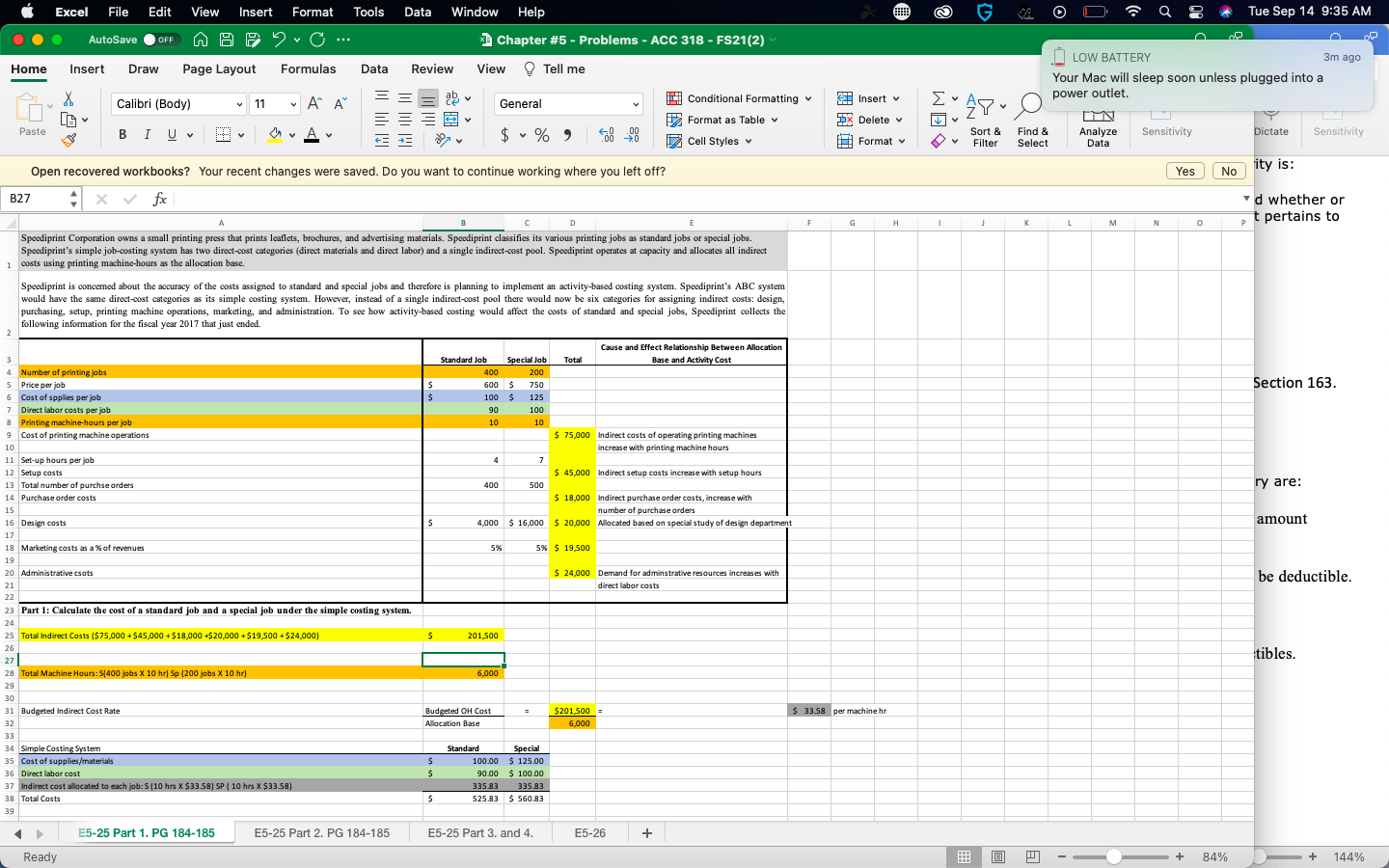

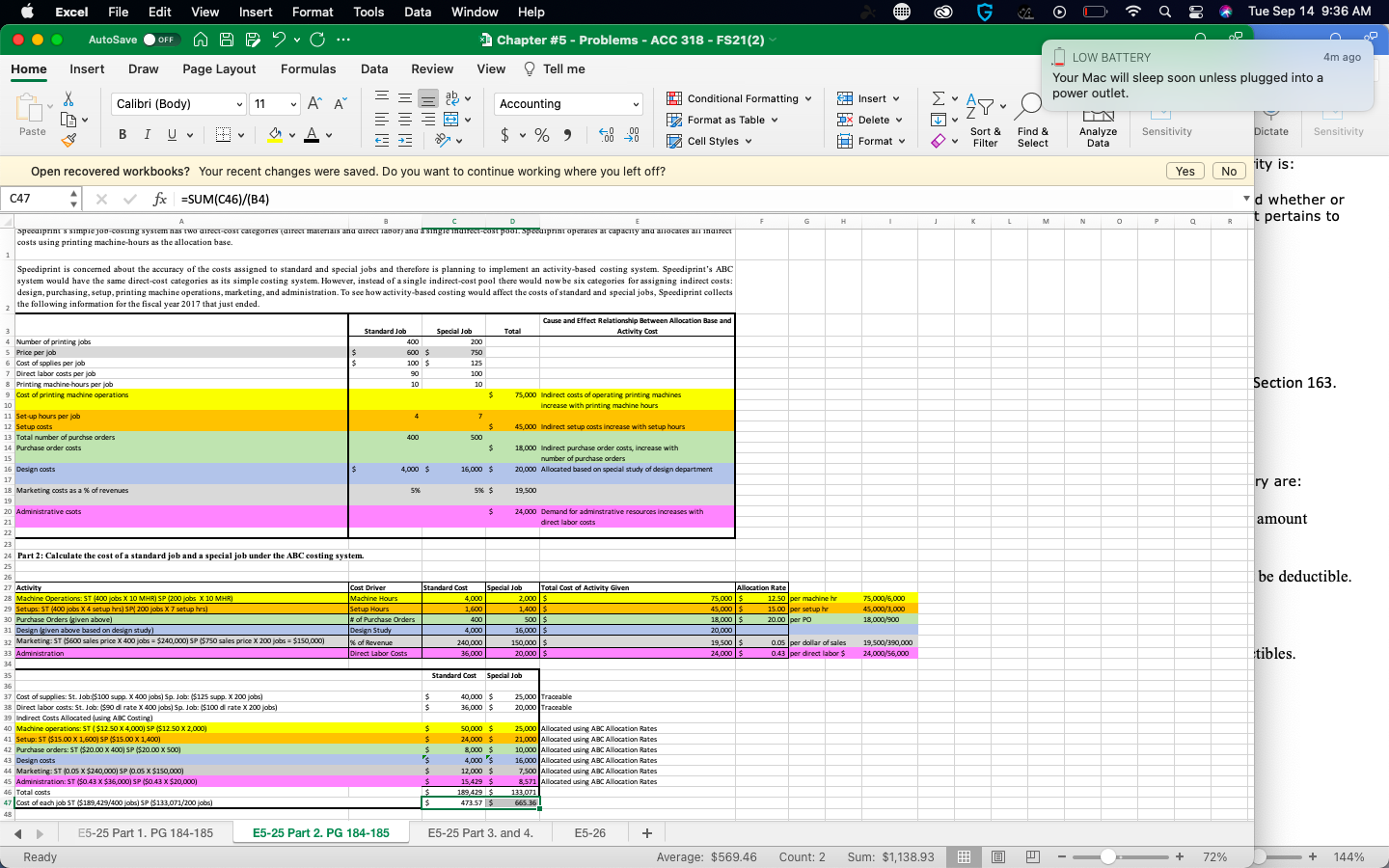

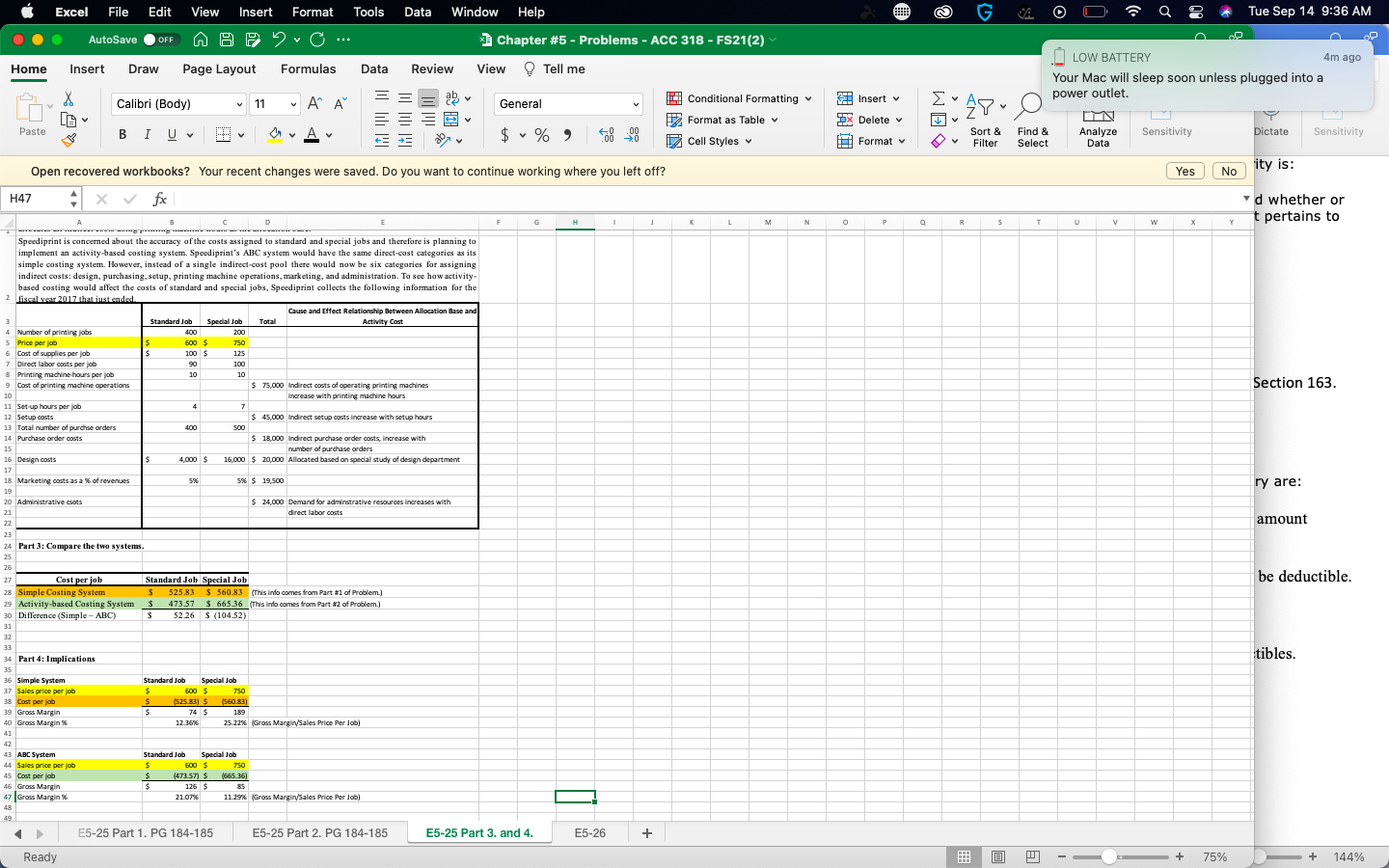

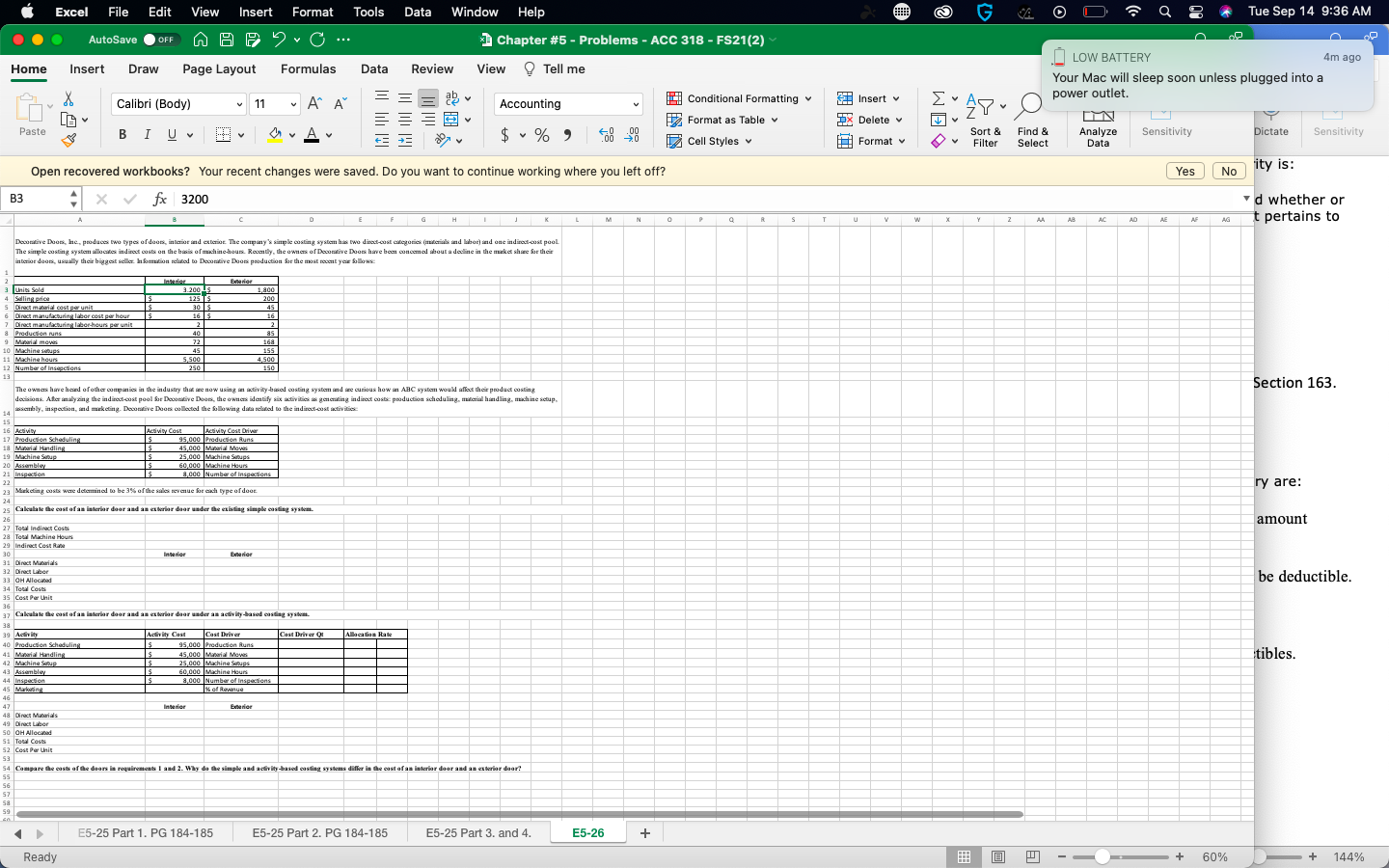

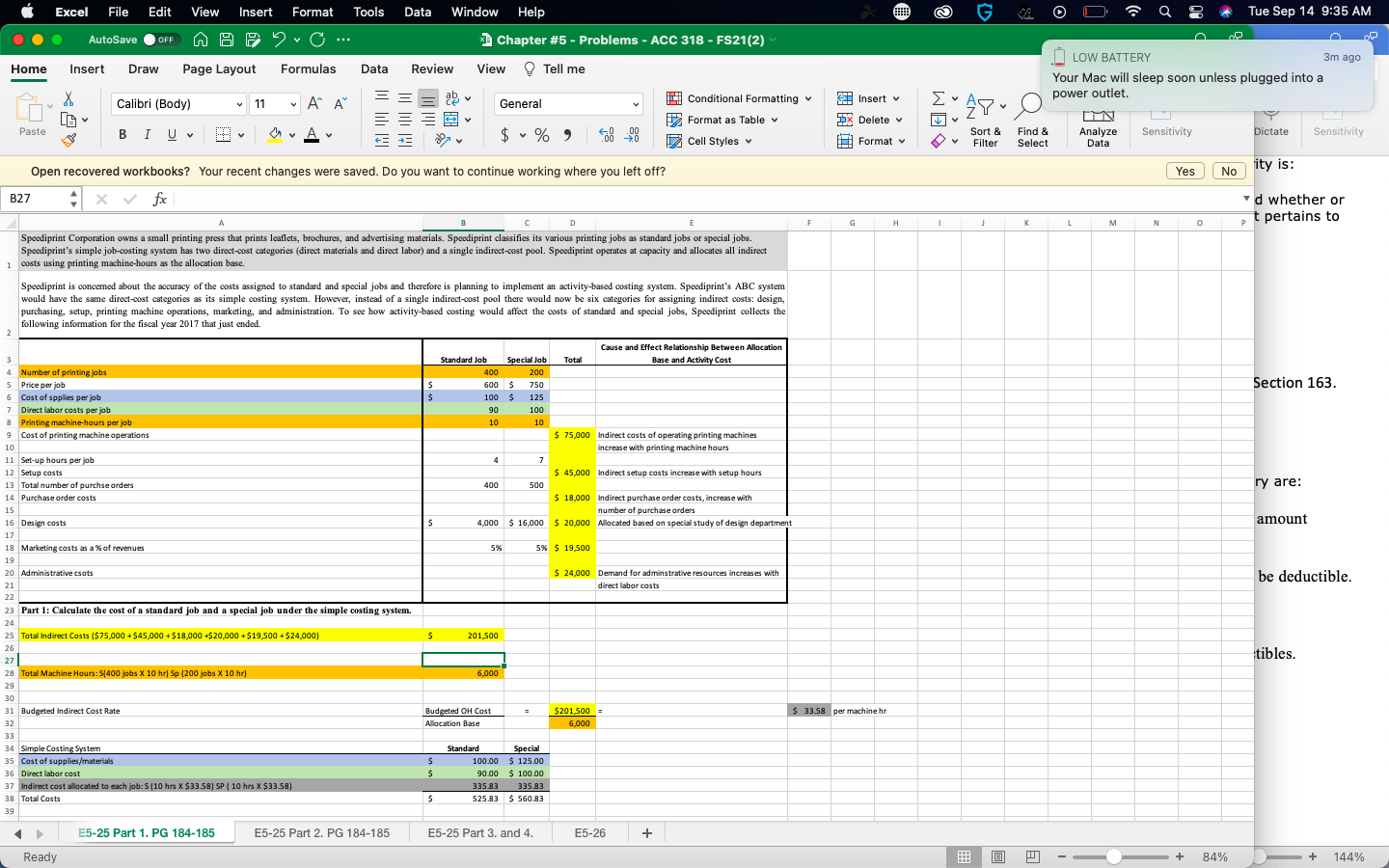

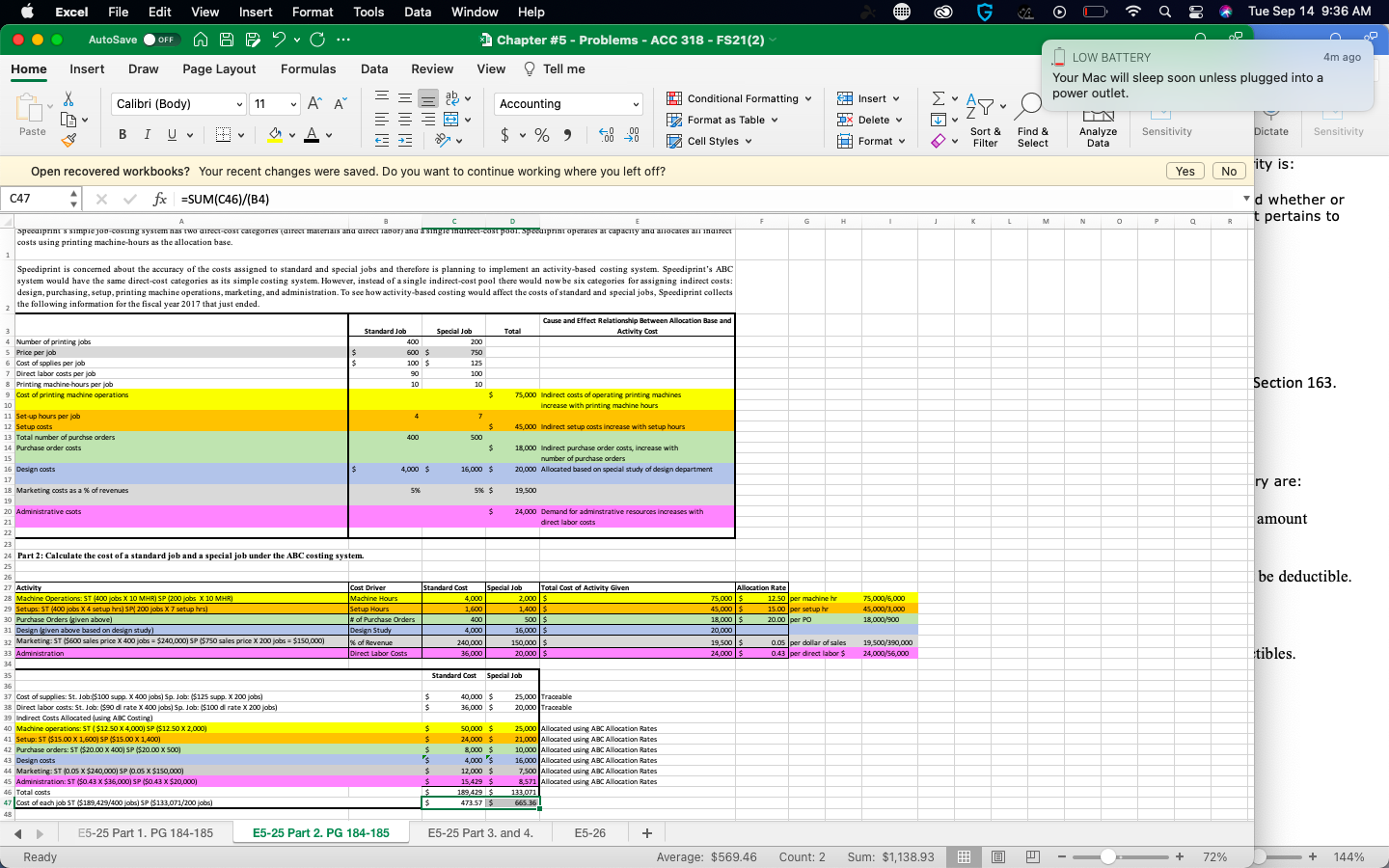

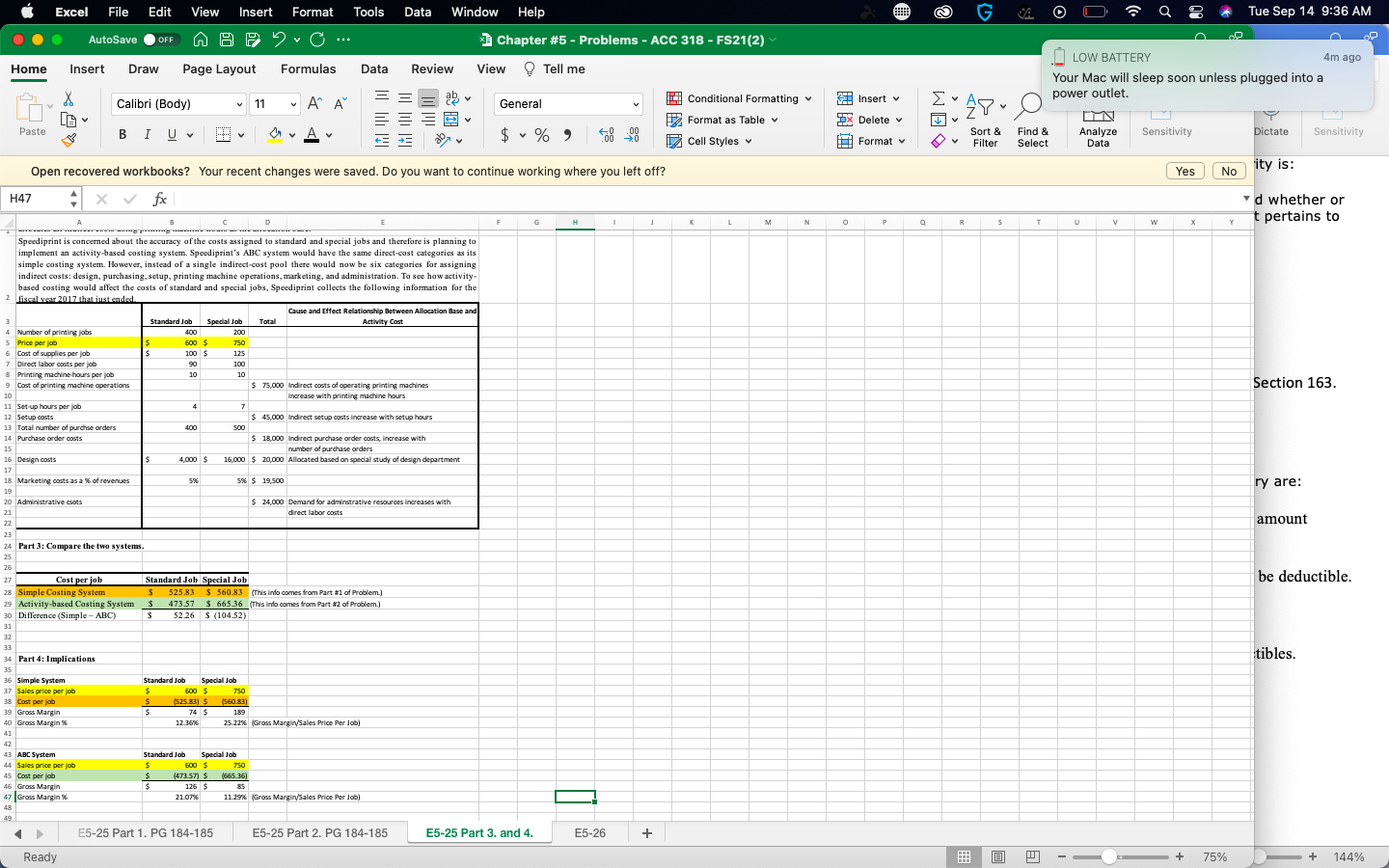

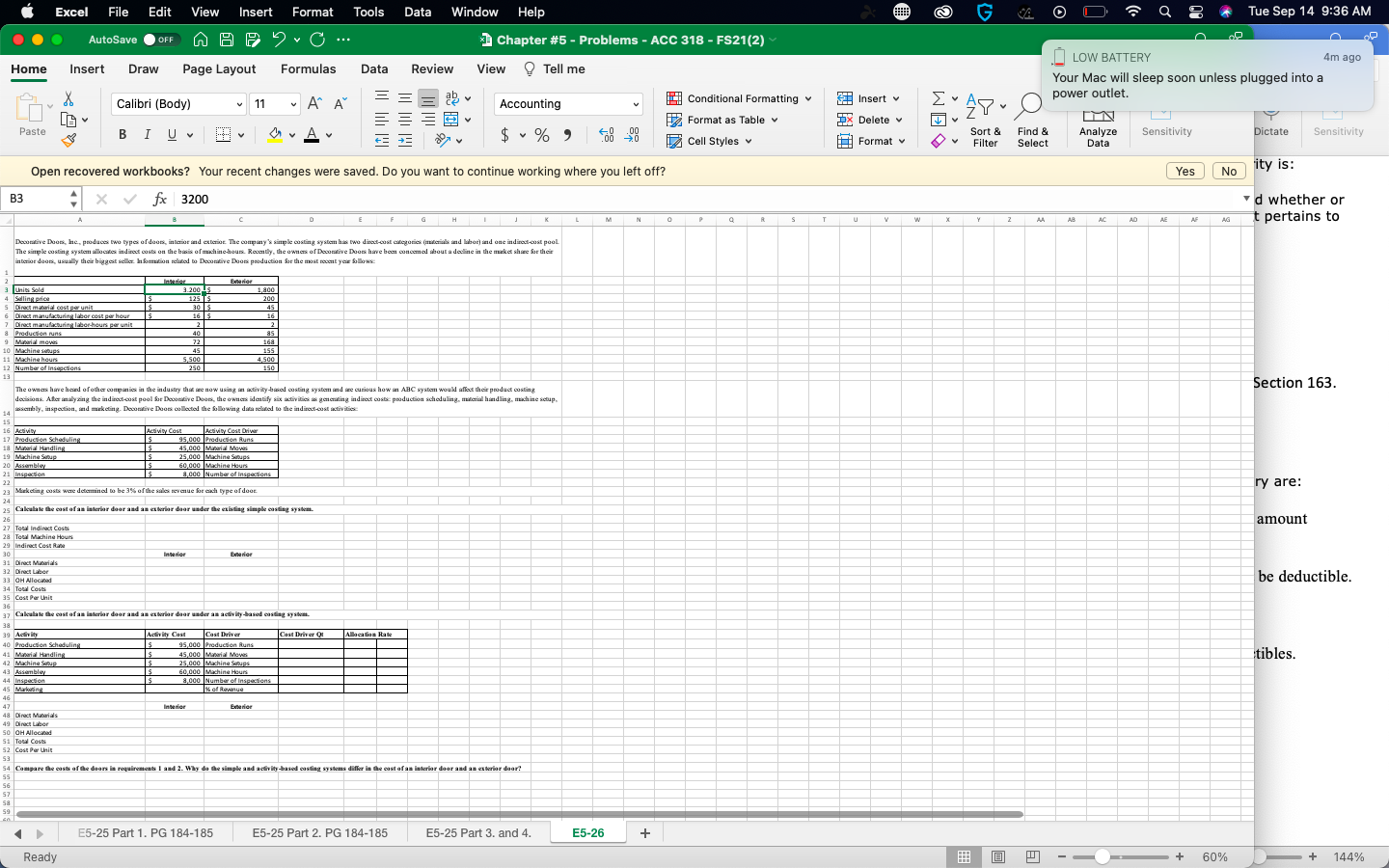

2 Tue Sep 14 9:35 AM Excel File Edit View Insert Format Tools Data Window Help AutoSave A @ O... Chapter #5 - Problems - ACC 318 - FS21(2) Q OFF Home Insert Draw Page Layout Formulas Data Review View Tell me LOW BATTERY 3m ago Your Mac will sleep soon unless plugged into a power outlet. Insert Calibri (Body) 11 X LO ~ Ai General al Conditional Formatting Format as Table Cell Styles Y DX Delete Paste BIU MvA 60 $ % ) 8 - Find & Select Sort & Filter Analyze Data Sensitivity Dictate Sensitivity Format Yes No ity is: Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? B27 A x fx d whether or t pertains to A D E F H 1 K L M N 0 P Speediprint Corporation owns a small printing press that prints leaflets, brochures, and advertising materials. Speediprint classifies its various printing jobs as standard jobs or special jobs. Speediprint's simple job-costing system has two direct-cost categories (direct materials and direct labor) and a single indirect-cost pool. Speediprint operates at capacity and allocates all indirect 1 costs using printing machine-hours as the allocation base. Speediprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Speediprint's ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity-based costing would affect the costs of standard and special jobs, Speediprint collects the following information for the fiscal year 2017 that just ended, 2 Section 163. $ $ Cause and Effect Relationship between Allocation Standard Job Special Job Total Base and Activity Cost 400 200 600 S 750 100 $ 125 90 100 10 10 $ 75,000 Indirect costs of operating printing machines increase with printing machine hours 4 7 $ 45,000 indirect setup costs increase with setup hours 400 500 $ 18,000 Indirect purchase order costs, increase with number of purchase orders 4,000 $ 16,000 $ 20,000 Allocated based on special study of design department ry are: $ amount 5% 5% $ 19,500 3 4 Number of printing jobs 5 Price per job 6 Cost of spplies per job 7 Direct labor costs per job & Printing machine-hours per job 9 Cost of printing machine operations 10 11 Set-up hours per job 12 Setup costs 13 Total number of purchse orders 14 Purchase order costs 15 16 Design costs 17 18 Marketing costs as a % of revenues 19 20 Administrative cats 21 22 23 Part 1: Calculate the cost of a standard job and a special job under the simple costing system. 24 25 Total Indirect costs ($75,000 +$45,000 +$18,000 +$20,000+ $19,500 +$24,000) 26 27 28 Total Machine Hours: /400 jobs X 10 hr) Sp (200 jobs X 10 hr) 29 30 31 Budgeted Indirect Cost Rate 32 33 34 Simple Costing System 35 Cost of supplies/materials 36 Direct labor cost 37 Indirect cost allocated to each job:5(10 hrs X $33.58) SP ( 10 hrs X $33.58) 38 Total Costs 39 $ 24,000 Demand for adminstrative resources increases with direct labor costs be deductible. $ 201 500 tibles. 