2 through 4 i need help

this is all the information gaven

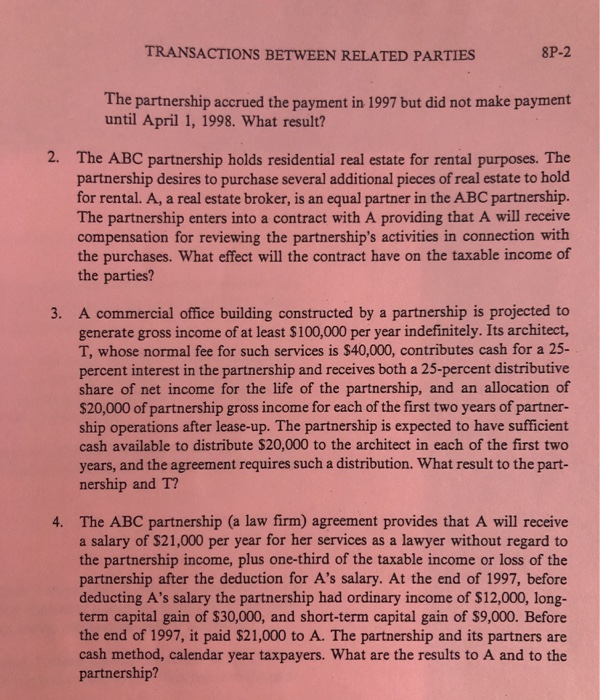

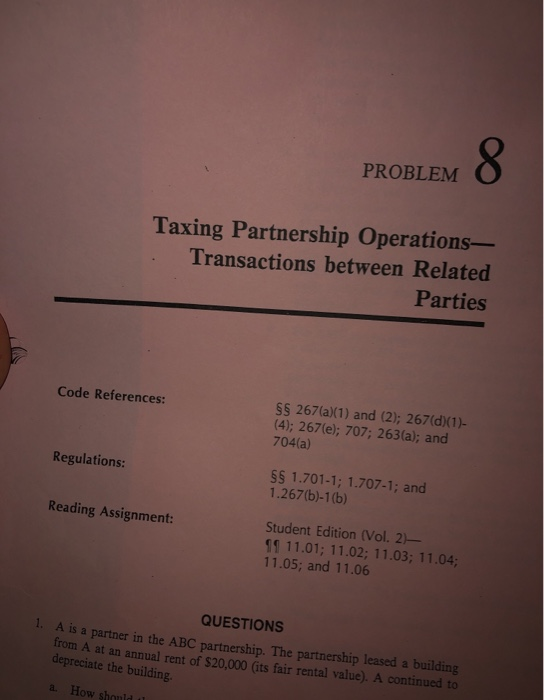

TRANSACTIONS BETWEEN RELATED PARTIES 8P-2 The partnership accrued the payment in 1997 but did not make payment until April 1, 1998. What result? 2. The ABC partnership holds residential real estate for rental purposes. The partnership desires to purchase several additional pieces of real estate to hold for rental. A, a real estate broker, is an equal partner in the ABC partnership The partnership enters into a contract with A providing that A will receive compensation for reviewing the partnership's activities in connection with the purchases. What effect will the contract have on the taxable income of the parties? 3. A commercial office building constructed by a partnership is projected to generate gross income of at least $100,000 per year indefinitely. Its architect, T, whose normal fee for such services is $40,000, contributes cash for a 25- percent interest in the partnership and receives both a 25-percent distributive share of net income for the life of the partnership, and an allocation of $20,000 of partnership gross income for each of the first two years of partner- ship operations after lease-up. The partnership is expected to have sufficient cash available to distribute $20,000 to the architect in each of the first two years, and the agreement requires such a distribution. What result to the part- nership and T? 4. The ABC partnership (a law firm) agreement provides that A will receive a salary of $21,000 per year for her services as a lawyer without regard to the partnership income, plus one-third of the taxable income or loss of the partnership after the deduction for A's salary. At the end of 1997, before deducting A's salary the partnership had ordinary income of $12,000, long- term capital gain of $30,000, and short-term capital gain of $9,000. Before the end of 1997, it paid $21,000 to A. The partnership and its partners are cash method, calendar year taxpayers. What are the results to A and to the partnership? PROBLEM Taxing Partnership Operations- Transactions between Related Parties Code References: SS 267(a)(1) and (2); 267(d)(1)- (4); 267(e); 707; 263(a); and 704(a) Regulations: $$ 1.701-1; 1.707-1; and 1.267(b)-1(b) Reading Assignment: Student Edition (Vol. 2) 11 11.01; 11.02; 11.03; 11.04; 11.05; and 11.06 1. QUESTIONS A is a partner in the ABC partnership. The partnership leased a building from A at an annual rent of $20,000 (its fair rental value). A continued to depreciate the building. a. How should TRANSACTIONS BETWEEN RELATED PARTIES 8P-2 The partnership accrued the payment in 1997 but did not make payment until April 1, 1998. What result? 2. The ABC partnership holds residential real estate for rental purposes. The partnership desires to purchase several additional pieces of real estate to hold for rental. A, a real estate broker, is an equal partner in the ABC partnership The partnership enters into a contract with A providing that A will receive compensation for reviewing the partnership's activities in connection with the purchases. What effect will the contract have on the taxable income of the parties? 3. A commercial office building constructed by a partnership is projected to generate gross income of at least $100,000 per year indefinitely. Its architect, T, whose normal fee for such services is $40,000, contributes cash for a 25- percent interest in the partnership and receives both a 25-percent distributive share of net income for the life of the partnership, and an allocation of $20,000 of partnership gross income for each of the first two years of partner- ship operations after lease-up. The partnership is expected to have sufficient cash available to distribute $20,000 to the architect in each of the first two years, and the agreement requires such a distribution. What result to the part- nership and T? 4. The ABC partnership (a law firm) agreement provides that A will receive a salary of $21,000 per year for her services as a lawyer without regard to the partnership income, plus one-third of the taxable income or loss of the partnership after the deduction for A's salary. At the end of 1997, before deducting A's salary the partnership had ordinary income of $12,000, long- term capital gain of $30,000, and short-term capital gain of $9,000. Before the end of 1997, it paid $21,000 to A. The partnership and its partners are cash method, calendar year taxpayers. What are the results to A and to the partnership? PROBLEM Taxing Partnership Operations- Transactions between Related Parties Code References: SS 267(a)(1) and (2); 267(d)(1)- (4); 267(e); 707; 263(a); and 704(a) Regulations: $$ 1.701-1; 1.707-1; and 1.267(b)-1(b) Reading Assignment: Student Edition (Vol. 2) 11 11.01; 11.02; 11.03; 11.04; 11.05; and 11.06 1. QUESTIONS A is a partner in the ABC partnership. The partnership leased a building from A at an annual rent of $20,000 (its fair rental value). A continued to depreciate the building. a. How should