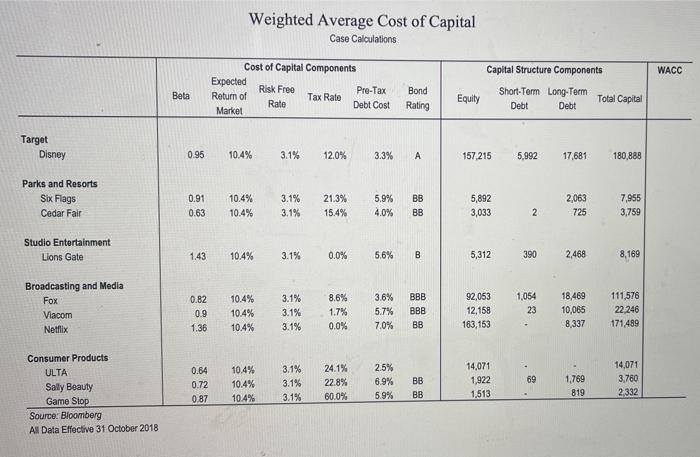

2. Using the accompanying spreadsheet, calculate the WACC for each Disney segment comparable. Describe the prima- ry WACC drivers that explain the differences between the WACC of Disney and its comparables. Weighted Average Cost of Capital Case Calculations Cost of Capital Components Capital Structure Components WACC Risk Free Bond Beta Expected Return of Market Tax Rate Pro-Tax Debt Cost Rate Short-Term Long-Term Debt Debt Equity Total Capital Rating Target Disney 0.95 10.4% 3.1% 12.0% 3.3% A 157 215 5,992 17.681 180,888 Parks and Resorts Six Flags Cedar Fair 0.91 0.63 10.4% 10.4% 3.1% 3.1% 21.3% 15.4% 5.9% 4.0% BB BB 5,892 3,033 2,063 725 2 7,955 3,759 Studio Entertainment Lions Gate 1.43 10.4% 3.1% 0.0% 5.6% B 5,312 390 2,468 8,169 BBB Broadcasting and Media Fox Viacom Netflix 0.82 0.9 1.36 10.4% 10.4% 10.4% 3.1% 3.1% 3.1% 8.6% 1.7% 0.0% 3.6% 5.7% 7.0% 92,063 12,168 163,153 1,054 23 BBB 18,469 10,065 8,337 111,576 22.246 171.489 BB 10.4% 10.4% Consumer Products ULTA Sally Beauty Game Stop Source: Bloomberg Al Data Effective 31 October 2018 0.64 0.72 0.87 69 3.1% 3.1% 3.1% 24.1% 22.8% 60.0% 2.5% 6.9% 5.9% 14,071 1,922 1.513 BB BB 1,769 819 14,071 3,760 2332 10.4% 2. Using the accompanying spreadsheet, calculate the WACC for each Disney segment comparable. Describe the prima- ry WACC drivers that explain the differences between the WACC of Disney and its comparables. Weighted Average Cost of Capital Case Calculations Cost of Capital Components Capital Structure Components WACC Risk Free Bond Beta Expected Return of Market Tax Rate Pro-Tax Debt Cost Rate Short-Term Long-Term Debt Debt Equity Total Capital Rating Target Disney 0.95 10.4% 3.1% 12.0% 3.3% A 157 215 5,992 17.681 180,888 Parks and Resorts Six Flags Cedar Fair 0.91 0.63 10.4% 10.4% 3.1% 3.1% 21.3% 15.4% 5.9% 4.0% BB BB 5,892 3,033 2,063 725 2 7,955 3,759 Studio Entertainment Lions Gate 1.43 10.4% 3.1% 0.0% 5.6% B 5,312 390 2,468 8,169 BBB Broadcasting and Media Fox Viacom Netflix 0.82 0.9 1.36 10.4% 10.4% 10.4% 3.1% 3.1% 3.1% 8.6% 1.7% 0.0% 3.6% 5.7% 7.0% 92,063 12,168 163,153 1,054 23 BBB 18,469 10,065 8,337 111,576 22.246 171.489 BB 10.4% 10.4% Consumer Products ULTA Sally Beauty Game Stop Source: Bloomberg Al Data Effective 31 October 2018 0.64 0.72 0.87 69 3.1% 3.1% 3.1% 24.1% 22.8% 60.0% 2.5% 6.9% 5.9% 14,071 1,922 1.513 BB BB 1,769 819 14,071 3,760 2332 10.4%