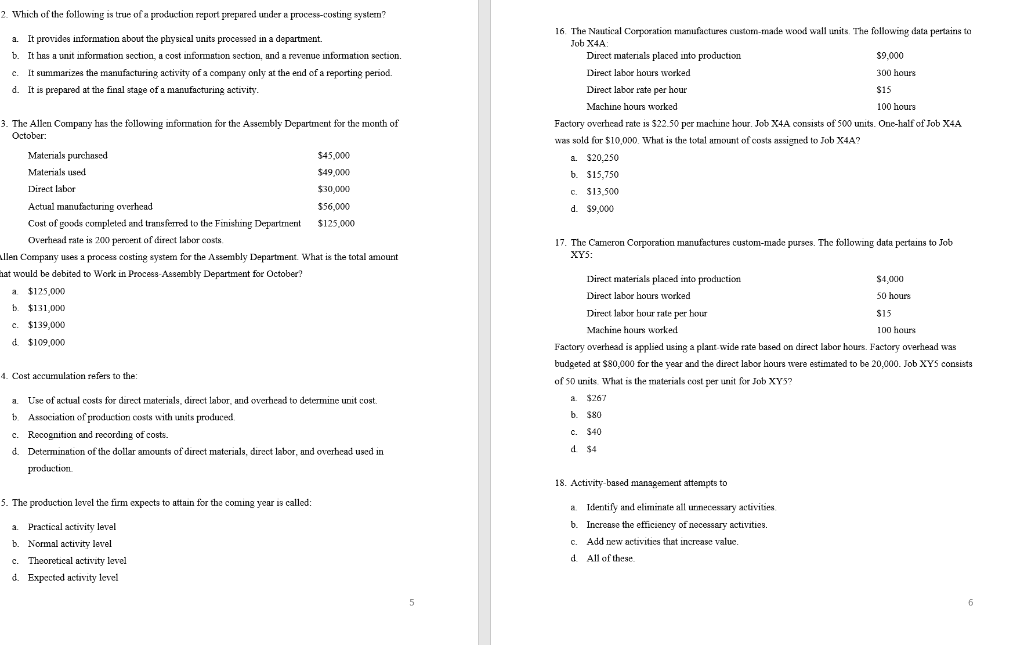

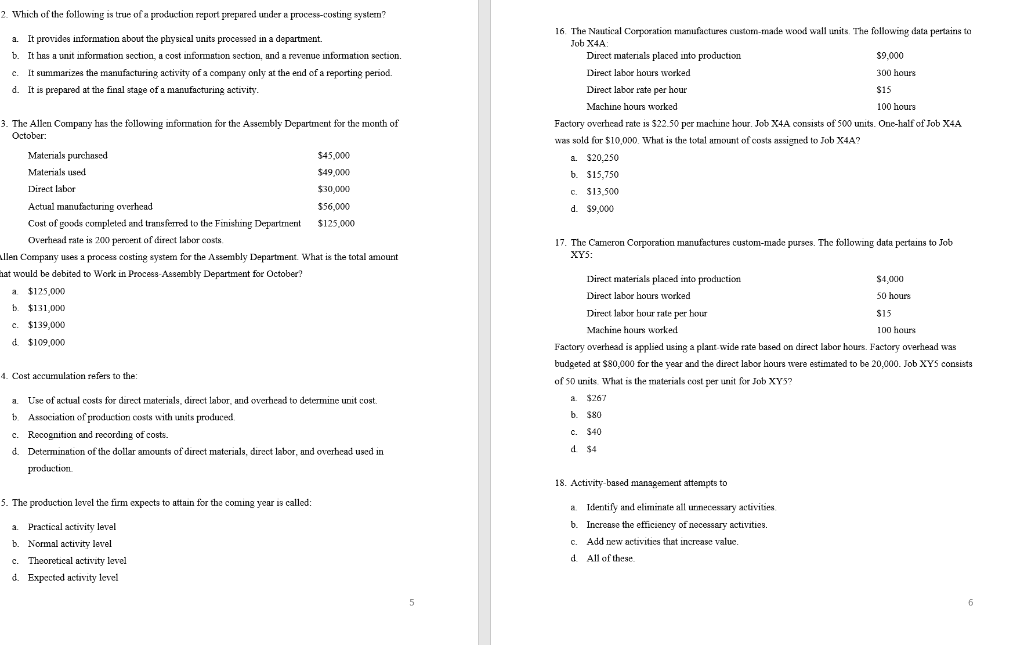

2. Which of the following is true of a preluction report prepared under a process-costing system? a. It provides information about the physical units processed in a department. b. It has a unit information section, a cost information section, and a revenue information section. c. It summarizes the manufacturing activity of a company only at the end of a reporting period. d. It is prepared at the final stage of a manufacturing activity. $15 16. The Nautical Corporation manufactures custom-made wood wall units. The following data pertains to Job X4A Direct materials placed into production $9,000 Direct labor hours worked 300 hours Direct labor rate per hour Machine hours worked 100 hours Factory overticad rate is 522.50 per machine hour. Job X4A consists of 500 units. One-half of Job X4A was sold for $10,000. What is the total amount of costs assigned to Job X4A? a. $20,250 b. 515,750 c. $13,500 d. $9,000 3. The Allen Company has the following information for the Assembly Department for the month of October: Materials purchased $45.000 Materials used $49,000 Direct labor $30,000 Actual manufacturing overhead $56,000 Cost of gooxts completed and transferred to the Finishing Department $125.000 Overhead rate is 200 percent of direct labor costs llen Company uses a process costing system for the Assembly Department. What is the total amount that would be debited to Work in Process Assembly Department for October a $125,000 b. $131,000 c. $139,000 d $109,000 17. The Cameron Corporation manufactures custom-made purses. The following data pertains to Job XY5: $15 Direct materials placed into production $4,000 Direct labor hours worked 50 hours Direct labor hour rate per hour Machine hours worked 100 hours Factory overhead is applied using a plant wide rate based on direct labor hours. Factory overhead was budgeted at $80,000 for the year and the direct labor hours were estimated to be 20,000. Job XYS consists of 50 units What is the materials cost per unit for Job XY5? a $267 b. $80 c. $40 4. Cost accumulation refers to the: a. Use of actual costs for direct materials, direct labor, and overhead to determine unit cost. b. Association of production costs with units produced c. Recognition and recording of costs. d. Determination of the dollar amounts of direct matcrials, direct labor, and overhead used in production 18. Activity-based management attempts to 5. The production level the firm expects to attain for the coming year is called: a. Practical activity level b. Normal activity level c. Theoretical activity level d Expected activity level a Tulentify and eliminate all unnecessary activities b. Increase the efficiency of necessary activities. c. Add new