Answered step by step

Verified Expert Solution

Question

1 Approved Answer

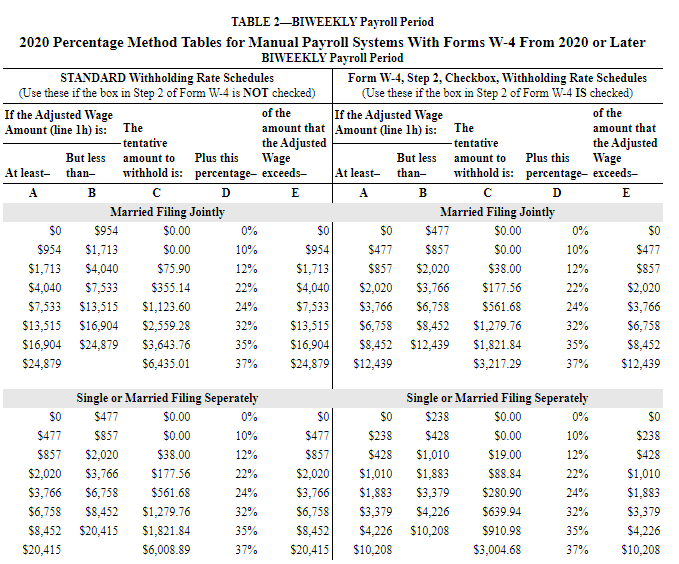

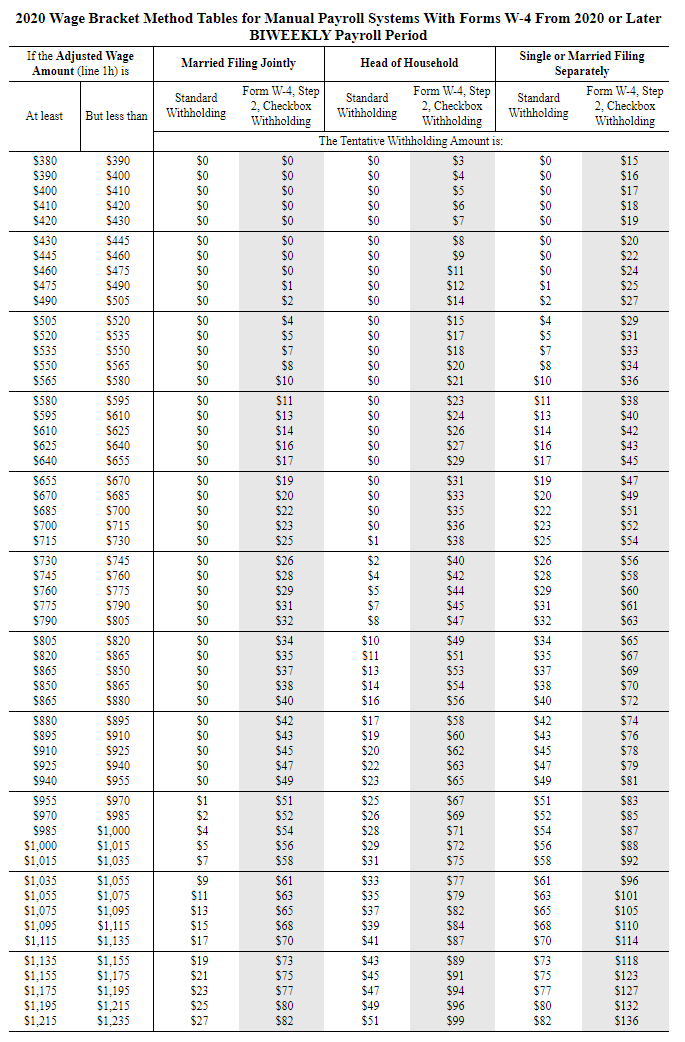

(2) Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages: Patrick Patrone (single),

(2) Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages:

