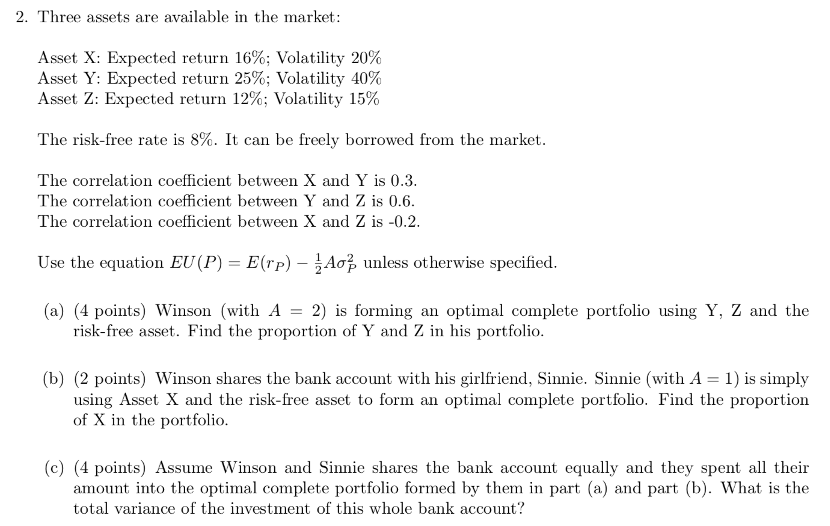

2. Three assets are available in the market: Asset X: Expected return 16%; Volatility 20% Asset Y: Expected return 25%; Volatility 40% Asset Z: Expected return 12%; Volatility 15% The risk-free rate is 8%. It can be freely borrowed from the market. The correlation coefficient between X and Y is 0.3. The correlation coefficient between Y and Z is 0.6. The correlation coefficient between X and Z is -0.2. Use the equation EU (P) = E(rp) - Ag unless otherwise specified. = (a) (4 points) Winson (with A 2) is forming an optimal complete portfolio using Y, Z and the risk-free asset. Find the proportion of Y and Z in his portfolio. (b) (2 points) Winson shares the bank account with his girlfriend, Sinnie. Sinnie (with A = 1) is simply using Asset X and the risk-free asset to form an optimal complete portfolio. Find the proportion of X in the portfolio. (c) (4 points) Assume Winson and Sinnie shares the bank account equally and they spent all their amount into the optimal complete portfolio formed by them in part (a) and part (b). What is the total variance of the investment of this whole bank account? 2. Three assets are available in the market: Asset X: Expected return 16%; Volatility 20% Asset Y: Expected return 25%; Volatility 40% Asset Z: Expected return 12%; Volatility 15% The risk-free rate is 8%. It can be freely borrowed from the market. The correlation coefficient between X and Y is 0.3. The correlation coefficient between Y and Z is 0.6. The correlation coefficient between X and Z is -0.2. Use the equation EU (P) = E(rp) - Ag unless otherwise specified. = (a) (4 points) Winson (with A 2) is forming an optimal complete portfolio using Y, Z and the risk-free asset. Find the proportion of Y and Z in his portfolio. (b) (2 points) Winson shares the bank account with his girlfriend, Sinnie. Sinnie (with A = 1) is simply using Asset X and the risk-free asset to form an optimal complete portfolio. Find the proportion of X in the portfolio. (c) (4 points) Assume Winson and Sinnie shares the bank account equally and they spent all their amount into the optimal complete portfolio formed by them in part (a) and part (b). What is the total variance of the investment of this whole bank account