activities that increase value. d. All of these 2. Which of the following is true of a preluction report prepared under a process-costing system? a. It provides information about the physical units processed in a department. b. It has a unit information section, a cost information section, and a revenue information section. c. It summarizes the manufacturing activity of a company only at the end of a reporting period. d. It is prepared at the final stage of a manufacturing activity. $15 16. The Nautical Corporation manufactures custom-made wood wall units. The following data pertains to Job X4A Direct materials placed into production $9,000 Direct labor hours worked 300 hours Direct labor rate per hour Machine hours worked 100 hours Factory overticad rate is 522.50 per machine hour. Job X4A consists of 500 units. One-half of Job X4A was sold for $10,000. What is the total amount of costs assigned to Job X4A? a. $20,250 b. 515,750 c. $13,500 d. $9,000 3. The Allen Company has the following information for the Assembly Department for the month of October: Materials purchased $45.000 Materials used $49,000 Direct labor $30,000 Actual manufacturing overhead $56,000 Cost of gooxts completed and transferred to the Finishing Department $125.000 Overhead rate is 200 percent of direct labor costs llen Company uses a process costing system for the Assembly Department. What is the total amount that would be debited to Work in Process Assembly Department for October a $125,000 b. $131,000 c. $139,000 d $109,000 17. The Cameron Corporation manufactures custom-made purses. The following data pertains to Job XY5: $15 Direct materials placed into production $4,000 Direct labor hours worked 50 hours Direct labor hour rate per hour Machine hours worked 100 hours Factory overhead is applied using a plant wide rate based on direct labor hours. Factory overhead was budgeted at $80,000 for the year and the direct labor hours were estimated to be 20,000. Job XYS consists of 50 units What is the materials cost per unit for Job XY5? a $267 b. $80 c. $40 4. Cost accumulation refers to the: a. Use of actual costs for direct materials, direct labor, and overhead to determine unit cost. b. Association of production costs with units produced c. Recognition and recording of costs. d. Determination of the dollar amounts of direct matcrials, direct labor, and overhead used in production 18. Activity-based management attempts to 5. The production level the firm expects to attain for the coming year is called: a. Practical activity level b. Normal activity level c. Theoretical activity level d Expected activity level a Tulentify and eliminate all unnecessary activities b. Increase the efficiency of necessary activities. c. Add new activities that increase value. d. All of these