Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Use the following information to estimate the implied EVA for Boston Properties. Boston properties believes that their development experience, their organizational depth, and their

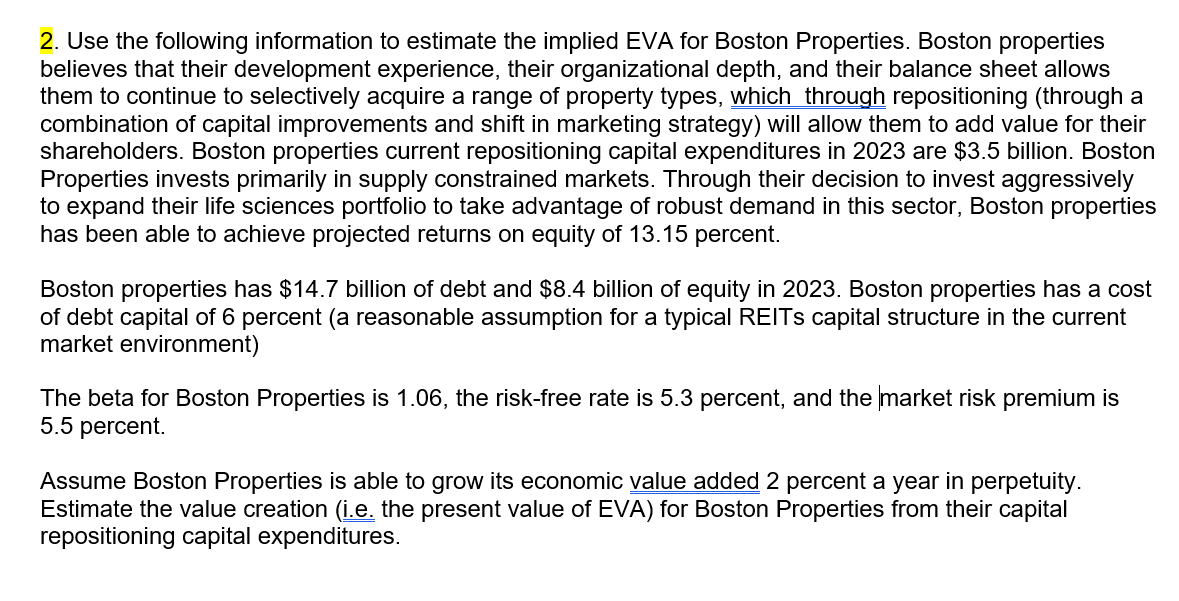

2. Use the following information to estimate the implied EVA for Boston Properties. Boston properties believes that their development experience, their organizational depth, and their balance sheet allows them to continue to selectively acquire a range of property types, which through repositioning (through a combination of capital improvements and shift in marketing strategy) will allow them to add value for their shareholders. Boston properties current repositioning capital expenditures in 2023 are $3.5 billion. Boston Properties invests primarily in supply constrained markets. Through their decision to invest aggressively to expand their life sciences portfolio to take advantage of robust demand in this sector, Boston properties has been able to achieve projected returns on equity of 13.15 percent. Boston properties has $14.7 billion of debt and $8.4 billion of equity in 2023 . Boston properties has a cost of debt capital of 6 percent (a reasonable assumption for a typical REITs capital structure in the current market environment) The beta for Boston Properties is 1.06 , the risk-free rate is 5.3 percent, and the market risk premium is 5.5 percent. Assume Boston Properties is able to grow its economic value added 2 percent a year in perpetuity. Estimate the value creation (i.e. the present value of EVA) for Boston Properties from their capital repositioning capital expenditures

2. Use the following information to estimate the implied EVA for Boston Properties. Boston properties believes that their development experience, their organizational depth, and their balance sheet allows them to continue to selectively acquire a range of property types, which through repositioning (through a combination of capital improvements and shift in marketing strategy) will allow them to add value for their shareholders. Boston properties current repositioning capital expenditures in 2023 are $3.5 billion. Boston Properties invests primarily in supply constrained markets. Through their decision to invest aggressively to expand their life sciences portfolio to take advantage of robust demand in this sector, Boston properties has been able to achieve projected returns on equity of 13.15 percent. Boston properties has $14.7 billion of debt and $8.4 billion of equity in 2023 . Boston properties has a cost of debt capital of 6 percent (a reasonable assumption for a typical REITs capital structure in the current market environment) The beta for Boston Properties is 1.06 , the risk-free rate is 5.3 percent, and the market risk premium is 5.5 percent. Assume Boston Properties is able to grow its economic value added 2 percent a year in perpetuity. Estimate the value creation (i.e. the present value of EVA) for Boston Properties from their capital repositioning capital expenditures Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started