Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Upon graduating from college, you take the proceeds from your successful shirt company and begin a company that sells foreign securities in the U.S.

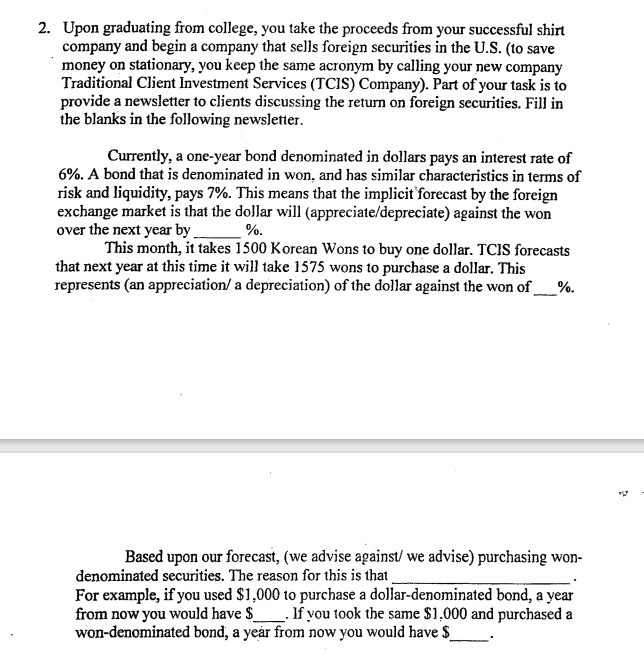

2. Upon graduating from college, you take the proceeds from your successful shirt company and begin a company that sells foreign securities in the U.S. (to save money on stationary, you keep the same acronym by calling your new company Traditional Client Investment Services (TCIS) Company). Part of your task is to provide a newsletter to clients discussing the return on foreign securities. Fill in the blanks in the following newsletter. Currently, a one-year bond denominated in dollars pays an interest rate of 6%. A bond that is denominated in won, and has similar characteristics in terms of risk and liquidity, pays 7%. This means that the implicit forecast by the foreign exchange market is that the dollar will (appreciate/depreciate) against the won over the next year by %. This month, it takes 1500 Korean Wons to buy one dollar. TCIS forecasts that next year at this time it will take 1575 wons to purchase a dollar. This represents (an appreciation/ a depreciation) of the dollar against the won of %. Based upon our forecast, (we advise against/ we advise) purchasing wondenominated securities. The reason for this is that For example, if you used $1,000 to purchase a dollar-denominated bond, a year from now you would have $ . If you took the same $1,000 and purchased a won-denominated bond, a year from now you would have $

2. Upon graduating from college, you take the proceeds from your successful shirt company and begin a company that sells foreign securities in the U.S. (to save money on stationary, you keep the same acronym by calling your new company Traditional Client Investment Services (TCIS) Company). Part of your task is to provide a newsletter to clients discussing the return on foreign securities. Fill in the blanks in the following newsletter. Currently, a one-year bond denominated in dollars pays an interest rate of 6%. A bond that is denominated in won, and has similar characteristics in terms of risk and liquidity, pays 7%. This means that the implicit forecast by the foreign exchange market is that the dollar will (appreciate/depreciate) against the won over the next year by %. This month, it takes 1500 Korean Wons to buy one dollar. TCIS forecasts that next year at this time it will take 1575 wons to purchase a dollar. This represents (an appreciation/ a depreciation) of the dollar against the won of %. Based upon our forecast, (we advise against/ we advise) purchasing wondenominated securities. The reason for this is that For example, if you used $1,000 to purchase a dollar-denominated bond, a year from now you would have $ . If you took the same $1,000 and purchased a won-denominated bond, a year from now you would have $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started