6,000 $ 33.58 per machine hr Budgeted OH Cost Allocation Base $ 201,500 6,000 $ $ Standard Special 100.00 $ 125.00 90.00 $ 100.00 335.83 335.83 525.83 $ 560.83 $ E5-25 Part 1. PG 184-185 E5-25 Part 2. PG 184-185 E5-25 Part 3. and 4. E5-26 + Ready a + 84% + 144% Excel File Edit View Insert Format Tools Data Window Help 2 Tue Sep 14 9:36 AM AutoSave OFF A @ O... Chapter #5 - Problems - ACC 318 - FS21(2) Home Insert Draw Page Layout Formulas Data Review View Tell me LOW BATTERY 4m ago Your Mac will sleep soon unless plugged into a power outlet. Insert X LO Calibri (Body) 11 v Ai al Accounting Conditional Formatting Format as Table Cell Styles WE Y DX Delete Paste BIU MA 60 $ % Find & Select Sort & Filter Analyze Data Sensitivity Dictate Sensitivity Format Yes No ity is: Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? C47 4 x fx =SUM(C46)/(84) d whether or t pertains to F G H 1 K L M N 0 R A B Speedprints simpic00-costing system as two CCE-Cost Categories (Direct materials and director, anam CCUSER.Specprint operates al capacity and allocates an indirect D E costs using printing machine-hours as the allocation base. Section 163. ry are: amount 1 Speediprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Speediprint's ABC system would have the same direct-cost categories as its simple casting system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity-based casting would affect the costs of standard and special jobs, Speediprint collects the following information for the fiscal year 2017 that just ended Cause and Effect Relationship Between Allocation Base and 3 Standard Job Special Job Total Activity Cost 4 Number of printing jobs 400 200 5 Price per job 600 $ 750 6 Cost of spplies per job $ 100 $ 125 7 Direct labor costs per job 90 100 8 Printing machine hours per job 10 10 9 Cost of printing machine operations $ 75,000 Indirect costs of operating printing machines 10 increase with printing machine hours 11 Set up hours per job 4 7 12 Setup costs $ 45,000 Indirect setup costs increase with setup hours 13 Total number of purchase orders 400 500 14 Purchase order costs $ 18,000 Indirect purchase order costs, increase with 15 number of purchase orders 16 Design costs 4,000 $ 16,000 $ 20,000 Allocated based on special study of design department 17 18 Marketing costs as a % of revenues 5% 5% $ 19,500 19 20 Administrative coats $ 24,000 Demand for adminstrative resources increases with 21 direct labor costs 22 23 24 Part 2: Calculate the cost of a standard job and a special job under the ABC costing system. 25 26 27 Activity Cost Driver Standard Cost Special Job Total Cost of Activity Given Allocation Rate 28 Machine Operations: ST (400 jobs X 10 MHR) SP 200 jobs X 10 MHR) Machine Hours 4,000 2,000 $ 75,000 $ 12.50 per machine 29 Setups: ST (400 jobs x 4 setup hrs) SP/ 200 jobs X 7 setup hers) Setup Hours 1,600 1,400 $ 45,000 $ 15.00 per setup he 30 Purchase Orders given above) # of Purchase Orders 400 500$ 18,000 $ 20.00 per PO 31 Design (given above based on design stud) Design Study 4,000 16,000 $ 20.000 32 Marketing: ST ($600 sales price X 400 jobs = $240,000) SP ($750 sales price X 200 jobs = $150,000) % of Revenue 240,000 150,000 $ 19,500 $ O.Os per dollar of sales 33 Administration Direct Labor Costs 36,000 20,000 $ 24,000 $ 0.43 per direct labor $ 34 35 Standard Cost Special Job 36 37 Cost of supplies: St. Job:($100 supp. X 400 jobs) Sp.Job: ($125 supp. X 200 jobs) $ 40,000 $ 25,000 Traceable 38 Direct labor costs: St. Job: ($90 dirate X 400 jobs) Sp.Job: ($100 dirate X 200 jobs) $ 36,000 $ 20,000 Traceable 39 Indirect Costs Allocated using ABC Costing) 40 Machine operations: ST ($1250 X 4,000) SP ($12.50 x 2,000) $ 50,000 $ 25,000 