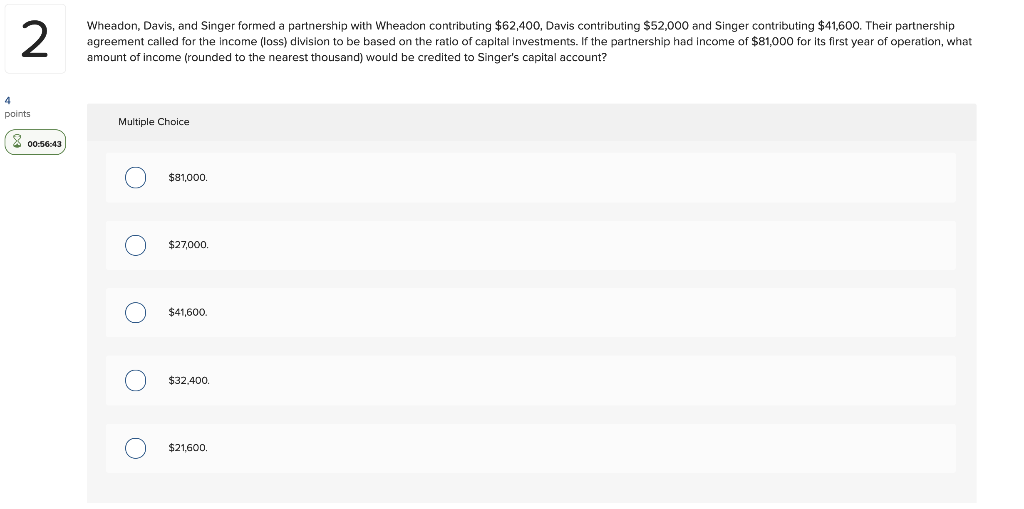

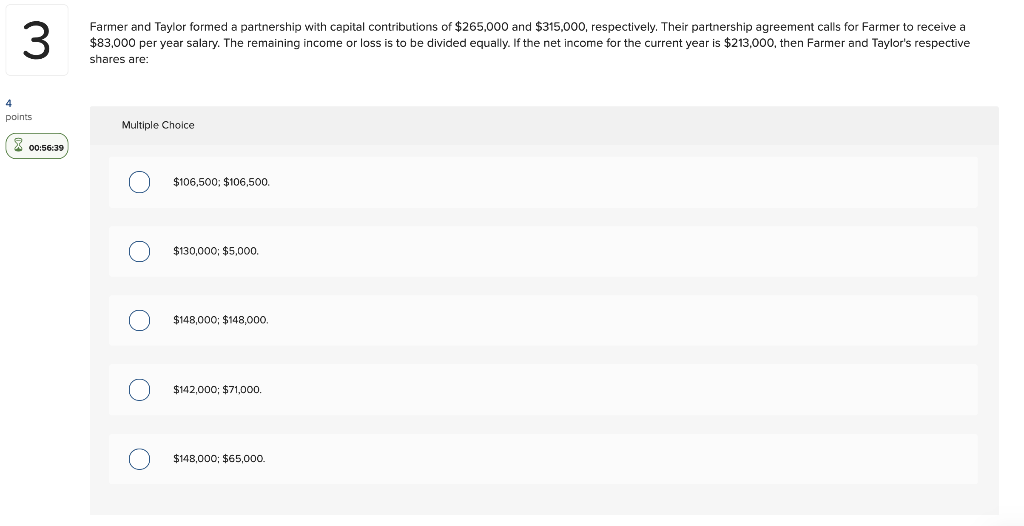

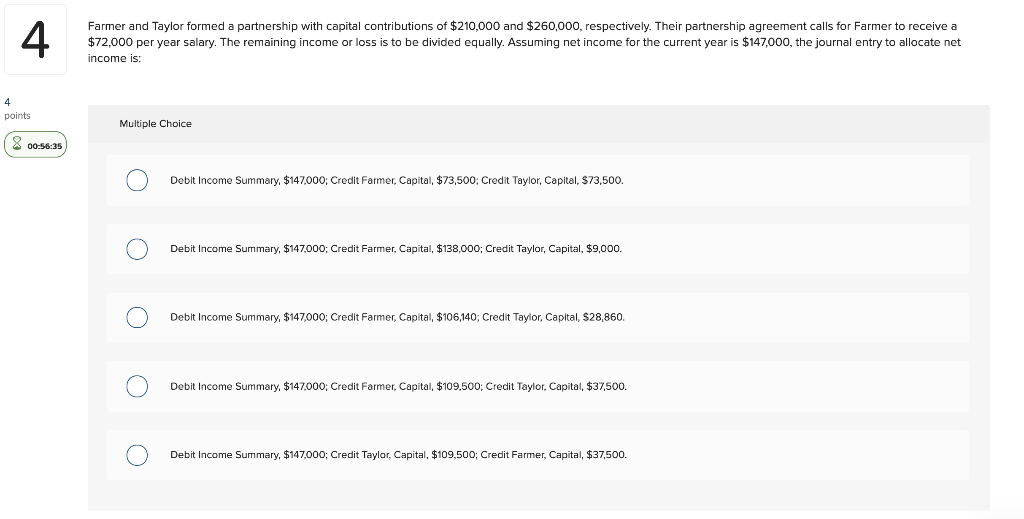

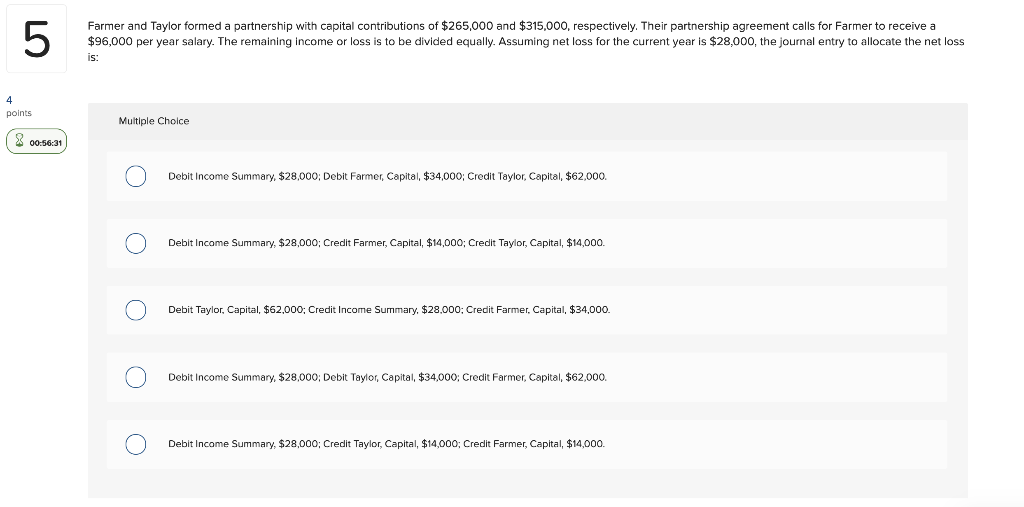

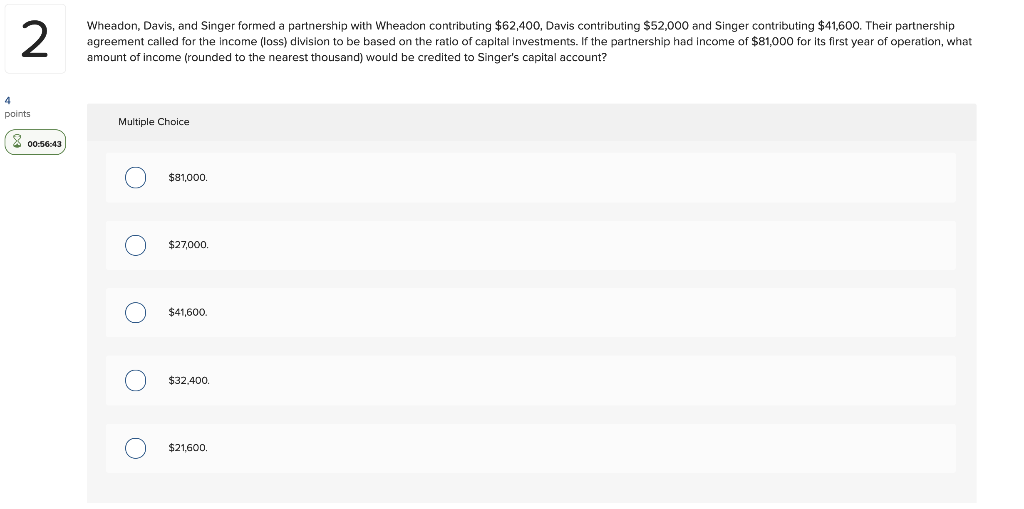

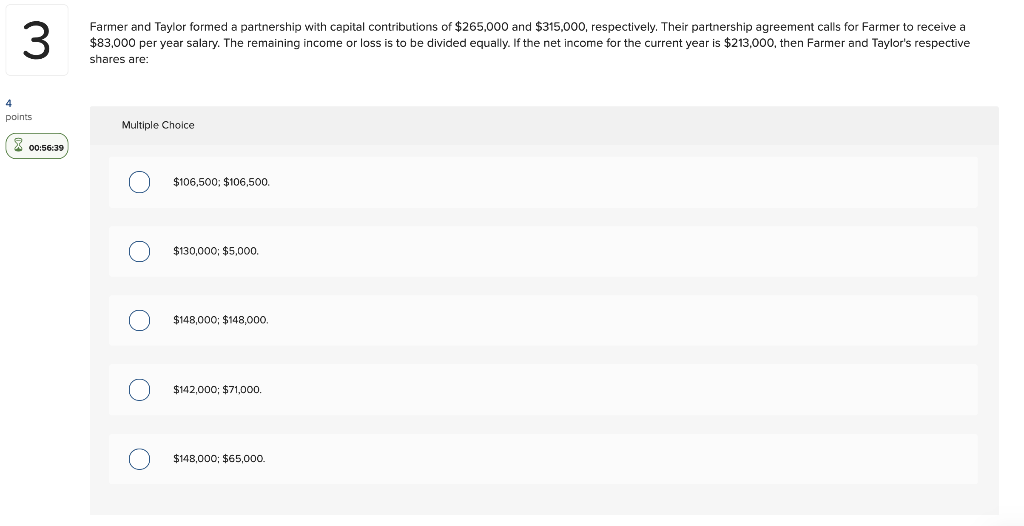

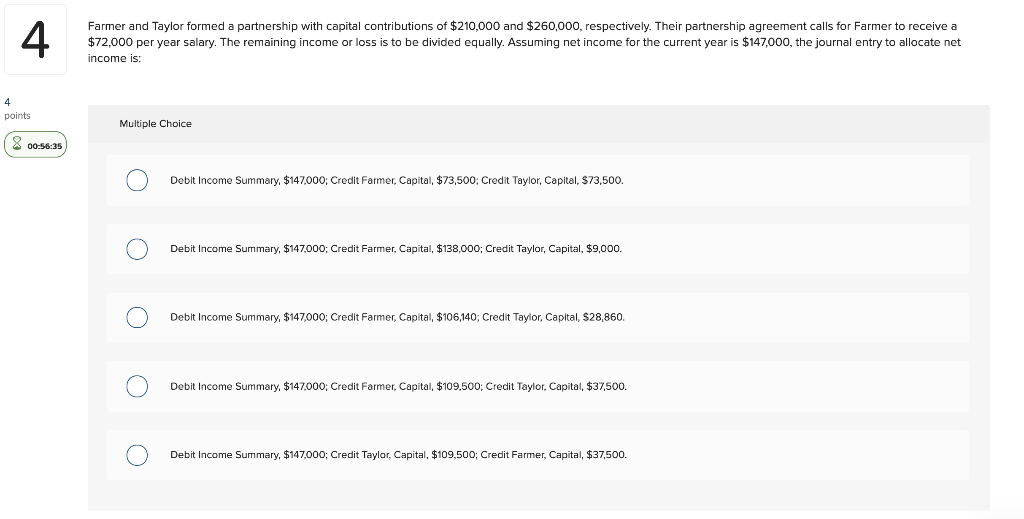

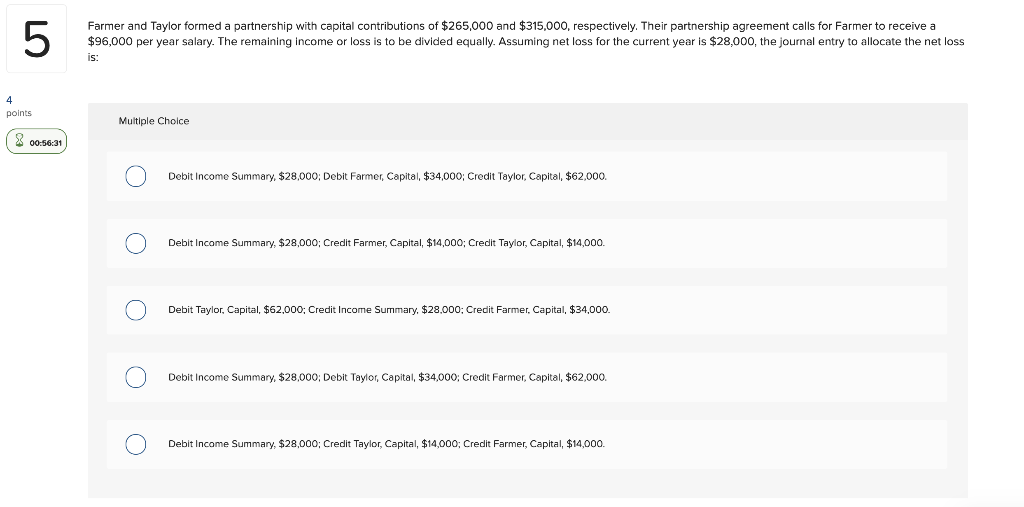

2 Wheadon, Davis, and Singer formed a partnership with Wheadon contributing $62,400, Davis contributing $52,000 and Singer contributing $41,600. Their partnership agreement called for the income (loss) division to be based on the ratio of capital investments. If the partnership had income of $81,000 for its first year of operation, what amount of income (rounded to the nearest thousand) would be credited to Singer's capital account? 