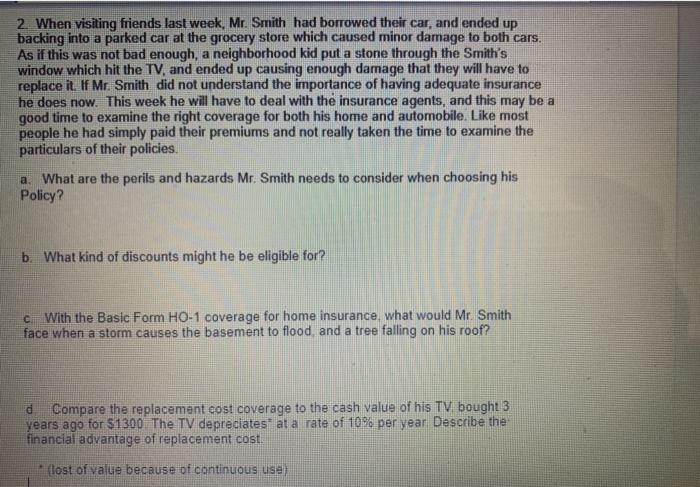

2. When visiting friends last week, Mr. Smith had borrowed their car, and ended up backing into a parked car at the grocery store which caused minor damage to both cars. As if this was not bad enough, a neighborhood kid put a stone through the Smith's window which hit the TV, and ended up causing enough damage that they will have to replace it. If Mr. Smith did not understand the importance of having adequate insurance he does now. This week he will have to deal with the insurance agents, and this may be a good time to examine the right coverage for both his home and automobile. Like most people he had simply paid their premiums and not really taken the time to examine the particulars of their policies. a. What are the perils and hazards Mr. Smith needs to consider when choosing his Policy? b. What kind of discounts might he be eligible for? c. With the Basic Form HO-1 coverage for home insurance, what would Mr. Smith face when a storm causes the basement to flood, and a tree falling on his roof? d Compare the replacement cost coverage to the cash value of his TV bought 3 years ago for $1300 The TV depreciates at a rate of 10% per year Describe the financial advantage of replacement cost. (lost of value because of continuous use) 2. When visiting friends last week, Mr. Smith had borrowed their car, and ended up backing into a parked car at the grocery store which caused minor damage to both cars. As if this was not bad enough, a neighborhood kid put a stone through the Smith's window which hit the TV, and ended up causing enough damage that they will have to replace it. If Mr. Smith did not understand the importance of having adequate insurance he does now. This week he will have to deal with the insurance agents, and this may be a good time to examine the right coverage for both his home and automobile. Like most people he had simply paid their premiums and not really taken the time to examine the particulars of their policies. a. What are the perils and hazards Mr. Smith needs to consider when choosing his Policy? b. What kind of discounts might he be eligible for? c. With the Basic Form HO-1 coverage for home insurance, what would Mr. Smith face when a storm causes the basement to flood, and a tree falling on his roof? d Compare the replacement cost coverage to the cash value of his TV bought 3 years ago for $1300 The TV depreciates at a rate of 10% per year Describe the financial advantage of replacement cost. (lost of value because of continuous use)