Allocated using ABC Allocation Rates 41 Setup: ST ($15.00 X 1,600) SP ($15.00 X 1,400) $ 24,000 $ 21,000 Allocated using ABC Allocation Rates 42 Purchase orders: ST ($20.00 X 400) SP ($20.00 X 500) $ 8,000 $ 10,000 Allocated using ABC Allocation Rates 43 Design costs $ 16,000 Allocated using ABC Allocation Rates 44 Marketing: ST (0.05 X $240,000) SP (0.05 X $150,000) $ 12,000 $ 7 500 Allocated using ABC Allocation Rates 45 Administration: ST ($0.43 X $36,000) SP ($0.43 X $20,000) $ 15,429 $ 8.571 Allocated using ABC Allocation Rates 46 Total costs $ 189.429 $ 133.071 47 Cost of each ob ST ($189.429/400 obs) SP ($133,071/200 jobs) $ 473.57 $ 66536 be deductible. 75,000/6.000 45,000/3,000 18,000/900 19 500/390,000 24,000/56,000 tibles. 4,000's 48 E5-25 Part 1. PG 184-185 E5-25 Part 2. PG 184-185 E5-25 Part 3. and 4. E5-26 + Ready Average: $569.46 Count: 2 Sum: $1,138.93 D a + 72% + 144% Excel File Edit O 2 View Insert Format Tools Data Window Help A @ O... Chapter #5 - Problems - ACC 318 - FS21(2) Tue Sep 14 9:36 AM AutoSave OFF Home Insert Draw Page Layout Formulas Data Review View Tell me LOW BATTERY 4m ago Your Mac will sleep soon unless plugged into a power outlet Insert Calibri (Body) 11 X LO Ai General al Conditional Formatting Format as Table Cell Styles WE Y DX Delete Paste BIU MA 60 $ % ) 8 - Sort & Filter Find & Select Analyze Data Sensitivity Dictate Format v Sensitivity Yes No ity is: Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? H47 A x fx d whether or t pertains to F G H K L M N P a R 5 T U V w X Y Section 163. A C 1 wwwwwwwwwwwwwwwwwww Speediprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Speediprint's ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity based casting would affect the costs of standard and special jobs, Speediprint collects the following information for the 2 fiscal year 2017 that intended Cause and Effect Relationship between Allocation Base and 3 Standard Job Special Job Total Activity Cost 4 Number of printing jobs 400 200 5 Price per job $ 600 $ 750 6 Cost of supplies per job $ 100 $ 125 7 Direct labor costs per job 90 100 8 Printing machine hours per job 10 10 9 Cost of printing machine operations $ 75,000 Indirect costs of operating printing machines 10 Increase with printing machine hours 11 Set up hours per job 4 7 12 Setup costs $ 45,000 Indirect setup costs increase with setup hours 13 Total number of purchse orders 400 500 14 Purchase order costs $ 18,000 Indirect purchase order costs, increase with 15 number of purchase orders 16 Design costs $ 4,000 $ 16,000 $ 20,000 Allocated based on special study of design department 17 18 Marketing costs as a % of revenues 5% 5% $ 19,500 19 20 Administrative csots $ 24,000 Demand for adminstrative resources increases with 21 direct labor costs 22 23 24 Part 3: Compare the two systems 25 26 27 Cost per job Standard Job Special Job 28 Simple Costing System $ 525.83 $ 560.83 (This info comes from Part #1 of Problem.) 29 Activity-based Costing System $ 473.57 $ 665.36 (This into comes from Part #2 of Problem.) 30 Difference (Simple - ABC) $ 52 26 $ (104.52) 31 32 33 34 Part 4: Implications 35 36 Simple System Standard Job Special Job 37 Sales price per job $ 600 $ 750 38 Cost per job $ (525.83) $ (560.83) 39 Gross Margin $ 74 $ 189 40 Gross Margin 12 36% 25.22% (Gross Margin/Sales Price Per Job) ( 41 ry are: amount be deductible. tibles. 