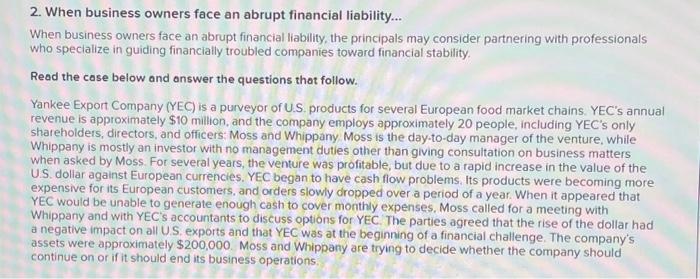

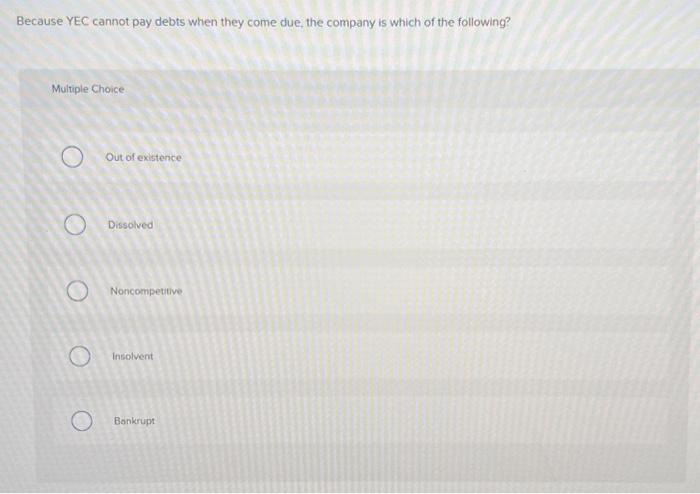

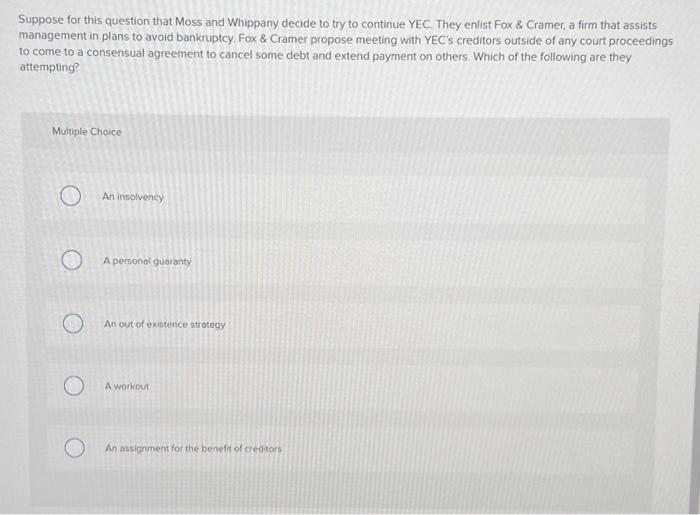

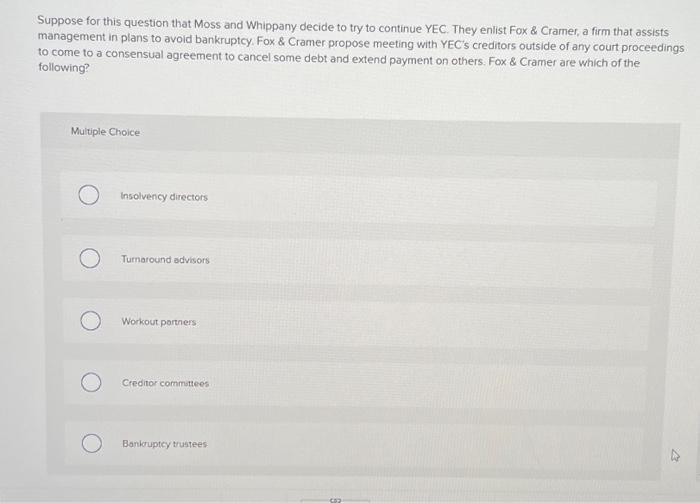

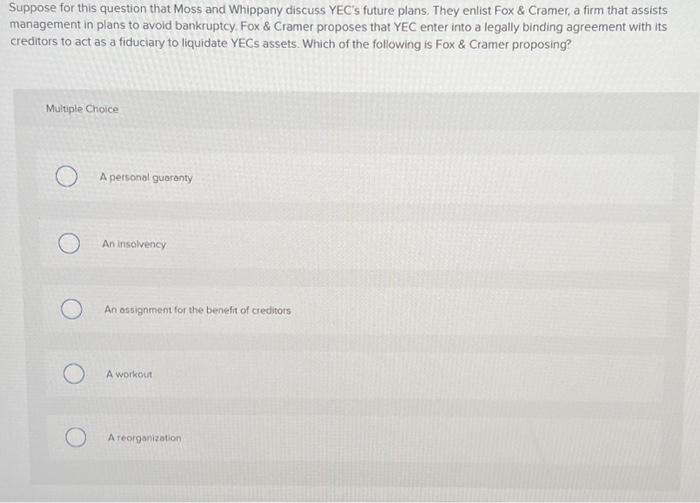

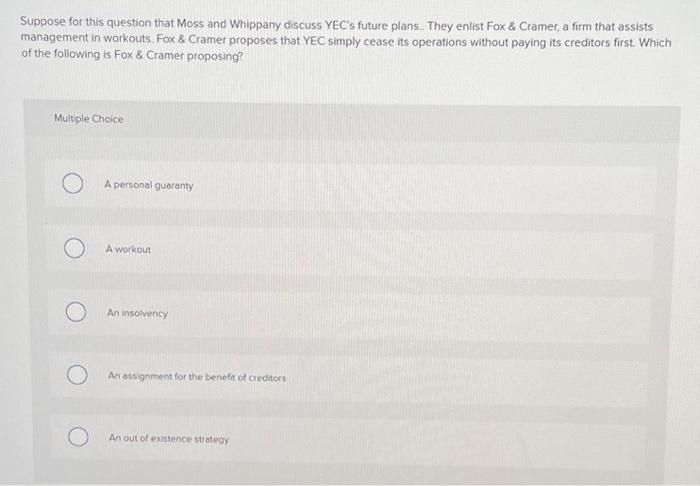

2. When business owners face an abrupt financial liability... When business owners face an abrupt financial liability, the principals may consider partnering with professionals who specialize in guiding financially troubled companies toward financial stability. Read the case below and answer the questions that follow. Yankee Export Company (YEC) is a purveyor of U.S. products for several European food market chains. YEC's annual revenue is approximately $10 million, and the company empioys approximately 20 people, including YEC's only shareholders, directors, and officers: Moss and Whippany Moss is the day-to-day manager of the venture, while Whippany is mostly an investor with no management duties other than giving consultation on business matters when asked by Moss. For several years, the venture was profitable, but due to a rapid increase in the value of the US. dollar against European currencies. YEC began to have cash flow problems. Its products were becoming more expensive for its European customers, and orders slowly dropped over a period of a year. When it appeared that YEC would be unable to generate enough cash to cover monthly expenses. Moss called for a meeting with Whippany and with YEC's accountants to discuss options for YEC. The parties agreed that the rise of the dollar had a negative impact on all US, exports and that YEC was at the beginning of a financial challenge. The company's assets were approximately $200,000. Moss and Whippany are trying to decide whether the company should continue on or if it should end its business operations. Because YEC cannot pay debts when they come due, the company is which of the following? Multiple Choice Out of