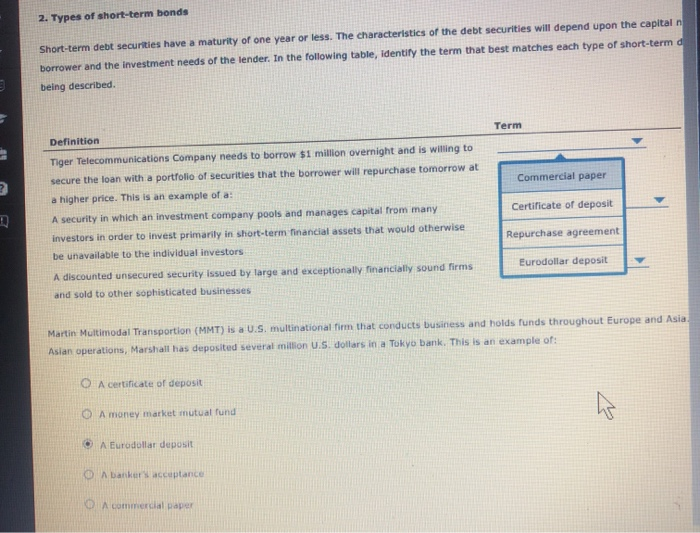

2. Types of short-term bonds Short-term debt securities have a maturity of one year or less. The characteristics of the debt securities will depend upon the capital n borrower and the investment needs of the lender. In the following table, identify the term that best matches each type of short-term d being described Definit Term Tiger Telecommunications Company needs to borrow $1 million overnight and is willing to secure the loan with a portfolio of securities that the borrower will repurchase tomorrow at a higher price. This is an example of a Commercial paper Certificate of deposit A security in which an investment company pools and manages capital from many investors in order to invest primarily in short-term financial assets that would otherwise be unavailable to the individual investors Repurchase agreement Eurodollar deposit A discounted unsecured security issued by large and exceptionally financially sound firms and sold to other sophisticated businesses Martin Multimodal Transportion (MMT) is a U.S. multinational firm that conducts business and holds funds throughout Europe and Asia Aslan operations, Marshall has deposited several million U.S. dollars in a Tokyo bank. This is an example of: O A certificate of deposit A money market mutual fund A Eurodollar deposit A banker's acceptance A commercial paper 3. Long-term debt securities Long-term debt securities have maturities greater than one year and are typically characterized by periodic interest payments. Long-term debt securities can usually be classified as either term loans or bonds. A term loan is a privately arranged contract in which the borrower agrees to make a series of interest and principal payments to a lender, usually a bank, Insurance company, or pension Fund. A bond is a long-term contract under which the borrower (issuer) agrees to make interest and principal payments to its bondholders (investors). Term loans and bonds exhibit differing characteristics and advantages. True or Falset in general, term loans may be created and modified more easily than bond issues because (1) there are fewer parties to the transaction, and (2) the borrower and the lander have the potential to meet directly to reach mutually agreeable Terms Orale True or False In general the provisions and terms of bond i s can be better customed to fit the needs of a wide variety of bondholders, while the story provisions of term loans are less lexible