43 ABC System 44 Sales price per job 45 Cost per job 46 Gross Margin 47 Gross Margin 48 49 Standard Job Special lot $ 600 $ 750 $ (473.57) $ 1865 36) $ 126 $ 85 21.07% 11.29% (Gross Margin/Sales Price Per Job) E5-25 Part 1. PG 184-185 E5-25 Part 2. PG 184-185 E5-25 Part 3. and 4. E5-26 + Ready A + 75% + 144% Excel File Edit O 2 Tue Sep 14 9:36 AM AutoSave OFF View Insert Format Tools Data Window Help A @ O... Chapter #5 - Problems - ACC 318 - FS21(2) Page Layout Formulas Data Review View Tell me Home Insert Draw LOW BATTERY 4m ago Your Mac will sleep soon unless plugged into a power outlet Insert Calibri (Body) 11 X LO ~ Ai al Accounting Conditional Formatting Format as Table Y DX Delete Paste BIU CA $ % ) 60 000 Dictate Find & Select Sensitivity Cell Styles Sort & Filter Sensitivity Format v v Analyze Data Yes No ity is: Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? 4 x fx 3200 B3 d whether or t pertains to A D E F H K M N O P R S U V w X Y 2 AA AB AC AD AE AF AG Section 163. ry are: Decolive Doors, he produces two types of doors, interior and exterior. The company simple costing system has two direct cost cities als and bot) and one indirect custpool The simple casting system allocate indirect costs on the basis of machinehous. Recently, the ownes of Decorative Doors have been concomod soul a decline in the makesh Bartheir interior doors, usually their biggest sellic: Smion related to Decorative Doces production at the most recent year Slow 1 2 Exterior 3 Unit Sold 3.2005 1,800 4 Sling S 125 TS 200 5 Direct mail cost per unit S 30 45 6 Direct manufacturing labor cost per hour S 165 16 7 Direct manufacturing laber-hours per unit 2 2 & Production uns 40 85 9 Mimos 72 168 10 Machine seus 45 155 11 Machine heurs S 500 4,500 12 Number of insgestions 250 150 13 The owners have heard of other companies in the industry that we now using an activity-based costing system and secutious low ABC system would lost their product casting decisions. After malyzing the indirect cost pool for Decorative Doces, the ownes identify six activities ayanteling in direct cost production scheduling, milicial handling machinescup. 14 sedly, inspection, and making. Decorative Doors collected the following data related to the indirect cost activities 15 16 Activity Activity Cost Activity Costa 17 Production Scheduling 95.000 Production Runs 18 M Handling s 45,000 Mil News 19 Machine Stup $ 25,000 Machine Songs 20 Assembly S 60,000 Machine Hours 21 Inspection S 8,000 Number of inspections 22 23 Meketing costs were determined to be 35 of the sales revenue for each type of door 24 25 Calculate the cost of an interior door and an exterior doar under the existing simple casting system. 26 27 Total Indirect costs 28 Total Machine Hours 29 Indirect Costa 30 Inner Exte 31 Direct Mars 32 Director 33 OH Allecand 34 Tow Cost 35 Cost Per Unit 36 37 Calculate the cost of an interior door and an exterior doar under an activity-based costing system 38 39 Activity Activity Cast Cast Driver Cast Driver Albacoa a 40 Production Scheduling 95,000 Production Runs 41 Mal Handling $ 45.000 MM 42 Machine Sup $ 25,000 Machine Stups 43 Assembley IS 60,000 Machine Hours 44 Inspection S 8,000 Number of inspections 45 Multing % of Revenue 46 42 Inter Er 48 Direct Mails 49 Director SO OH Allocated 51 Tow Cost 52 Cost Per Unit 53 54 Compare the cast of the doors is requirements and 2. Why do the simple and activity-based casting systems differ in the cast of an interior door