2.) Use the financial statements above for Digia, Inc. and draw pro-forma statements for the year 2019. Sales are projected to grow by 12 percent. Costs of goods sold, depreciation expense, other expenses, current assets, and accounts payable increase spontaneously with sales. Interest expense will remain constant. Dividend payout amount and the tax rate will remain constant. If the firm is operating at 80% of its capacity and no new debt or equity is issued. What is the firms full capacity sales? How much is the external financing needed to support the 12 percent growth rate in sales?

2.) Use the financial statements above for Digia, Inc. and draw pro-forma statements for the year 2019. Sales are projected to grow by 12 percent. Costs of goods sold, depreciation expense, other expenses, current assets, and accounts payable increase spontaneously with sales. Interest expense will remain constant. Dividend payout amount and the tax rate will remain constant. If the firm is operating at 80% of its capacity and no new debt or equity is issued. What is the firms full capacity sales? How much is the external financing needed to support the 12 percent growth rate in sales?

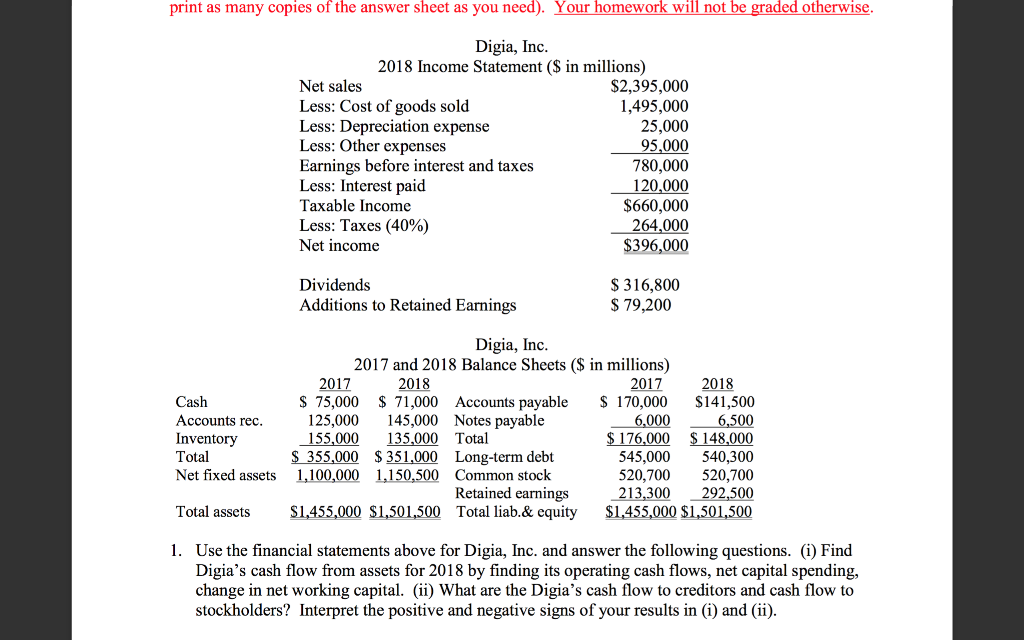

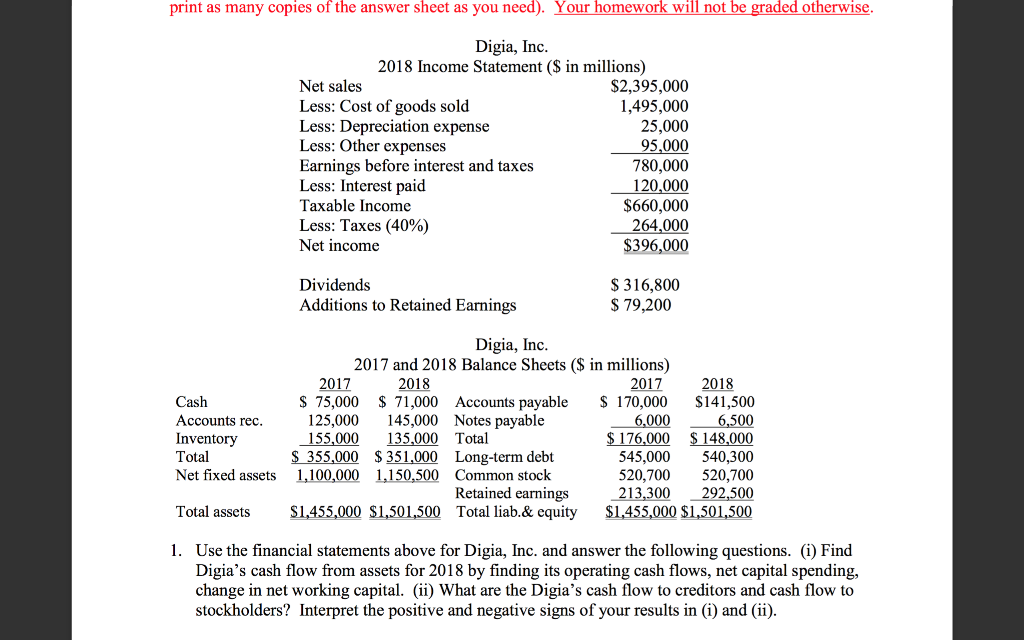

print as many copies of the answer sheet as you need). Your homework will not be graded otherwise. Digia, Inc. 2018 Income Statement ($ in millions) Net sales $2,395,000 Less: Cost of goods sold 1,495,000 Less: Depreciation expense 25,000 Less: Other expenses 95,000 Earnings before interest and taxes 780,000 Less: Interest paid 120,000 Taxable Income $660,000 Less: Taxes (40%) 264,000 Net income $396,000 Dividends Additions to Retained Earnings $ 316,800 $ 79,200 Cash Accounts rec. Inventory Total Net fixed assets Digia, Inc. 2017 and 2018 Balance Sheets ($ in millions) 2017 2018 2017 2018 $ 75,000 $ 71,000 Accounts payable $ 170,000 $141,500 125,000 145,000 Notes payable 6,000 6,500 155,000 135,000 Total $ 176,000 $ 148,000 $ 355,000 $ 351,000 Long-term debt 545,000 540,300 1,100,000 1,150,500 Common stock 520,700 520,700 Retained earnings 213,300 292,500 $1,455,000 $1,501,500 Total liab.& equity $1,455,000 $1,501,500 Total assets 1. Use the financial statements above for Digia, Inc. and answer the following questions. (i) Find Digia's cash flow from assets for 2018 by finding its operating cash flows, net capital spending, change in net working capital. (ii) What are the Digia's cash flow to creditors and cash flow to stockholders? Interpret the positive and negative