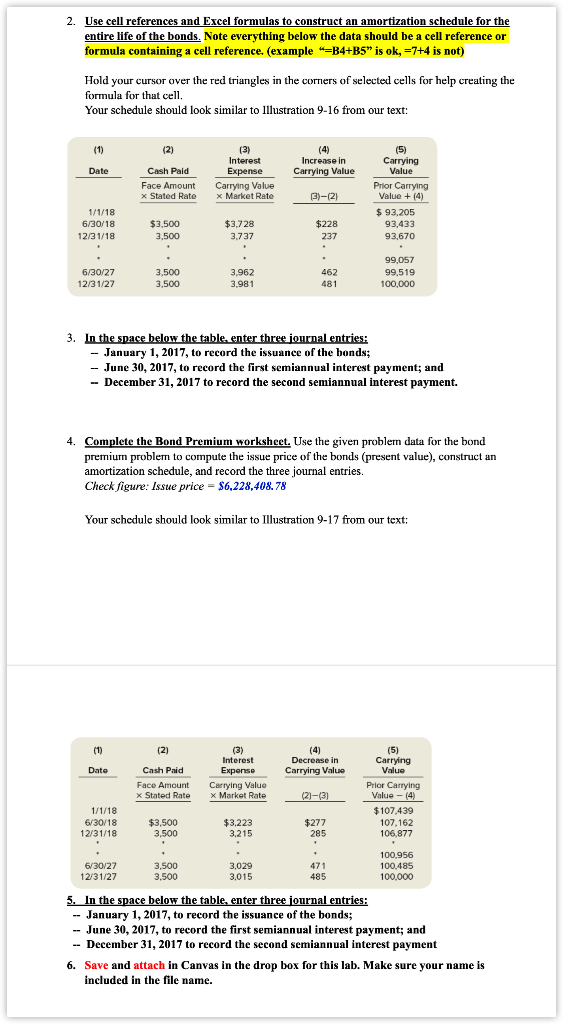

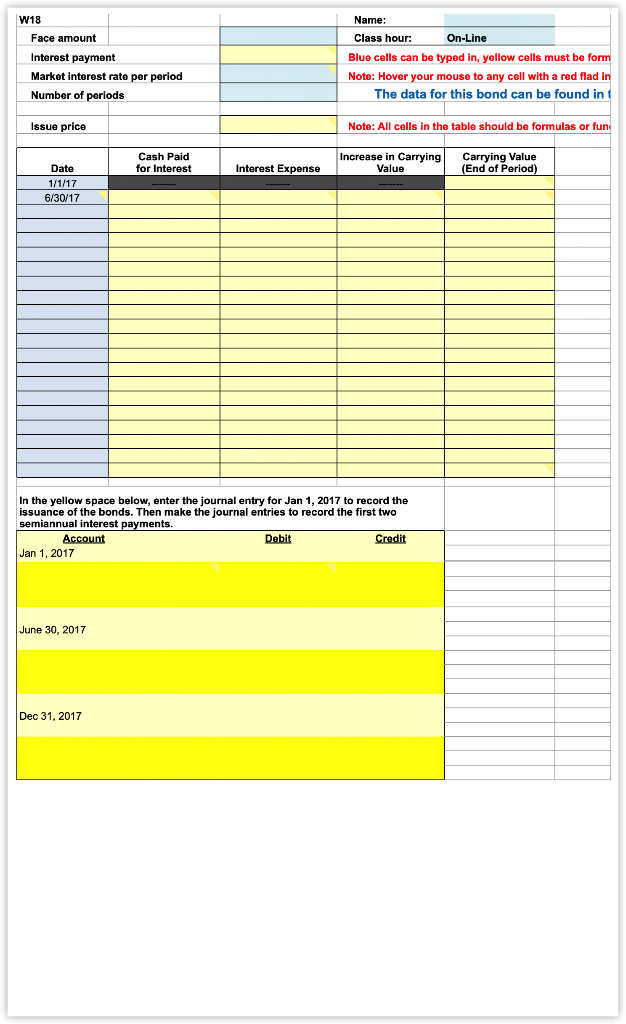

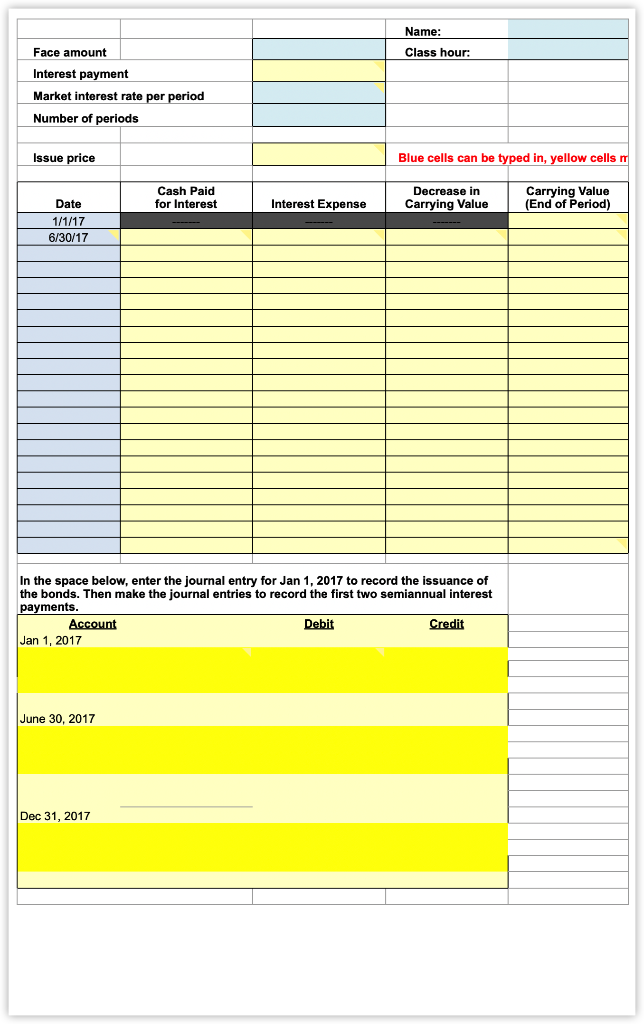

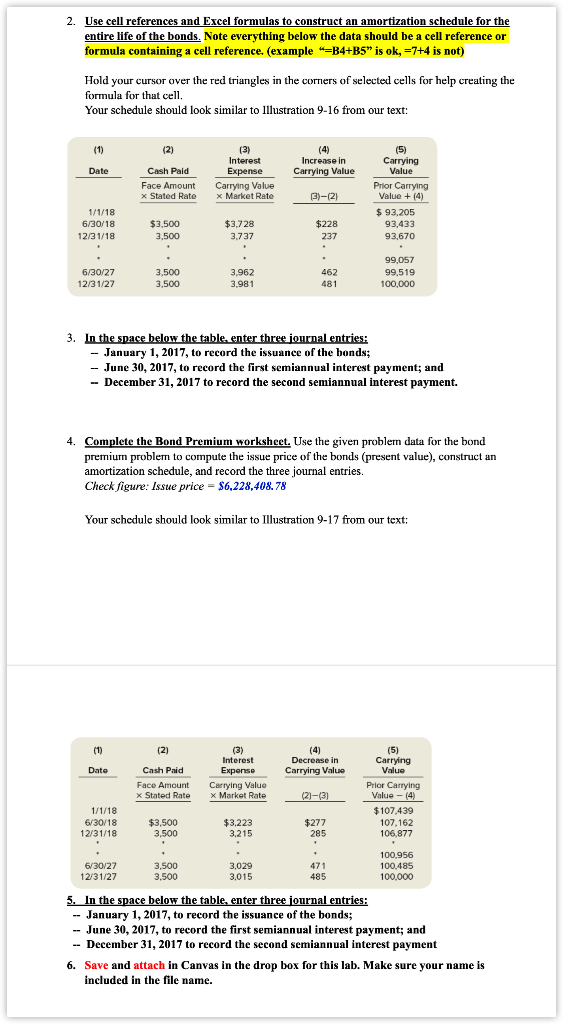

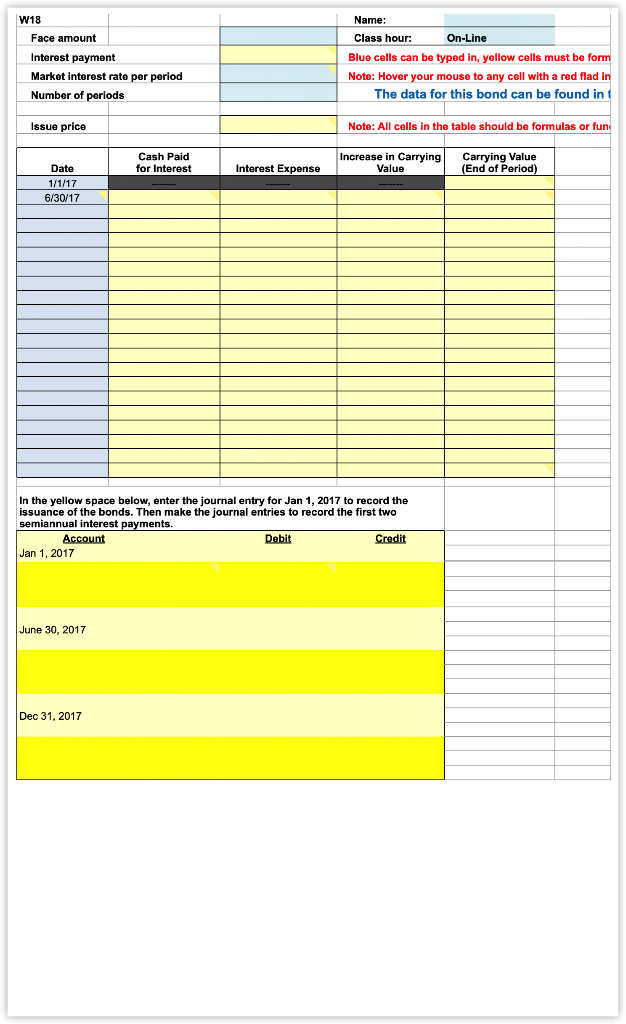

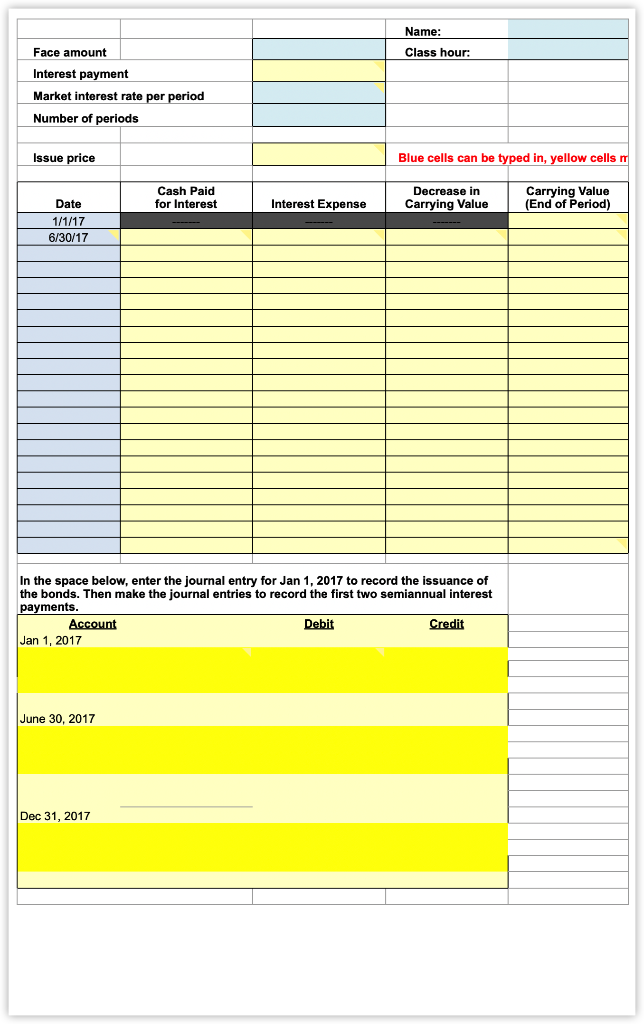

2. Use cell references and Excel formulas to construct an amortization schedule for the entire life of the bonds. Note everything below the data should be a cell reference or formula containing a cell reference. (example "=B4+B5" is ok, +7+4 is not) Hold your cursor over the red triangles in the corners of selected cells for help creating the formula for that cell, Your schedule should look similar to Illustration 9-16 from our text: (1) (2) Increase in Carrying Value Date (3) Interest Expense Carrying Value x Market Rate Cash Paid Face Amount x Stated Rato (3)-(2) (5) Carrying Value Prior Carrying Value + (4) $ 93,205 93,433 93,670 1/1/18 6/30/18 12/31/18 $3,500 3,500 $3.728 $228 237 3.737 6/30/27 12/31/27 3,500 3,500 3,962 3.981 462 481 99,057 99,519 100,000 3. In the space below the table, enter three journal entries: -- January 1, 2017, to record the issuance of the bonds; -- June 30, 2017, to record the first semiannual interest payment; and -- December 31, 2017 to record the second semiannual interest payment. 4. Complete the Bond Premium worksheet. Use the given problern data for the bond premium problem to compute the issue price of the bonds (present value), construct an amortization schedule, and record the three journal entries. Check figure: Issue price = $6,228,408.78 Your schedule should look similar to Illustration 9-17 from our text: (1) 121 (4) Decrease in Carrying Value Date (3) Interest Expense Carrying Value