and an exterior door! SS 56 57 Sa 59 amount be deductible. tibles. E5-25 Part 1. PG 184-185 E5-25 Part 2. PG 184-185 E5-25 Part 3. and 4. E5-26 + Ready - + 60% + 144% 2 Tue Sep 14 9:35 AM Excel File Edit View Insert Format Tools Data Window Help AutoSave A @ O... Chapter #5 - Problems - ACC 318 - FS21(2) Q OFF Home Insert Draw Page Layout Formulas Data Review View Tell me LOW BATTERY 3m ago Your Mac will sleep soon unless plugged into a power outlet. Insert Calibri (Body) 11 X LO ~ Ai General al Conditional Formatting Format as Table Cell Styles Y DX Delete Paste BIU MvA 60 $ % ) 8 - Find & Select Sort & Filter Analyze Data Sensitivity Dictate Sensitivity Format Yes No ity is: Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? B27 A x fx d whether or t pertains to A D E F H 1 K L M N 0 P Speediprint Corporation owns a small printing press that prints leaflets, brochures, and advertising materials. Speediprint classifies its various printing jobs as standard jobs or special jobs. Speediprint's simple job-costing system has two direct-cost categories (direct materials and direct labor) and a single indirect-cost pool. Speediprint operates at capacity and allocates all indirect 1 costs using printing machine-hours as the allocation base. Speediprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Speediprint's ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity-based costing would affect the costs of standard and special jobs, Speediprint collects the following information for the fiscal year 2017 that just ended, 2 Section 163. $ $ Cause and Effect Relationship between Allocation Standard Job Special Job Total Base and Activity Cost 400 200 600 S 750 100 $ 125 90 100 10 10 $ 75,000 Indirect costs of operating printing machines increase with printing machine hours 4 7 $ 45,000 indirect setup costs increase with setup hours 400 500 $ 18,000 Indirect purchase order costs, increase with number of purchase orders 4,000 $ 16,000 $ 20,000 Allocated based on special study of design department ry are: $ amount 5% 5% $ 19,500 3 4 Number of printing jobs 5 Price per job 6 Cost of spplies per job 7 Direct labor costs per job & Printing machine-hours per job 9 Cost of printing machine operations 10 11 Set-up hours per job 12 Setup costs 13 Total number of purchse orders 14 Purchase order costs 15 16 Design costs 17 18 Marketing costs as a % of revenues 19 20 Administrative cats 21 22 23 Part 1: Calculate the cost of a standard job and a special job under the simple costing system. 24 25 Total Indirect costs ($75,000 +$45,000 +$18,000 +$20,000+ $19,500 +$24,000) 26 27 28 Total Machine Hours: /400 jobs X 10 hr) Sp (200 jobs X 10 hr) 29 30 31 Budgeted Indirect Cost Rate 32 33 34 Simple Costing System 35 Cost of supplies/materials 36 Direct labor cost 37 Indirect cost allocated to each job:5(10 hrs X $33.58) SP ( 10 hrs X $33.58) 38 Total Costs 39 $ 24,000 Demand for adminstrative resources increases with direct labor costs be deductible. $ 201 500 tibles. 