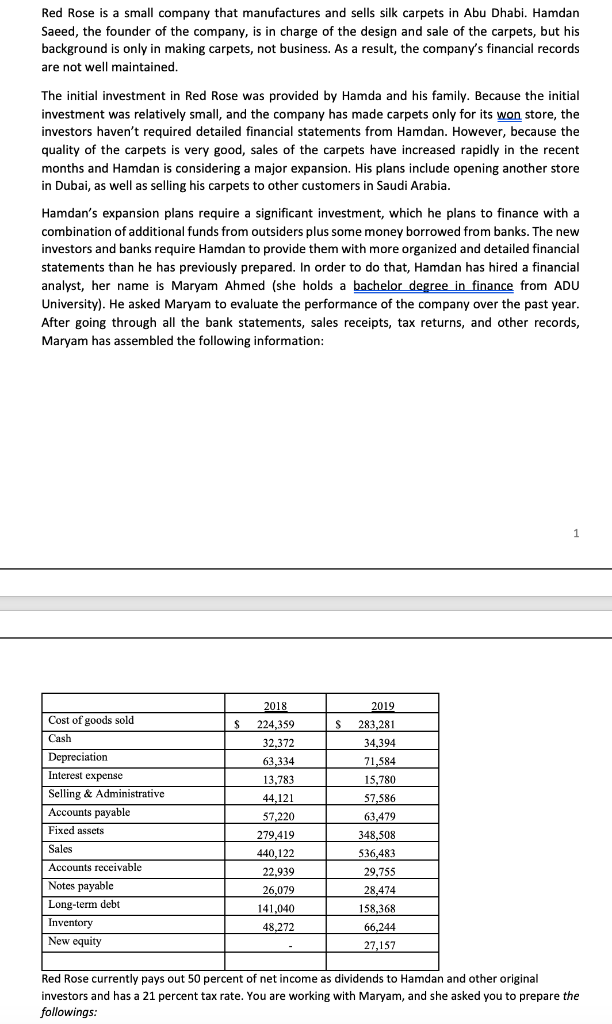

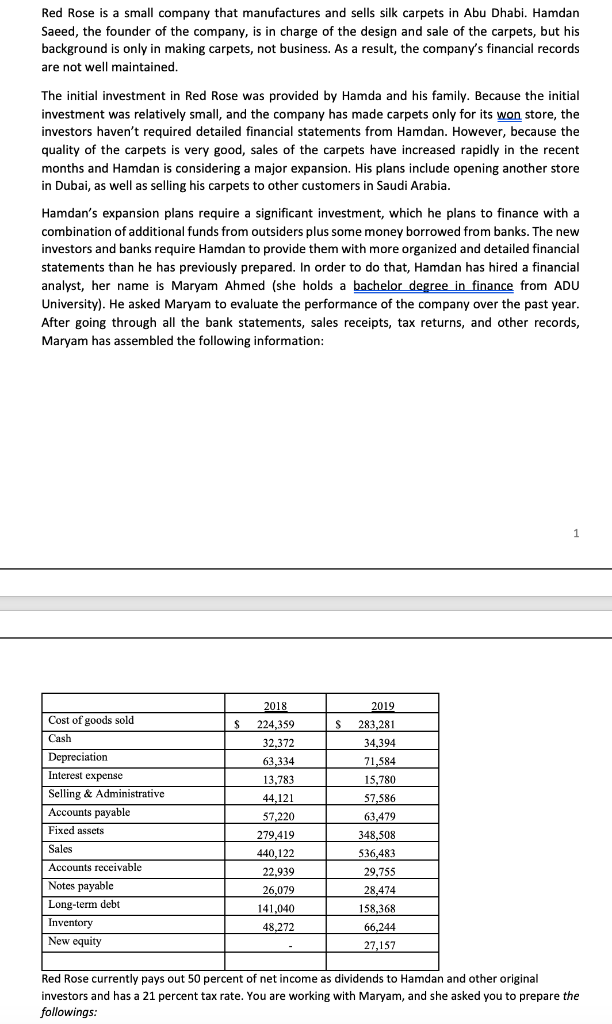

Red Rose is a small company that manufactures and sells silk carpets in Abu Dhabi. Hamdan Saeed, the founder of the company, is in charge of the design and sale of the carpets, but his background is only in making carpets, not business. As a result, the company's financial records are not well maintained. The initial investment in Red Rose was provided by Hamda and his family. Because the initial investment was relatively small, and the company has made carpets only for its won store, the investors haven't required detailed financial statements from Hamdan. However, because the quality of the carpets is very good, sales of the carpets have increased rapidly in the recent months and Hamdan is considering a major expansion. His plans include opening another store in Dubai, as well as selling his carpets to other customers in Saudi Arabia. Hamdan's expansion plans require a significant investment, which he plans to finance with a combination of additional funds from outsiders plus some money borrowed from banks. The new investors and banks require Hamdan to provide them with more organized and detailed financial statements than he has previously prepared. In order to do that, Hamdan has hired a financial analyst, her name is Maryam Ahmed (she holds a bachelor degree in finance from ADU University). He asked Maryam to evaluate the performance of the company over the past year. After going through all the bank statements, sales receipts, tax returns, and other records, Maryam has assembled the following information: Cost of goods sold $ $ 2019 283,281 34,394 71,584 Cash Depreciation Interest expense Selling & Administrative Accounts payable Fixed assets 15,780 57,586 2018 224,359 32,372 63,334 13,783 44,121 57,220 279.419 440,122 22.939 26,079 141,040 48,272 Sales Accounts receivable Notes payable Long-term debt Inventory New equity 63,479 348,508 536,483 29,755 28,474 158,368 66.244 27,157 Red Rose currently pays out 50 percent of net income as dividends to Hamdan and other original investors and has a 21 percent tax rate. You are working with Maryam, and she asked you to prepare the followings: 1. Income statement for 2018 and 2019. (4 marks) 2. A balance sheet for 2018 and 2019. (2 marks) 3. Operating cash flow for 2018 and 2019. (2 marks) 4. Cash flow from assets for 2019. (2 marks) 5. Cash flow to creditors for 2019. (2 marks) 6. Cash