Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that there are no storage costs for crude oil and the interest rate for borrowing or lending is 2.50% per annum (continuously compounded). Consider

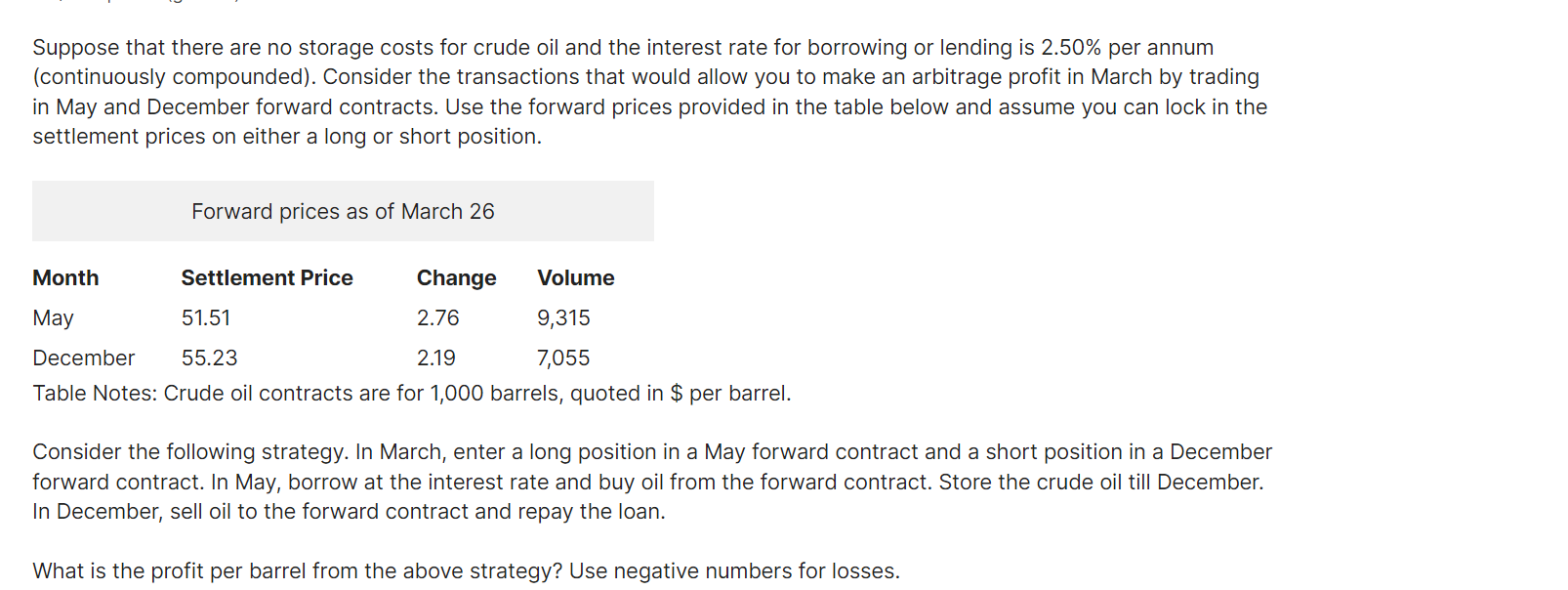

Suppose that there are no storage costs for crude oil and the interest rate for borrowing or lending is 2.50% per annum (continuously compounded). Consider the transactions that would allow you to make an arbitrage profit in March by trading in May and December forward contracts. Use the forward prices provided in the table below and assume you can lock in the settlement prices on either a long or short position. Table Notes: Crude oil contracts are for 1,000 barrels, quoted in $ per barrel. Consider the following strategy. In March, enter a long position in a May forward contract and a short position in a December forward contract. In May, borrow at the interest rate and buy oil from the forward contract. Store the crude oil till December. In December, sell oil to the forward contract and repay the loan. What is the profit per barrel from the above strategy? Use negative numbers for losses

Suppose that there are no storage costs for crude oil and the interest rate for borrowing or lending is 2.50% per annum (continuously compounded). Consider the transactions that would allow you to make an arbitrage profit in March by trading in May and December forward contracts. Use the forward prices provided in the table below and assume you can lock in the settlement prices on either a long or short position. Table Notes: Crude oil contracts are for 1,000 barrels, quoted in $ per barrel. Consider the following strategy. In March, enter a long position in a May forward contract and a short position in a December forward contract. In May, borrow at the interest rate and buy oil from the forward contract. Store the crude oil till December. In December, sell oil to the forward contract and repay the loan. What is the profit per barrel from the above strategy? Use negative numbers for losses Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started