x Market Rate Cash Paid Face Amount x Stated Rate (2)-(3) (5) Carrying Value Prior Carrying Value - (4) $107.439 107,162 106,877 1/1/18 6/30/18 12/31/18 $3,500 3,500 $3,223 3.215 $277 285 6/30/27 12/31/27 3,500 3,500 3,029 3,015 471 485 100,956 100,485 100,000 5. In the space below the table, enter three journal entries: -- January 1, 2017, to record the issuance of the bonds; -- June 30, 2017, to record the first semiannual interest payment; and -- December 31, 2017 to record the second semiannual interest payment 6. Save and attach in Canvas in the drop box for this lab. Make sure your name is included in the file name. W18 Face amount Interest payment Market interest rate per period Number of periods Name: Class hour: On-Line Blue cells can be typed in, yellow cells must be form Note: Hover your mouse to any cell with a red flad in The data for this bond can be found in Issue price Note: All cells in the table should be formulas or fun Cash Paid for Interest Increase in Carrying Interest Expense Value Carrying Value (End of Period) Date 1/1/17 6/30/17 In the yellow space below, enter the journal entry for Jan 1, 2017 to record the issuance of the bonds. Then make the journal entries to record the first two semiannual interest payments. Account Debit Credit Jan 1, 2017 June 30, 2017 Dec 31, 2017 Name: Face amount Class hour: Interest payment Market interest rate per period Number of periods Issue price Blue cells can be typed in, yellow cells i Cash Paid for Interest Interest Expense Decrease in Carrying Value Carrying Value (End of Period) Date 1/1/17 6/30/17 In the space below, enter the journal entry for Jan 1, 2017 to record the issuance of the bonds. Then make the