6,000 $ 33.58 per machine hr Budgeted OH Cost Allocation Base $ 201,500 6,000 $ $ Standard Special 100.00 $ 125.00 90.00 $ 100.00 335.83 335.83 525.83 $ 560.83 $ E5-25 Part 1. PG 184-185 E5-25 Part 2. PG 184-185 E5-25 Part 3. and 4. E5-26 + Ready a + 84% + 144% Excel File Edit View Insert Format Tools Data Window Help 2 Tue Sep 14 9:36 AM AutoSave OFF A @ O... Chapter #5 - Problems - ACC 318 - FS21(2) Home Insert Draw Page Layout Formulas Data Review View Tell me LOW BATTERY 4m ago Your Mac will sleep soon unless plugged into a power outlet. Insert X LO Calibri (Body) 11 v Ai al Accounting Conditional Formatting Format as Table Cell Styles WE Y DX Delete Paste BIU MA 60 $ % Find & Select Sort & Filter Analyze Data Sensitivity Dictate Sensitivity Format Yes No ity is: Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? C47 4 x fx =SUM(C46)/(84) d whether or t pertains to F G H 1 K L M N 0 R A B Speedprints simpic00-costing system as two CCE-Cost Categories (Direct materials and director, anam CCUSER.Specprint operates al capacity and allocates an indirect D E costs using printing machine-hours as the allocation base. Section 163. ry are: amount 1 Speediprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Speediprint's ABC system would have the same direct-cost categories as its simple casting system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity-based casting would affect the costs of standard and special jobs, Speediprint collects the following information for the fiscal year 2017 that just ended Cause and Effect Relationship Between Allocation Base and 3 Standard Job Special Job Total Activity Cost 4 Number of printing jobs 400 200 5 Price per job 600 $ 750 6 Cost of spplies per job $ 100 $ 125 7 Direct labor costs per job 90 100 8 Printing machine hours per job 10 10 9 Cost of printing machine operations $ 75,000 Indirect costs of operating printing machines 10 increase with printing machine hours 11 Set up hours per job 4 7 12 Setup costs $ 45,000 Indirect setup costs increase with setup hours 13 Total number of purchase orders 400 500 14 Purchase order costs $ 18,000 Indirect purchase order costs, increase with 15 number of purchase orders 16 Design costs 4,000 $ 16,000 $ 20,000 Allocated based on special study of design department 17 18 Marketing costs as a % of revenues 5% 5% $ 19,500 19 20 Administrative coats $ 24,000 Demand for adminstrative resources increases with 21 direct labor costs 22 23 24 Part 2: Calculate the cost of a standard job and a special job under the ABC costing system. 25 26 27 Activity Cost Driver Standard Cost Special Job Total Cost of Activity Given Allocation Rate 28 Machine Operations: ST (400 jobs X 10 MHR) SP 200 jobs X 10 MHR) Machine Hours 4,000 2,000 $ 75,000 $ 12.50 per machine 29 Setups: ST (400 jobs x 4 setup hrs) SP/ 200 jobs X 7 setup hers) Setup Hours 1,600 1,400 $ 45,000 $ 15.00 per setup he 30 Purchase Orders given above) # of Purchase Orders 400 500$ 18,000 $ 20.00 per PO 31 Design (given above based on design stud) Design Study 4,000 16,000 $ 20.000 32 Marketing: ST ($600 sales price X 400 jobs = $240,000) SP ($750 sales price X 200 jobs = $150,000) % of Revenue 240,000 150,000 $ 19,500 $ O.Os per dollar of sales 33 Administration Direct Labor Costs 36,000 20,000 $ 24,000 $ 0.43 per direct labor $ 34 35 Standard Cost Special Job 36 37 Cost of supplies: St. Job:($100 supp. X 400 jobs) Sp.Job: ($125 supp. X 200 jobs) $ 40,000 $ 25,000 Traceable 38 Direct labor costs: St. Job: ($90 dirate X 400 jobs) Sp.Job: ($100 dirate X 200 jobs) $ 36,000 $ 20,000 Traceable 39 Indirect Costs Allocated using ABC Costing) 40 Machine operations: ST ($1250 X 4,000) SP ($12.50 x 2,000) $ 50,000 $ 25,000 Allocated using ABC Allocation Rates 41 Setup: ST ($15.00 X 1,600) SP ($15.00 X 1,400) $ 24,000 $ 21,000 Allocated using ABC Allocation Rates 42 Purchase orders: ST ($20.00 X 400) SP ($20.00 X 500) $ 8,000 $ 10,000 Allocated using ABC Allocation Rates 43 Design costs $ 16,000 Allocated using ABC Allocation Rates 44 Marketing: ST (0.05 X $240,000) SP (0.05 X $150,000) $ 12,000 $ 7 500 Allocated using ABC Allocation Rates 45 Administration: ST ($0.43 X $36,000) SP ($0.43 X $20,000) $ 15,429 $ 8.571 Allocated using ABC Allocation Rates 46 Total costs $ 189.429 $ 133.071 47 Cost of each ob ST ($189.429/400 obs) SP ($133,071/200 jobs) $ 473.57 $ 66536 be deductible. 