flow to stockholders for 2019. (2 marks) Red Rose is a small company that manufactures and sells silk carpets in Abu Dhabi. Hamdan Saeed, the founder of the company, is in charge of the design and sale of the carpets, but his background is only in making carpets, not business. As a result, the company's financial records are not well maintained. The initial investment in Red Rose was provided by Hamda and his family. Because the initial investment was relatively small, and the company has made carpets only for its won store, the investors haven't required detailed financial statements from Hamdan. However, because the quality of the carpets is very good, sales of the carpets have increased rapidly in the recent months and Hamdan is considering a major expansion. His plans include opening another store in Dubai, as well as selling his carpets to other customers in Saudi Arabia. Hamdan's expansion plans require a significant investment, which he plans to finance with a combination of additional funds from outsiders plus some money borrowed from banks. The new investors and banks require Hamdan to provide them with more organized and detailed financial statements than he has previously prepared. In order to do that, Hamdan has hired a financial analyst, her name is Maryam Ahmed (she holds a bachelor degree in finance from ADU University). He asked Maryam to evaluate the performance of the company over the past year. After going through all the bank statements, sales receipts, tax returns, and other records, Maryam has assembled the following information: Cost of goods sold $ $ 2019 283,281 34,394 71,584 Cash Depreciation Interest expense Selling & Administrative Accounts payable Fixed assets 15,780 57,586 2018 224,359 32,372 63,334 13,783 44,121 57,220 279.419 440,122 22.939 26,079 141,040 48,272 Sales Accounts receivable Notes payable Long-term debt Inventory New equity 63,479 348,508 536,483 29,755 28,474 158,368 66.244 27,157 Red Rose currently pays out 50 percent of net income as dividends to Hamdan and other original investors and has a 21 percent tax rate. You are working with Maryam, and she asked you to prepare the followings: 1. Income statement for 2018 and 2019. (4 marks) 2. A balance sheet for 2018 and 2019. (2 marks) 3. Operating cash flow for 2018 and 2019. (2 marks) 4. Cash flow from assets for 2019. (2 marks) 5. Cash flow to creditors for 2019. (2 marks) 6. Cash flow to stockholders for 2019. (2 marks)