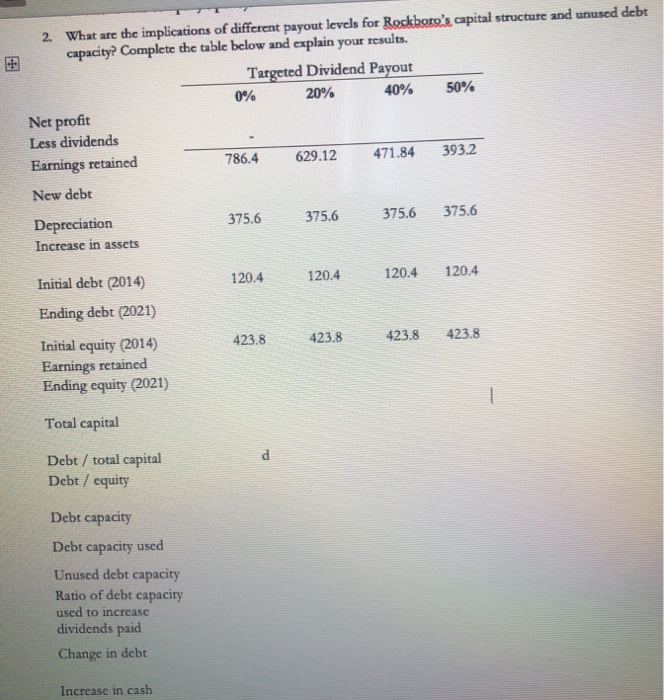

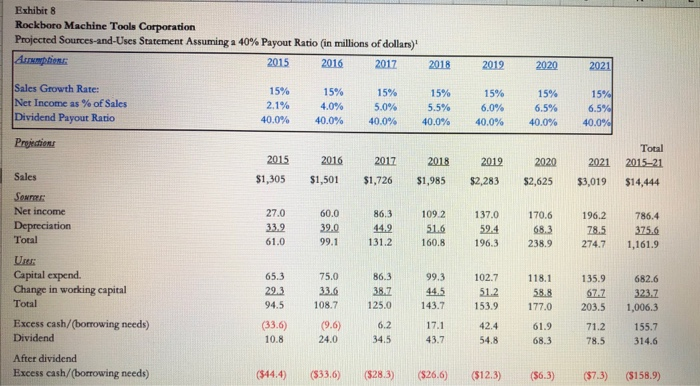

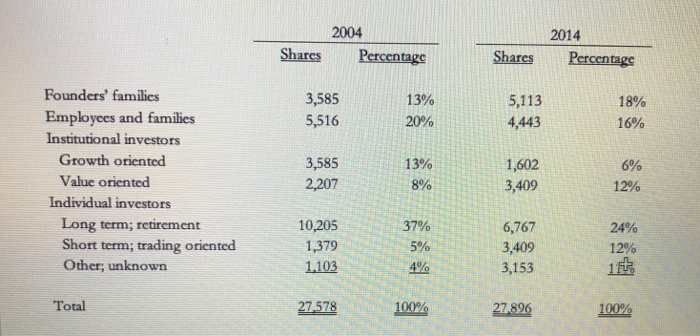

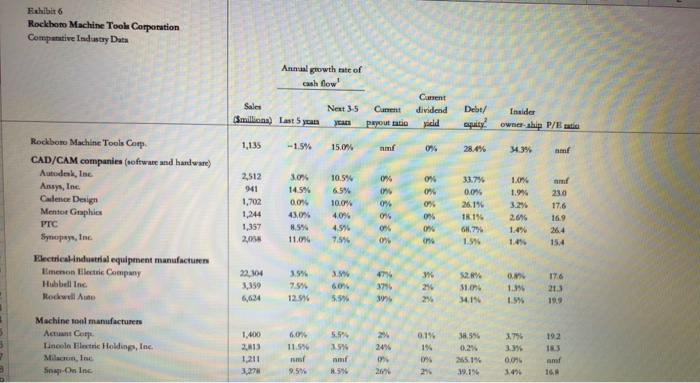

2. What are the implications of different payout levels for Rockboro's capital structure and unused debt capacit? Complete the table below and explain your results. Targeted Dividend Payout 40% 0% 0% 50% Net profit Less dividends Earnings retained New debt Depreciation 786.4 629.12 471.84 393.2 375.6 375.6 375.6 375.6 Increase in assets Initial debt (2014) 120.4 120.4 120.4 120.4 Ending debt (2021) 423.8 423.8 423.8 423.8 Initial equity (2014) Earnings retained Ending equity (2021) Total capital Debt / total capital Debt/equity Debt capacity Debt capacity used Unused debt capacity Ratio of debt capacity used to increase dividends paid Change in debt Increasc in cash 2004 2014 Shares Percentage Shares Percentage Founders' familics 3,585 5,516 13% 20% 5,113 4,443 18% 16% Employees and families Institutional investors Growth oriented Value oriented Individual investors 3,585 2,207 13% 8% 1,602 3,409 6% 12% Long term; retirement Short term; trading oriented Other; unknown 10,205 1,379 1103 37% 5% 6,767 3,409 3,153 24% 12% Total 27 578 27 896 100% Exhibit 6 Rockboto Machine Tools Corporation Comparative Industry Data Annal growth rate of cash low Cument Next 3-5 Cament dividend Debt/ Insider Rockboro Machine Tools Comp CAD/CAM companies (software and handware) 1,135-1.9% 15.05. nrnf 28,4% 34.3% anf Autodesk, Inc. Ansys, Inc Cadence Design Mentor Graphics 2.512 30% 10.5% 0% 0% ss.7% 10% nmf 941 1,702 0.0% 100% 0% 1,244 430% 40% 1,357 8.9% 4.9% .0% 2,058 11.0% 7.5% .0%,..0% 1.5% 1.4% 1s4 14.5% 65% 0% 0% 0.0% 1.9% 23.0 0%261% 32% 17.6 0%18.1% 26% 169 68.7% 1.4% 264 Symopays, Inc Electrical-industrial equipment manufactures Emenon Electric Company Hubbell Inc. Rockwell Auto 22,304 3.9% 33% 3%528% a8% 176 3,359 7.5% 60% ,37% 6,024 12.sss ss% 25-34,1% 13% 19, 2%310% 13% 21.3 Machine tool manufacturers Actuant Corp. Lincoln Electric Holdings, Inc Milacron, Inc Snap-On Inc 1,400 60% 55% 2,813 11.5% 