journal entries to record the first two semiannual interest payments. Account Debit Credit Jan 1, 2017 June 30, 2017 Dec 31, 2017 2. Use cell references and Excel formulas to construct an amortization schedule for the entire life of the bonds. Note everything below the data should be a cell reference or formula containing a cell reference. (example "=B4+B5" is ok, +7+4 is not) Hold your cursor over the red triangles in the corners of selected cells for help creating the formula for that cell, Your schedule should look similar to Illustration 9-16 from our text: (1) (2) Increase in Carrying Value Date (3) Interest Expense Carrying Value x Market Rate Cash Paid Face Amount x Stated Rato (3)-(2) (5) Carrying Value Prior Carrying Value + (4) $ 93,205 93,433 93,670 1/1/18 6/30/18 12/31/18 $3,500 3,500 $3.728 $228 237 3.737 6/30/27 12/31/27 3,500 3,500 3,962 3.981 462 481 99,057 99,519 100,000 3. In the space below the table, enter three journal entries: -- January 1, 2017, to record the issuance of the bonds; -- June 30, 2017, to record the first semiannual interest payment; and -- December 31, 2017 to record the second semiannual interest payment. 4. Complete the Bond Premium worksheet. Use the given problern data for the bond premium problem to compute the issue price of the bonds (present value), construct an amortization schedule, and record the three journal entries. Check figure: Issue price = $6,228,408.78 Your schedule should look similar to Illustration 9-17 from our text: (1) 121 (4) Decrease in Carrying Value Date (3) Interest Expense Carrying Value x Market Rate Cash Paid Face Amount x Stated Rate (2)-(3) (5) Carrying Value Prior Carrying Value - (4) $107.439 107,162 106,877 