/Sales 23%1% Net PP\&E/Sales 25% Tax Rate 35% EXHIBIT 1 BUCKEYE COMPUTERS, INC. (\$ millions) 2. [This question is optional. If you decide not to work on it, please assume that the optimal capital structure is ND* /(ND+E)=23.4%.] A careful analysis of Buckeye's strategy, its markets, and its dependence on outside sources of funding, software writers, customers, etc., suggests prudent worst-case interest coverage for Buckeye is 3 (that is, h=3 ). It is estimated that Buckeye will be able to borrow at a long-term interest rate of about 8.0% per year. Using this information, estimate BCI's optimal capital structure (i.e., net debt to enterprise value ratio at market values). 3. Estimate the equity beta for Buckeye post-purchase (i.e., relever its unlevered beta to the optimal capital structure -your answer to question 2). Use this levered beta in the CAPM to estimate BCl opportunity cost of equity capital. Finally, use this rE to estimate Buckeye's weighted average cost of capital at the optimal capital structure. As usual, use 5% for the market risk premium. 4. Estimate the residual value using the perpetuity with the growth formula. Base the residual value in a year when the subsequent FCF growth is constant. Compute the enterprise value. 5. What is the equity value of Buckeye Computers and its price per share? Conduct your valuation on December 312020 . Take all data as referring to values at the end of each calendar year. Your goal is to estimate and value the FCFs that start in 2021 and onwards. Buckeye Computer, Inc. (BCl) is introducing a new line of image generators and visual workstations in 2021 . BCl's revenues should grow by 15% per year through 2025 . The line should yield operating profit margins (i.e., EBIT/Sales) of 14%.1 Because of rapid technological change in the industry, the product life cycle of the workstations is no more than five years. As a result, at the beginning of 2026,BCl will introduce the second generation of workstations with fully integrated image generators based on research already underway. The second line is predicted, on average, to yield growth in revenue of 6% and operating profit margins of 12% starting in 2026 and lasting into the indefinite future [To be clear: Sales growth from 2025 to 2026 is 6% and this growth rate will be maintained from then on]. Other forecast ratios for BCl are given in Exhibit 2. BCI's past financial statements are shown in Exhibit 1. The current rate of interest on risk-free 30-day treasury bills is 4.8%. The yield on 10 -year treasury bonds is 6.2%. Other companies that produce similar high-performance image generators and visual workstations have, on average, equity betas of 0.9523 . These firms have no net debt. Buckeye itself has an equity beta of 1.10 . You will be evaluating the purchase of Buckeye Computer, whose equity currently (end of 2020) has a market value of approximately $2,900 million ( 50 million shares at $58 each). NOTE: Exhibits are also posted in a separate Excel file EXHIBIT 2 BUCKEYE COMPUTER, INC. Projected Ratios for Future Operation Ratio Projected Leve Accounts Receivable/Sales 14% Inventory/Sales 18% Prepaid Expenses/Sales Accounts Payable/Sales 9% Accrued Expenses/Sales Net Operating Working Capital/Sales 23%1% Net PP\&E/Sales 25% Tax Rate 35% EXHIBIT 1 BUCKEYE COMPUTERS, INC. (\$ millions)

2. [This question is optional. If you decide not to work on it, please assume that the optimal capital structure is ND* /(ND+E)=23.4%.] A careful analysis of Buckeye's strategy, its markets, and its dependence on outside sources of funding, software writers, customers, etc., suggests prudent worst-case interest coverage for Buckeye is 3 (that is, h=3 ). It is estimated that Buckeye will be able to borrow at a long-term interest rate of about 8.0% per year. Using this information, estimate BCI's optimal capital structure (i.e., net debt to enterprise value ratio at market values). 3. Estimate the equity beta for Buckeye post-purchase (i.e., relever its unlevered beta to the optimal capital structure -your answer to question 2). Use this levered beta in the CAPM to estimate BCl opportunity cost of equity capital. Finally, use this rE to estimate Buckeye's weighted average cost of capital at the optimal capital structure. As usual, use 5% for the market risk premium. 4. Estimate the residual value using the perpetuity with the growth formula. Base the residual value in a year when the subsequent FCF growth is constant. Compute the enterprise value. 