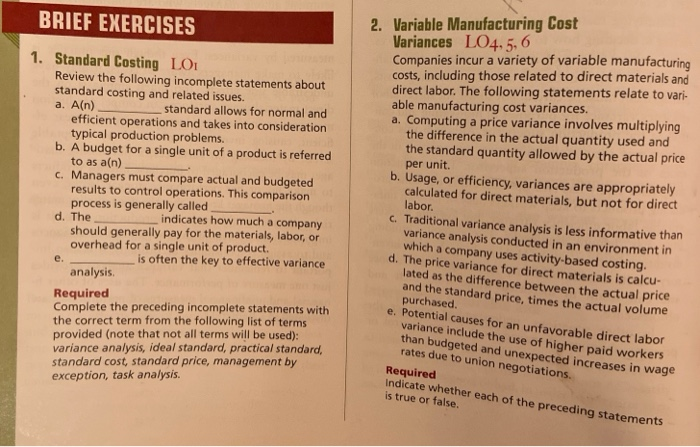

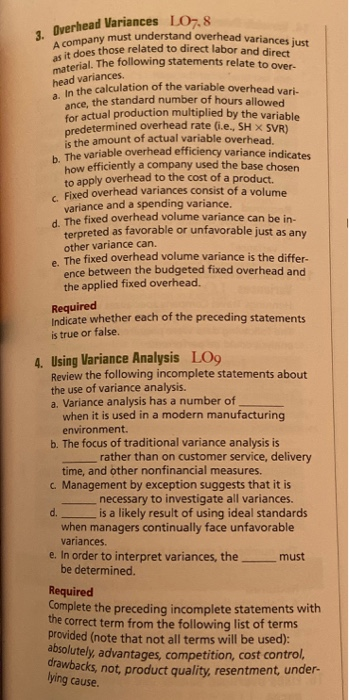

2. Variable Manufacturing Cost BRIEF EXERCISES Variances LO4. 5,6 Companies incur a variety of variable manufacturing costs, including those related to direct materials and direct labor. The following statements relate to vari- able manufacturing cost variances. a. Computing a price variance involves multiplying the difference in the actual quantity used and the standard quantity allowed by the actual price per unit. b. Usage, or efficiency, variances are appropriately calculated for direct materials, but not for direct labor. c. Traditional variance analysis is less informative than variance analysis conducted in an environment in which a company uses activity-based costing. d. The price variance for direct materials is calcu- lated as the difference between the actual price and the standard price, times the actual volume purchased. e. Potential causes for an unfavorable direct labor variance include the use of higher paid workers than budgeted and unexpected increases in wage rates due to union negotiations. 1. Standard Costing LO Review the following incomplete statements about standard costing and related issues a. A(n) efficient operations and takes into consideration typical production problems. b. A budget for a single unit of a product is referred to as a(n) c. Managers must compare actual and budgeted results to control operations. This comparison process is generally called d. The should generally pay for the materials, labor, or overhead for a single unit of product. standard allows for normal and indicates how much a company is often the key to effective variance e. analysis. Required Complete the preceding incomplete statements with the correct term from the following list of terms provided (note that not all terms will be used): variance analysis, ideal standard, practical standard standard cost, standard price, management by exception, task analysis. Required Indicate whether each of the preceding statements is true or false. 1 Overhead Variances LO7.8 A company must understand overhead variances just as it does those related to direct labor and direct material. The following statements relate to over- head variances a. In the calculation of the variable overhead vari- ance, the standard number of hours allowed for actual production multiplied by the variable predetermined overhead rate (i.e., SH X SVR) is the amount of actual variable overhead. h The variable overhead efficiency variance indicates how efficiently a company used the base chosen to apply overhead to the cost of a product. Fixed overhead variances consist of a volume variance and a spending variance. d. The fixed overhead volume variance can be in- terpreted as favora ble or unfavorable just as any other variance can. e The fixed overhead volume variance is the differ- ence between the budgeted fixed overhead and the applied fixed overhead. Required Indicate whether each of the preceding statements is true or false. 4. Using Variance Analysis LOg Review the following incomplete statements about the use of variance analysis. a. Variance analysis has a number of when it is used ina modern manufacturing environment. b. The focus of traditional variance analysis is rather than on customer service, delivery time, and other nonfinancial measures. c. Management by exception suggests that it is necessary to investigate all variances. is a likely result of using ideal standards when managers continually face unfavorable variances. e. In order to interpret variances, the be determined. d. must Required Complete the preceding incomplete statements with the correct term from the following list of terms provided (note that not all terms will be used): absolutely, advantages, competition, cost control, drawbacks, not, product quality, resentment, under- lying cause