(2) Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages:

| Patrick Patrone (single), $925 wages | $fill in the blank 1 |

| Carson Leno (married filing jointly), $1,195 wages | $fill in the blank 2 |

| Carli Lintz (single), $700 wages | $fill in the blank 3 |

| Gene Hartz (single), $5,200 wages | $fill in the blank 4 |

| Mollie Parmer (married filing jointly), $4,000 wages | $fill in the blank 5 |

fullscreen

TABLE 2-BIWEEKLY Payroll Period 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 is NOT checked) (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage of the If the Adjusted Wage of the Amount (line lh) is: The amount that Amount (line 1h) is: The amount that tentative the Adjusted -tentative the Adjusted But less amount to Plus this Wage But less amount to Plus this Wage At least- than- withhold is: percentage- exceeds At least- than- withhold is: percentage- exceeds- A B D E A B D E Married Filing Jointly Married Filing Jointly $0 $954 $0.00 0% $0 $0 $477 $0.00 0% $0 $954 $1,713 $0.00 10% $954 $477 $0.00 10% $477 $1,713 $4,040 $75.90 12% $1,713 $857 $2,020 $38.00 12% $857 $4,040 $7,533 $355.14 22% $4,040 $2,020 $3,766 $177.56 22% $2,020 $7,533 $13,515 $1,123.60 24% $7,533 $3,766 $6,758 $561.68 24% $13,515 $16,904 $2,559.28 32% $13,515 $6,758 $8,452 $1,279.76 32% $6,758 $16,904 $24,879 $3,643.76 35% $16,904 $8,452 $12,439 $1,821.84 35% $8,452 $24,879 $6,435.01 37% $24,879| $12,439 $3,217.29 37% $12,439 $857 $3,766 $0 $0 $477 $857 $2,020 $3,766 $6,758 $8,452 $20,415 Single or Married Filing Seperately $477 $0.00 0% $857 $0.00 10% $2,020 $38.00 12% $3,766 $177.56 22% $6,758 $561.68 24% $8,452 $1,279.76 32% $20,415 $1,821.84 35% $6,008.89 37% $477 $857 $2,020 $3,766 $6,758 $8,452 $20,415 Single or Married Filing Seperately $0 $238 $0.00 0% $238 $428 $0.00 10% $428 $1,010 $19.00 12% $1,010 $1,883 $88.84 22% $1,883 $3,379 $280.90 24% $3,379 $4,226 $639.94 32% $4,226 $10,208 $910.98 35% $10,208 $3,004.68 37% SO $238 $428 $1,010 $1,883 $3,379 $4,226 $10,208 $390 $520 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Single or Married Filing Amount (line 1h) is Separately Form W-4. Step Standard Standard Form W-4, Step Form W-4, Step Standard 2. Checkbox 2. Checkbox At least But less than Withholding 2. Checkbox Withholding Withholding Withholding Withholding Withholding The Tentative Withholding Amount is: $380 $0 $0 $0 $3 SO $15 $390 $400 SO $0 $0 $4 $0 $16 $400 $410 $0 $0 SO $5 SO $17 $410 S420 $0 $0 SO $6 $0 $18 $420 $430 SO $0 SO $7 $0 $19 $430 $445 SO $0 $0 $8 $0 $20 $445 $460 $0 $0 $0 $9 $0 $22 $460 $475 $0 SO $0 $11 $0 $24 $475 $490 $0 $1 $0 $12 $1 $25 $490 S505 SO $2 $0 $14 $2 $27 $505 S520 $0 $4 $0 $15 $4 $29 $535 $0 $5 $0 $17 $5 $31 $535 $550 $0 $7 SO $18 $7 $33 $550 $565 $0 $8 $0 $20 $8 $34 S565 S580 SO $10 $0 $21 $10 $36 S580 $595 $0 S11 SO $23 $11 $38 $595 S610 $0 $13 $0 $24 $13 $40 S610 $625 $0 $14 SO $26 $14 $42 S625 S640 $0 $16 $0 $27 $16 $43 S640 S655 SO $17 $0 $29 $17 $45 S655 $670 $0 $19 SO $31 $19 $47 S670 S685 SO $20 $ SO $33 $20 $49 $685 200 $700 SO $22 SO $35 $22 $51 $700 $715 $0 $23 SO $36 $23 $52 $715 5730 $0 $25 $1 $38 $25 $54 $730 $745 SO $26 $2 $40 $26 $56 $745 $760 SO $28 $4 $42 $28 $58 $760 $775 SO $29 $5 $44 $29 $60 $775 $790 $0 $31 $7 $45 $31 $61 $805 $0 $32 $8 $S $47 $32 $63 5805 5820 SO $34 $10 $49 $34 $65 S820 5865 SO $35 S11 $51 $35 $67 5865 $850 SO $37 $13 $53 $37 $69 S850 5865 $0 $38 $ $14 $54 $38 $70 5865 S880 $0 $40 $16 $56 $40 $72 S880 5895 SO $42 $17 $58 $42 $74 5895 $910 SO $43 $19 $60 $43 $76 $910 SOOS S925 SO $45 $20 $62 $45 $78 $940 $0 $47 $22 $63 $47 $79 $940 5955 $0 $49 $ $23 $65 $49 $ $81 $955 S970 $1 $51 $25 $67 $51 $83 S970 $985 $2 $52 $26 $69 $52 $85 $985 $1,000 $4 $54 $28 $71 $54 $87 $1,000 $1,015 $5 $56 $29 $72 $56 $88 $1,015 $1,035 $7 $58 $31 $75 $58 $92 $1,035 $1,055 $9 $61 $33 $77 $61 $96 $1,055 $1,075 $11 $63 $35 $79 $63 $101 $1,075 $1,095 $13 $65 $37 $82 $65 $105 $1,095 $1,115 $15 $68 $39 $84 $68 S110 $1,115 $1,135 $17 $70 $41 $87 $ $114 $1,135 $1,155 $19 $73 $43 $89 $118 $1,155 $1,175 $21 $75 $45 $91 $75 $123 $1,175 $1,195 $23 $77 $47 $94 $77 $127 $1,195 $1,215 $25 $80 $49 $96 $80 $132 $1,215 $1,235 $27 $82 $51 $99 $82 $136 steret: ***** 28022233****************** rezaleteseles*** 5790 925 $73 TABLE 2-BIWEEKLY Payroll Period 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 is NOT checked) (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage of the If the Adjusted Wage of the Amount (line lh) is: The amount that Amount (line 1h) is: The amount that tentative the Adjusted -tentative the Adjusted But less amount to Plus this Wage But less amount to Plus this Wage At least- than- withhold is: percentage- exceeds At least- than- withhold is: percentage- exceeds- A B D E A B D E Married Filing Jointly Married Filing Jointly $0 $954 $0.00 0% $0 $0 $477 $0.00 0% $0 $954 $1,713 $0.00 10% $954 $477 $0.00 10% $477 $1,713 $4,040 $75.90 12% $1,713 $857 $2,020 $38.00 12% $857 $4,040 $7,533 $355.14 22% $4,040 $2,020 $3,766 $177.56 22% $2,020 $7,533 $13,515 $1,123.60 24% $7,533 $3,766 $6,758 $561.68 24% $13,515 $16,904 $2,559.28 32% $13,515 $6,758 $8,452 $1,279.76 32% $6,758 $16,904 $24,879 $3,643.76 35% $16,904 $8,452 $12,439 $1,821.84 35% $8,452 $24,879 $6,435.01 37% $24,879| $12,439 $3,217.29 37% $12,439 $857 $3,766 $0 $0 $477 $857 $2,020 $3,766 $6,758 $8,452 $20,415 Single or Married Filing Seperately $477 $0.00 0% $857 $0.00 10% $2,020 $38.00 