1/1/18 6/30/18 12/31/18 $3,500 3,500 $3,223 3.215 $277 285 6/30/27 12/31/27 3,500 3,500 3,029 3,015 471 485 100,956 100,485 100,000 5. In the space below the table, enter three journal entries: -- January 1, 2017, to record the issuance of the bonds; -- June 30, 2017, to record the first semiannual interest payment; and -- December 31, 2017 to record the second semiannual interest payment 6. Save and attach in Canvas in the drop box for this lab. Make sure your name is included in the file name. W18 Face amount Interest payment Market interest rate per period Number of periods Name: Class hour: On-Line Blue cells can be typed in, yellow cells must be form Note: Hover your mouse to any cell with a red flad in The data for this bond can be found in Issue price Note: All cells in the table should be formulas or fun Cash Paid for Interest Increase in Carrying Interest Expense Value Carrying Value (End of Period) Date 1/1/17 6/30/17 In the yellow space below, enter the journal entry for Jan 1, 2017 to record the issuance of the bonds. Then make the journal entries to record the first two semiannual interest payments. Account Debit Credit Jan 1, 2017 June 30, 2017 Dec 31, 2017 Name: Face amount Class hour: Interest payment Market interest rate per period Number of periods Issue price Blue cells can be typed in, yellow cells i Cash Paid for Interest Interest Expense Decrease in Carrying Value Carrying Value (End of Period) Date 1/1/17 6/30/17 In the space below, enter the journal entry for Jan 1, 2017 to record the issuance of the bonds. Then make the journal entries to record the first two semiannual interest payments. Account Debit Credit Jan 1, 2017 June 30, 2017 Dec 31, 2017