15% , 24% 25, 0.1% 38.596 3.796 192 I% 0.2% i3% 1A3 0%265.1% 0.0% anf 9.596 8.556 2. What are the implications of different payout levels for Rockboro's capital structure and unused debt capacit? Complete the table below and explain your results. Targeted Dividend Payout 40% 0% 0% 50% Net profit Less dividends Earnings retained New debt Depreciation 786.4 629.12 471.84 393.2 375.6 375.6 375.6 375.6 Increase in assets Initial debt (2014) 120.4 120.4 120.4 120.4 Ending debt (2021) 423.8 423.8 423.8 423.8 Initial equity (2014) Earnings retained Ending equity (2021) Total capital Debt / total capital Debt/equity Debt capacity Debt capacity used Unused debt capacity Ratio of debt capacity used to increase dividends paid Change in debt Increasc in cash 2004 2014 Shares Percentage Shares Percentage Founders' familics 3,585 5,516 13% 20% 5,113 4,443 18% 16% Employees and families Institutional investors Growth oriented Value oriented Individual investors 3,585 2,207 13% 8% 1,602 3,409 6% 12% Long term; retirement Short term; trading oriented Other; unknown 10,205 1,379 1103 37% 5% 6,767 3,409 3,153 24% 12% Total 27 578 27 896 100% Exhibit 6 Rockboto Machine Tools Corporation Comparative Industry Data Annal growth rate of cash low Cument Next 3-5 Cament dividend Debt/ Insider Rockboro Machine Tools Comp CAD/CAM companies (software and handware) 1,135-1.9% 15.05. nrnf 28,4% 34.3% anf Autodesk, Inc. Ansys, Inc Cadence Design Mentor Graphics 2.512 30% 10.5% 0% 0% ss.7% 10% nmf 941 1,702 0.0% 100% 0% 1,244 430% 40% 1,357 8.9% 4.9% .0% 2,058 11.0% 7.5% .0%,..0% 1.5% 1.4% 1s4 14.5% 65% 0% 0% 0.0% 1.9% 23.0 0%261% 32% 17.6 0%18.1% 26% 169 68.7% 1.4% 264 Symopays, Inc Electrical-industrial equipment manufactures Emenon Electric Company Hubbell Inc. Rockwell Auto 22,304 3.9% 33% 3%528% a8% 176 3,359 7.5% 60% ,37% 6,024 12.sss ss% 25-34,1% 13% 19, 2%310% 13% 21.3 Machine tool manufacturers Actuant Corp. Lincoln Electric Holdings, Inc Milacron, Inc Snap-On Inc 1,400 60% 55% 2,813 11.5% 15% , 24% 25, 0.1% 38.596 3.796 192 I% 0.2% i3% 1A3 0%265.1% 0.0% anf 9.596 8.556