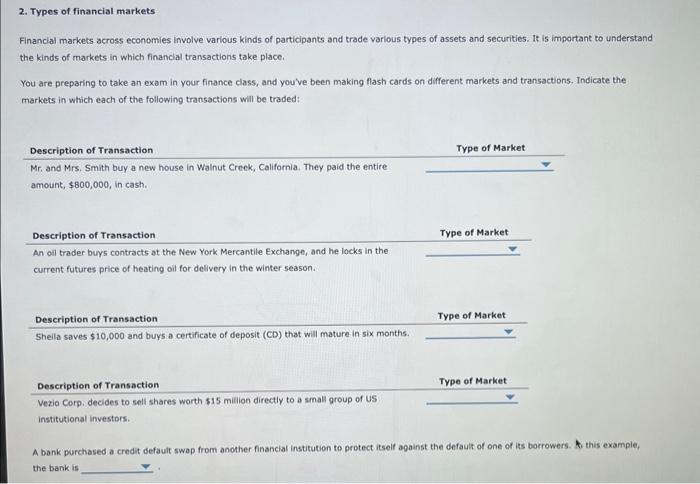

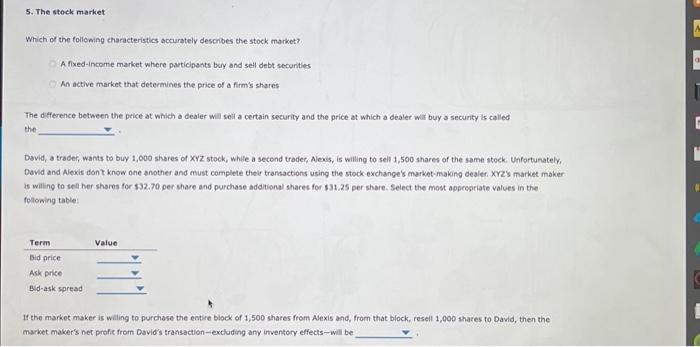

2. Types of financial markets Financial markets across economies involve varlous kinds of participants and trade varlous types of assets and securities. It is important to understand the kinds of markets in which financial transactions take place. You are preparing to take an exam in your finance class, and you've been making flash cards on different markets and transactions. Indicate the markets in which each of the following transactions will be traded: A bank purchased a credit default swap from another financial institution to protect itself against the default of one of its borrowers. A, this example, the bank is Which of the following characteristics sccurately desconbes the stock market? A fixed-income market where participants bury and sell debt securities An active market that determines the price of a firm's shares The difference between the price at which a dealer will sell a certain security and the price at which a dealer war buy a security is called the David, a trader, wants to buy 1,000 shares of XYZ stock, while a second trader, Alexis, is willing to sell 1,500 shares of the same stock. Unfortunately, David and Alexis dont know one another and must complete their tranactions using the stock exchange's market-making dealer. Xnz's market maker is wiling to seli her shares for $32.70 per share and purchase additional shares for $31.25 per share. Select the most apprepriate values in the folowing table: If the market maker is willing to purchase the entire block of 1,500 shares from Alexis and, from that block, resell 1,000 shares to David, then the market maker's net profic from David's transaction-excluding any imventory effects-will be 2. Types of financial markets Financial markets across economies involve varlous kinds of participants and trade varlous types of assets and securities. It is important to understand the kinds of markets in which financial transactions take place. You are preparing to take an exam in your finance class, and you've been making flash cards on different markets and transactions. Indicate the markets in which each of the following transactions will be traded: A bank purchased a credit default swap from another financial institution to protect itself against the default of one of its borrowers. A, this example, the bank is Which of the following characteristics sccurately desconbes the stock market? A fixed-income market where participants bury and sell debt securities An active market that determines the price of a firm's shares The difference between the price at which a dealer will sell a certain security and the price at which a dealer war buy a security is called the David, a trader, wants to buy 1,000 shares of XYZ stock, while a second trader, Alexis, is willing to sell 1,500 shares of the same stock. Unfortunately, David and Alexis dont know one another and must complete their tranactions using the stock exchange's market-making dealer. Xnz's market maker is wiling to seli her shares for $32.70 per share and purchase additional shares for $31.25 per share. Select the most apprepriate values in the folowing table: If the market maker is willing to purchase the entire block of 1,500 shares from Alexis and, from that block, resell 1,000 shares to David, then the market maker's net profic from David's transaction-excluding any imventory effects-will be