existence Dissolved Noncompetive Insolvent Bonkrupt Suppose for this question that Moss and Whippany decide to try to continue YEC. They enlist Fox \& Cramer, a firm that assists management in plans to avoid bankruptcy. Fox \& Cramer propose meeting with YEC's creditors outside of any court proceedings to come to a consensual agreement to cancel some debt and extend payment on others. Which of the following are they attempting? Multiple Choice An insolvency. A personol guasanty An out of existence strotegy A workou An ossignment for the benefit of cieditors Suppose for this question that Moss and Whippany decide to try to continue YEC. They enlist Fox \& Cramer, a firm that assists management in plans to avoid bankruptcy. Fox \& Cramer propose meeting with YEC's creditors outside of any court proceedings to come to a consensual agreement to cancel some debt and extend payment on others. Fox \& Cramer are which of the following? Multiple Choice Insolvency directors Tumaround advisors Workout partners Creditor committees Bankouptcy trustees Suppose for this question that Moss and Whippany discuss YEC's future plans. They enlist Fox \& Cramer, a firm that assists management in plans to avold bankruptcy. Fox \& Cramer proposes that YEC enter into a legally binding agreement with its creditors to act as a fiduciary to liquidate YECs assets. Which of the following is Fox \& Cramer proposing? Multiple Choice A personal guaranty An insolvency An ossignment for the benefit of creditors A workout A reorganization Suppose for this question that Moss and Whippany discuss YEC's future plans. They enlist Fox \& Cramer, a firm that assists management in workouts. Fox \& Cramer proposes that YEC simply cease its operations without paying its creditors first. Which of the following is Fox \& Cramer proposing? Multiple Choice A personal gueranty A workout An insolvency An ossignment for the benefit of creditors An out of existence strotegy