Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. When raising external capital is costly, how should the costs of issuing new stocks and bonds be considered? (Choose the right option) Add the

2. When raising external capital is costly, how should the costs of issuing new stocks and bonds be considered? (Choose the right option)

Add the external financing cost directly at period zero

Subtract the external financing costs directly at period zero and do not calculate WACC any differently.

Multiply the cost of equity and cost of debt by the external financing cost and then calculate WACC.

Subtract the external financing cost from the last period

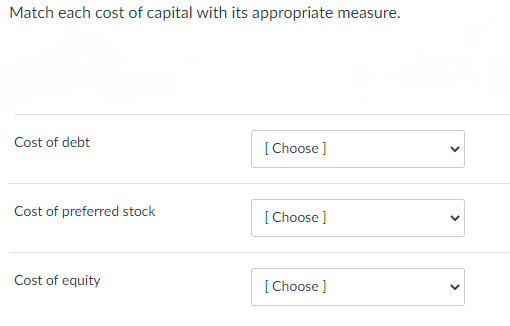

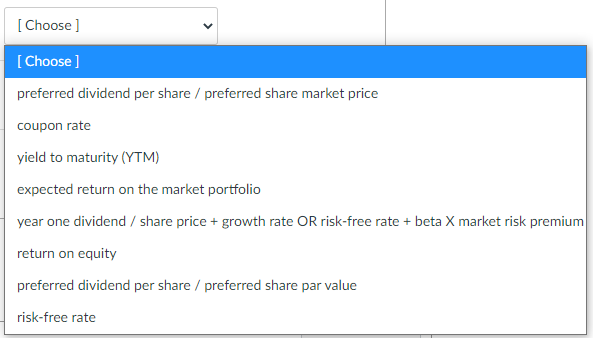

Match each cost of capital with its appropriate measure. Cost of debt [Choose ] Cost of preferred stock [Choose ] Cost of equity [Choose ] [Choose ] [Choose] preferred dividend per share/preferred share market price coupon rate yield to maturity (YTM) expected return on the market portfolio year one dividend / share price + growth rate OR risk-free rate + beta X market risk premium return on equity preferred dividend per share / preferred share par value risk-free rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started