signs of your results in (i) and (ii). print as many copies of the answer sheet as you need). Your homework will not be graded otherwise. Digia, Inc. 2018 Income Statement ($ in millions) Net sales $2,395,000 Less: Cost of goods sold 1,495,000 Less: Depreciation expense 25,000 Less: Other expenses 95,000 Earnings before interest and taxes 780,000 Less: Interest paid 120,000 Taxable Income $660,000 Less: Taxes (40%) 264,000 Net income $396,000 Dividends Additions to Retained Earnings $ 316,800 $ 79,200 Cash Accounts rec. Inventory Total Net fixed assets Digia, Inc. 2017 and 2018 Balance Sheets ($ in millions) 2017 2018 2017 2018 $ 75,000 $ 71,000 Accounts payable $ 170,000 $141,500 125,000 145,000 Notes payable 6,000 6,500 155,000 135,000 Total $ 176,000 $ 148,000 $ 355,000 $ 351,000 Long-term debt 545,000 540,300 1,100,000 1,150,500 Common stock 520,700 520,700 Retained earnings 213,300 292,500 $1,455,000 $1,501,500 Total liab.& equity $1,455,000 $1,501,500 Total assets 1. Use the financial statements above for Digia, Inc. and answer the following questions. (i) Find Digia's cash flow from assets for 2018 by finding its operating cash flows, net capital spending, change in net working capital. (ii) What are the Digia's cash flow to creditors and cash flow to stockholders? Interpret the positive and negative signs of your results in (i) and (ii)

2.) Use the financial statements above for Digia, Inc. and draw pro-forma statements for the year 2019. Sales are projected to grow by 12 percent. Costs of goods sold, depreciation expense, other expenses, current assets, and accounts payable increase spontaneously with sales. Interest expense will remain constant. Dividend payout amount and the tax rate will remain constant. If the firm is operating at 80% of its capacity and no new debt or equity is issued. What is the firms full capacity sales? How much is the external financing needed to support the 12 percent growth rate in sales?

2.) Use the financial statements above for Digia, Inc. and draw pro-forma statements for the year 2019. Sales are projected to grow by 12 percent. Costs of goods sold, depreciation expense, other expenses, current assets, and accounts payable increase spontaneously with sales. Interest expense will remain constant. Dividend payout amount and the tax rate will remain constant. If the firm is operating at 80% of its capacity and no new debt or equity is issued. What is the firms full capacity sales? How much is the external financing needed to support the 12 percent growth rate in sales?