75,000/6.000 45,000/3,000 18,000/900 19 500/390,000 24,000/56,000 tibles. 4,000's 48 E5-25 Part 1. PG 184-185 E5-25 Part 2. PG 184-185 E5-25 Part 3. and 4. E5-26 + Ready Average: $569.46 Count: 2 Sum: $1,138.93 D a + 72% + 144% Excel File Edit O 2 View Insert Format Tools Data Window Help A @ O... Chapter #5 - Problems - ACC 318 - FS21(2) Tue Sep 14 9:36 AM AutoSave OFF Home Insert Draw Page Layout Formulas Data Review View Tell me LOW BATTERY 4m ago Your Mac will sleep soon unless plugged into a power outlet Insert Calibri (Body) 11 X LO Ai General al Conditional Formatting Format as Table Cell Styles WE Y DX Delete Paste BIU MA 60 $ % ) 8 - Sort & Filter Find & Select Analyze Data Sensitivity Dictate Format v Sensitivity Yes No ity is: Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? H47 A x fx d whether or t pertains to F G H K L M N P a R 5 T U V w X Y Section 163. A C 1 wwwwwwwwwwwwwwwwwww Speediprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Speediprint's ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity based casting would affect the costs of standard and special jobs, Speediprint collects the following information for the 2 fiscal year 2017 that intended Cause and Effect Relationship between Allocation Base and 3 Standard Job Special Job Total Activity Cost 4 Number of printing jobs 400 200 5 Price per job $ 600 $ 750 6 Cost of supplies per job $ 100 $ 125 7 Direct labor costs per job 90 100 8 Printing machine hours per job 10 10 9 Cost of printing machine operations $ 75,000 Indirect costs of operating printing machines 10 Increase with printing machine hours 11 Set up hours per job 4 7 12 Setup costs $ 45,000 Indirect setup costs increase with setup hours 13 Total number of purchse orders 400 500 14 Purchase order costs $ 18,000 Indirect purchase order costs, increase with 15 number of purchase orders 16 Design costs $ 4,000 $ 16,000 $ 20,000 Allocated based on special study of design department 17 18 Marketing costs as a % of revenues 5% 5% $ 19,500 19 20 Administrative csots $ 24,000 Demand for adminstrative resources increases with 21 direct labor costs 22 23 24 Part 3: Compare the two systems 25 26 27 Cost per job Standard Job Special Job 28 Simple Costing System $ 525.83 $ 560.83 (This info comes from Part #1 of Problem.) 29 Activity-based Costing System $ 473.57 $ 665.36 (This into comes from Part #2 of Problem.) 30 Difference (Simple - ABC) $ 52 26 $ (104.52) 31 32 33 34 Part 4: Implications 35 36 Simple System Standard Job Special Job 37 Sales price per job $ 600 $ 750 38 Cost per job $ (525.83) $ (560.83) 39 Gross Margin $ 74 $ 189 40 Gross Margin 12 36% 25.22% (Gross Margin/Sales Price Per Job) ( 41 ry are: amount be deductible. tibles. 