5. What is the equity value of Buckeye Computers and its price per share? Conduct your valuation on December 312020 . Take all data as referring to values at the end of each calendar year. Your goal is to estimate and value the FCFs that start in 2021 and onwards. Buckeye Computer, Inc. (BCl) is introducing a new line of image generators and visual workstations in 2021 . BCl's revenues should grow by 15% per year through 2025 . The line should yield operating profit margins (i.e., EBIT/Sales) of 14%.1 Because of rapid technological change in the industry, the product life cycle of the workstations is no more than five years. As a result, at the beginning of 2026,BCl will introduce the second generation of workstations with fully integrated image generators based on research already underway. The second line is predicted, on average, to yield growth in revenue of 6% and operating profit margins of 12% starting in 2026 and lasting into the indefinite future [To be clear: Sales growth from 2025 to 2026 is 6% and this growth rate will be maintained from then on]. Other forecast ratios for BCl are given in Exhibit 2. BCI's past financial statements are shown in Exhibit 1. The current rate of interest on risk-free 30-day treasury bills is 4.8%. The yield on 10 -year treasury bonds is 6.2%. Other companies that produce similar high-performance image generators and visual workstations have, on average, equity betas of 0.9523 . These firms have no net debt. Buckeye itself has an equity beta of 1.10 . You will be evaluating the purchase of Buckeye Computer, whose equity currently (end of 2020) has a market value of approximately $2,900 million ( 50 million shares at $58 each). NOTE: Exhibits are also posted in a separate Excel file EXHIBIT 2 BUCKEYE COMPUTER, INC. Projected Ratios for Future Operation Ratio Projected Leve Accounts Receivable/Sales 14% Inventory/Sales 18% Prepaid Expenses/Sales Accounts Payable/Sales 9% Accrued Expenses/Sales Net Operating Working Capital/Sales 23%1% Net PP\&E/Sales 25% Tax Rate 35% EXHIBIT 1 BUCKEYE COMPUTERS, INC. (\$ millions) 2. [This question is optional. If you decide not to work on it, please assume that the optimal capital structure is ND* /(ND+E)=23.4%.] A careful analysis of Buckeye's strategy, its markets, and its dependence on outside sources of funding, software writers, customers, etc., suggests prudent worst-case interest coverage for Buckeye is 3 (that is, h=3 ). It is estimated that Buckeye will be able to borrow at a long-term interest rate of about 8.0% per year. Using this information, estimate BCI's optimal capital structure (i.e., net debt to enterprise value ratio at market values). 3. Estimate the equity beta for Buckeye post-purchase (i.e., relever its unlevered beta to the optimal capital structure -your answer to question 2). Use this levered beta in the CAPM to estimate BCl opportunity cost of equity capital. Finally, use this rE to estimate Buckeye's weighted average cost of capital at the optimal capital structure. As usual, use 5% for the market risk premium. 4. Estimate the residual value using the perpetuity with the growth formula. Base the residual value in a year when the subsequent FCF growth is constant. Compute the enterprise value. 5. What is the equity value of Buckeye Computers and its price per share? Conduct your valuation on December 312020 . Take all data as referring to values at the end of each calendar year. Your goal is to estimate and value the FCFs that start in 2021 and onwards. Buckeye Computer, Inc. (BCl) is introducing a new line of image generators and visual workstations in 2021 . BCl's revenues should grow by 15% per year through 2025 . The line should yield operating profit margins (i.e., EBIT/Sales) of 14%.1 Because of rapid technological change in the industry, the product life cycle of the workstations is no more than five years. As a result, at the beginning of 2026,BCl will introduce the second generation of workstations with fully integrated image generators based on research already underway. The second line is predicted, on average, to yield growth in revenue of 6% and operating profit margins of 12% starting in 2026 and lasting into the indefinite future [To be clear: Sales growth from 2025 to 2026 is 6% and this growth rate will be maintained from then on]. Other forecast ratios for BCl are given in Exhibit 2. BCI's past financial statements are shown in Exhibit 1. The current rate of interest on risk-free 30-day treasury bills is 4.8%. The yield on 10 -year treasury bonds is 6.2%. Other companies that produce similar high-performance image generators and visual workstations have, on average, equity betas of 0.9523 . These firms have no net debt. Buckeye itself has an equity beta of 1.10 . You will be evaluating the purchase of Buckeye Computer, whose equity currently (end of 2020) has a market value of approximately $2,900 million ( 50 million shares at $58 each). NOTE: Exhibits are also posted in a separate Excel file EXHIBIT 2 BUCKEYE COMPUTER, INC. Projected Ratios for Future Operation Ratio Projected Leve Accounts Receivable/Sales 14% Inventory/Sales 18% Prepaid Expenses/Sales Accounts Payable/Sales 9% Accrued Expenses/Sales Net Operating Working Capital/Sales 23%1% Net PP\&E/Sales 25% Tax Rate 35% EXHIBIT 1 BUCKEYE COMPUTERS, INC. (\$ millions) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started