Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. what is the amount of change in sales amount based on the 40% growth assumption? a. $1,300,000 b. $400,000 c. $300,000 d. none of

2. what is the amount of change in sales amount based on the 40% growth assumption?

a.

$1,300,000

b.

$400,000

c.

$300,000

d.

none of the choices

3. given in the table below, what is the additional financing needed (AFN) for next year?

| Total Assets | 800000 |

| Accounts Payables | 40000 |

| Accrued Liabilities | 20000 |

a. $1,000,000

B. $130,000

c. $500,000

D. $226,000

4. what is the expected value of the sales growth rate for next year?

| a. | .25 (25%) | |

| b. | .103 (10.3%) | |

| c. | .035 (3.5%) | |

| d. | .229 (22.9%) |

5. use the information from the previous questions as repeated in the table below.

| Sales | 1000000 |

| Net Profit | 50000 |

| Total Assets | 800000 |

| Accounts Payables | 40000 |

| Accrued Liabilities | 20000 |

Calculate the additional financing needed (AFN).

| A. | $99,000 | |

| B. | $122,500 | |

| C. | $155,000 | |

| D. | None of the choices |

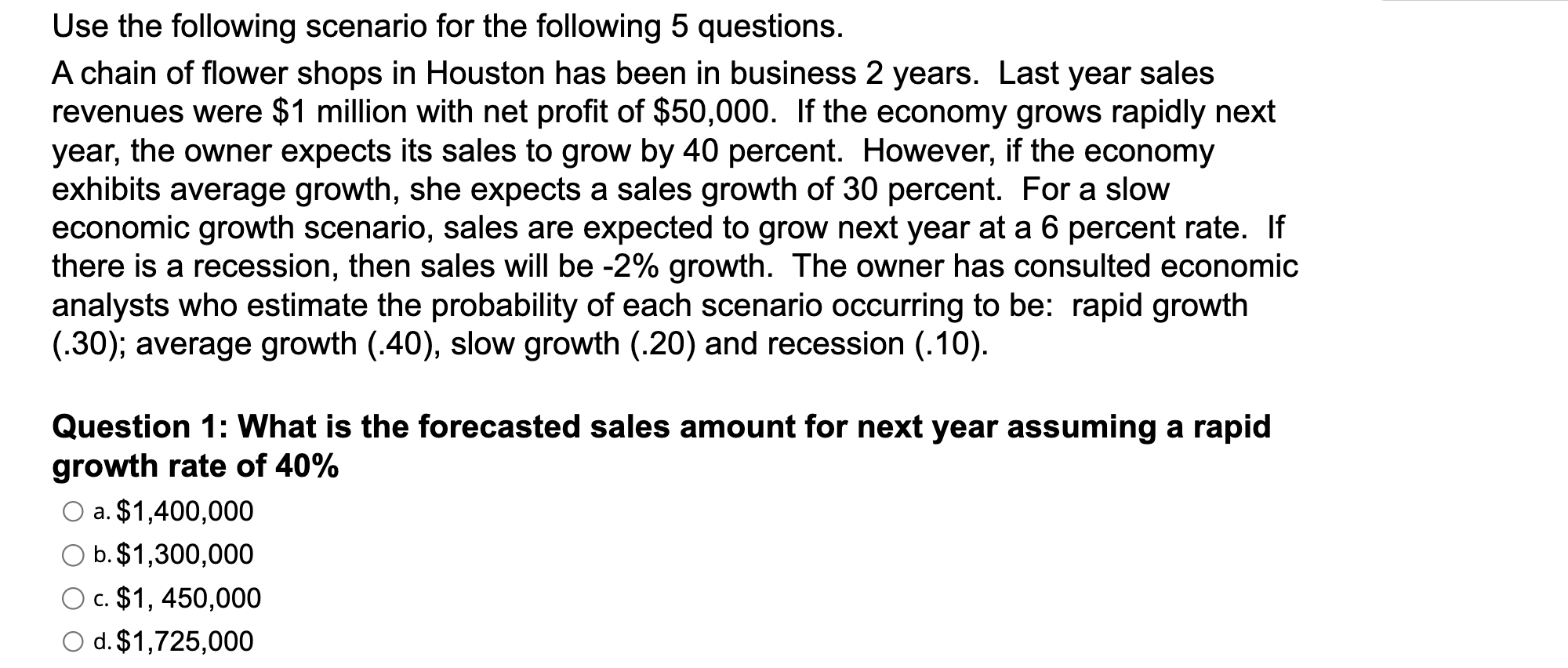

Use the following scenario for the following 5 questions. A chain of flower shops in Houston has been in business 2 years. Last year sales revenues were $1 million with net profit of $50,000. If the economy grows rapidly next year, the owner expects its sales to grow by 40 percent. However, if the economy exhibits average growth, she expects a sales growth of 30 percent. For a slow economic growth scenario, sales are expected to grow next year at a 6 percent rate. If there is a recession, then sales will be 2% growth. The owner has consulted economic analysts who estimate the probability of each scenario occurring to be: rapid growth (.30); average growth (.40), slow growth (.20) and recession (.10). Question 1: What is the forecasted sales amount for next year assuming a rapid growth rate of 40% a. $1,400,000 b. $1,300,000 c. $1,450,000 d. $1,725,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started