43 ABC System 44 Sales price per job 45 Cost per job 46 Gross Margin 47 Gross Margin 48 49 Standard Job Special lot $ 600 $ 750 $ (473.57) $ 1865 36) $ 126 $ 85 21.07% 11.29% (Gross Margin/Sales Price Per Job) E5-25 Part 1. PG 184-185 E5-25 Part 2. PG 184-185 E5-25 Part 3. and 4. E5-26 + Ready A + 75% + 144% Excel File Edit O 2 Tue Sep 14 9:36 AM AutoSave OFF View Insert Format Tools Data Window Help A @ O... Chapter #5 - Problems - ACC 318 - FS21(2) Page Layout Formulas Data Review View Tell me Home Insert Draw LOW BATTERY 4m ago Your Mac will sleep soon unless plugged into a power outlet Insert Calibri (Body) 11 X LO ~ Ai al Accounting Conditional Formatting Format as Table Y DX Delete Paste BIU CA $ % ) 60 000 Dictate Find & Select Sensitivity Cell Styles Sort & Filter Sensitivity Format v v Analyze Data Yes No ity is: Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? 4 x fx 3200 B3 d whether or t pertains to A D E F H K M N O P R S U V w X Y 2 AA AB AC AD AE AF AG Section 163. ry are: Decolive Doors, he produces two types of doors, interior and exterior. The company simple costing system has two direct cost cities als and bot) and one indirect custpool The simple casting system allocate indirect costs on the basis of machinehous. Recently, the ownes of Decorative Doors have been concomod soul a decline in the makesh Bartheir interior doors, usually their biggest sellic: Smion related to Decorative Doces production at the most recent year Slow 1 2 Exterior 3 Unit Sold 3.2005 1,800 4 Sling S 125 TS 200 5 Direct mail cost per unit S 30 45 6 Direct manufacturing labor cost per hour S 165 16 7 Direct manufacturing laber-hours per unit 2 2 & Production uns 40 85 9 Mimos 72 168 10 Machine seus 45 155 11 Machine heurs S 500 4,500 12 Number of insgestions 250 150 13 The owners have heard of other companies in the industry that we now using an activity-based costing system and secutious low ABC system would lost their product casting decisions. After malyzing the indirect cost pool for Decorative Doces, the ownes identify six activities ayanteling in direct cost production scheduling, milicial handling machinescup. 14 sedly, inspection, and making. Decorative Doors collected the following data related to the indirect cost activities 15 16 Activity Activity Cost Activity Costa 17 Production Scheduling 95.000 Production Runs 18 M Handling s 45,000 Mil News 19 Machine Stup $ 25,000 Machine Songs 20 Assembly S 60,000 Machine Hours 21 Inspection S 8,000 Number of inspections 22 23 Meketing costs were determined to be 35 of the sales revenue for each type of door 24 25 Calculate the cost of an interior door and an exterior doar under the existing simple casting system. 26 27 Total Indirect costs 28 Total Machine Hours 29 Indirect Costa 30 Inner Exte 31 Direct Mars 32 Director 33 OH Allecand 34 Tow Cost 35 Cost Per Unit 36 37 Calculate the cost of an interior door and an exterior doar under an activity-based costing system 38 39 Activity Activity Cast Cast Driver Cast Driver Albacoa a 40 Production Scheduling 95,000 Production Runs 41 Mal Handling $ 45.000 MM 42 Machine Sup $ 25,000 Machine Stups 43 Assembley IS 60,000 Machine Hours 44 Inspection S 8,000 Number of inspections 45 Multing % of Revenue 46 42 Inter Er 48 Direct Mails 49 Director SO OH Allocated 51 Tow Cost 52 Cost Per Unit 53 54 Compare the cast of the doors is requirements and 2. Why do the simple and activity-based casting systems differ in the cast of an interior door and an exterior door! SS 56 57 Sa 59 amount be deductible. tibles. E5-25 Part 1. PG 184-185 E5-25 Part 2. PG 184-185 E5-25 Part 3. and 4. E5-26 + Ready - + 60% + 144%