Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 What's an Option Worth? Over the last few weeks we got into the habit of describing more complex financial instruments as collections of simpler

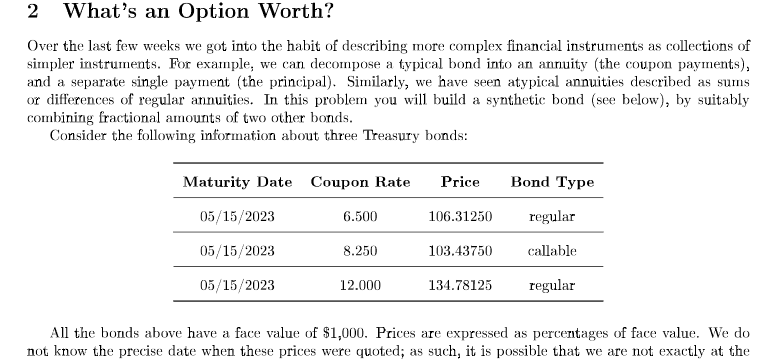

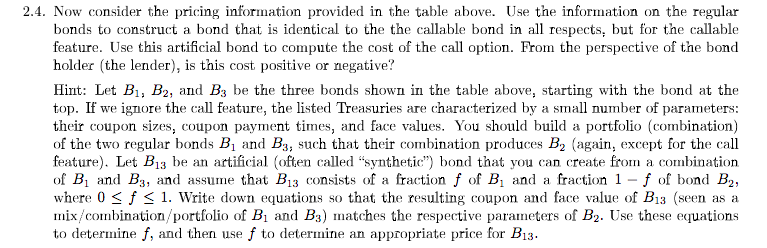

2 What's an Option Worth? Over the last few weeks we got into the habit of describing more complex financial instruments as collections of simpler instruments. For example, we can decompose a typical bond into an annuity (the coupon payments), and a separate single payment (the principal). Similarly, we have seen atypical annuities described as sums or differences of regular annuities. In this problem you will build a synthetic bond (see below), by suitably combining fractional amounts of two other bonds. Maturity Date Coupon Rate Price Bond Type 05/15/2023 6.500 05/15/2023 12.000 134.78125 regular All the bonds above have a face value of $1,000. Prices are expressed as percentages of face value. We do not know the precise date when these prices were quoted; as such, it is possible that we are not exactly at the beginning of a coupon period. We do know, however, that all coupon payment dates for all these bonds are the same; the coupons, of course, are not. The bond in the middle is a so-called callable bond, while the other two 2.4. Now consider the pricing information provided in the table above. Use the information on the regular feature. Use this artificial bond to compute the cost of the call option. From the perspective of the bond Hint: Let B1, B2, and By be the three bonds shown in the table above, starting with the bond at the top. If we ignore the call feature, the listed Treasuries are characterized by a small number of parameters: their coupon sizes, coupon payment times, and face values. You should build a portfolio (combination) of the two regular bonds B1 and B2, such that their combination produces B2 (again, except for the call feature). Let B13 be an artificial (often called "synthetic") bond that you can create from a combination of B1 and B3, and assume that B13 consists of a fraction f of B, and a fraction 1-f of bond B2, where 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started