4 points Multiple Choice 00:56:43 $81,000. $27000. $41,600 $32.400. $21,600 O 3 Farmer and Taylor formed a partnership with capital contributions of $265,000 and $315,000, respectively. Their partnership agreement calls for Farmer to receive a $83,000 per year salary. The remaining income or loss is to be divided equally. If the net income for the current year is $213,000, then Farmer and Taylor's respective shares are: 4 points Multiple Choice 00:56:39 $106,500; $106,500. $130,000; $5,000. $148,000; $148,000. $142,000; $71,000. $148,000; $65,000. 4 Farmer and Taylor formed a partnership with capital contributions of $210,000 and $260,000, respectively. Their partnership agreement calls for Farmer to receive a $72,000 per year salary. The remaining income or loss is to be divided equally. Assuming net income for the current year is $147,000, the journal entry to allocate net income is: points Multiple Choice 00:56:35 Debit Income Summary, $147,000; Credit Farmer, Capital, $73,500; Credit Taylor, Capital, $73,500. Debit Income Summary, $147,0o0; Credit Farmer, Capital, $138,000; Credit Taylor, Capital, $9,00oo. Debit Income Summary, $147,0000; Credit Farmer, Capital, $106,140; Credit Taylor, Capital, $28,860. Debit Income Summary, $147,0o0; Credit Farmer, Capital, $109,500; Credit Taylor, Capital, $37,500. Debit Income Summary, $147,000; Credit Taylor, Capital, $109,500; Credit Farmer, Capital, $37,500. O Farmer and Taylor formed a partnership with capital contributions of $265,000 and $315,000, respectively. Their partnership agreement calls for Farmer to receive a $96,000 per year salary. The remaining income or loss is to be divided equally. Assuming net loss for the current year is $28,000, the journal entry to allocate the net loss IS. 4 points Multiple Choice oo:56:31 Debit Income Summary, $28,000; Debit Farmer, Capital, $34,000; Credit Taylor, Capital, $62,000. Debit Income Summary, $28,000; Credit Farmer, Capital, $14,000; Credit Taylor, Capital, $14,000. Debit Taylor, Capital, $62,000; Credit Income Summary, $28,000; Credit Farmer, Capital, $34,000 Debit Income Summary, $28,000; Debit Taylor, Capital, $34,000; Credit Farmer, Capital, $62,000. Debit Income Summary, $28,000; Credit Taylor, Capital, $14,000; Credit Farmer, Capital, $14,000. LO