12% $3,766 $177.56 22% $6,758 $561.68 24% $8,452 $1,279.76 32% $20,415 $1,821.84 35% $6,008.89 37% $477 $857 $2,020 $3,766 $6,758 $8,452 $20,415 Single or Married Filing Seperately $0 $238 $0.00 0% $238 $428 $0.00 10% $428 $1,010 $19.00 12% $1,010 $1,883 $88.84 22% $1,883 $3,379 $280.90 24% $3,379 $4,226 $639.94 32% $4,226 $10,208 $910.98 35% $10,208 $3,004.68 37% SO $238 $428 $1,010 $1,883 $3,379 $4,226 $10,208 $390 $520 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Single or Married Filing Amount (line 1h) is Separately Form W-4. Step Standard Standard Form W-4, Step Form W-4, Step Standard 2. Checkbox 2. Checkbox At least But less than Withholding 2. Checkbox Withholding Withholding Withholding Withholding Withholding The Tentative Withholding Amount is: $380 $0 $0 $0 $3 SO $15 $390 $400 SO $0 $0 $4 $0 $16 $400 $410 $0 $0 SO $5 SO $17 $410 S420 $0 $0 SO $6 $0 $18 $420 $430 SO $0 SO $7 $0 $19 $430 $445 SO $0 $0 $8 $0 $20 $445 $460 $0 $0 $0 $9 $0 $22 $460 $475 $0 SO $0 $11 $0 $24 $475 $490 $0 $1 $0 $12 $1 $25 $490 S505 SO $2 $0 $14 $2 $27 $505 S520 $0 $4 $0 $15 $4 $29 $535 $0 $5 $0 $17 $5 $31 $535 $550 $0 $7 SO $18 $7 $33 $550 $565 $0 $8 $0 $20 $8 $34 S565 S580 SO $10 $0 $21 $10 $36 S580 $595 $0 S11 SO $23 $11 $38 $595 S610 $0 $13 $0 $24 $13 $40 S610 $625 $0 $14 SO $26 $14 $42 S625 S640 $0 $16 $0 $27 $16 $43 S640 S655 SO $17 $0 $29 $17 $45 S655 $670 $0 $19 SO $31 $19 $47 S670 S685 SO $20 $ SO $33 $20 $49 $685 200 $700 SO $22 SO $35 $22 $51 $700 $715 $0 $23 SO $36 $23 $52 $715 5730 $0 $25 $1 $38 $25 $54 $730 $745 SO $26 $2 $40 $26 $56 $745 $760 SO $28 $4 $42 $28 $58 $760 $775 SO $29 $5 $44 $29 $60 $775 $790 $0 $31 $7 $45 $31 $61 $805 $0 $32 $8 $S $47 $32 $63 5805 5820 SO $34 $10 $49 $34 $65 S820 5865 SO $35 S11 $51 $35 $67 5865 $850 SO $37 $13 $53 $37 $69 S850 5865 $0 $38 $ $14 $54 $38 $70 5865 S880 $0 $40 $16 $56 $40 $72 S880 5895 SO $42 $17 $58 $42 $74 5895 $910 SO $43 $19 $60 $43 $76 $910 SOOS S925 SO $45 $20 $62 $45 $78 $940 $0 $47 $22 $63 $47 $79 $940 5955 $0 $49 $ $23 $65 $49 $ $81 $955 S970 $1 $51 $25 $67 $51 $83 S970 $985 $2 $52 $26 $69 $52 $85 $985 $1,000 $4 $54 $28 $71 $54 $87 $1,000 $1,015 $5 $56 $29 $72 $56 $88 $1,015 $1,035 $7 $58 $31 $75 $58 $92 $1,035 $1,055 $9 $61 $33 $77 $61 $96 $1,055 $1,075 $11 $63 $35 $79 $63 $101 $1,075 $1,095 $13 $65 $37 $82 $65 $105 $1,095 $1,115 $15 $68 $39 $84 $68 S110 $1,115 $1,135 $17 $70 $41 $87 $ $114 $1,135 $1,155 $19 $73 $43 $89 $118 $1,155 $1,175 $21 $75 $45 $91 $75 $123 $1,175 $1,195 $23 $77 $47 $94 $77 $127 $1,195 $1,215 $25 $80 $49 $96 $80 $132 $1,215 $1,235 $27 $82 $51 $99 $82 $136 steret: ***** 28022233****************** rezaleteseles*** 5790 925 $73Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started