2.

2.

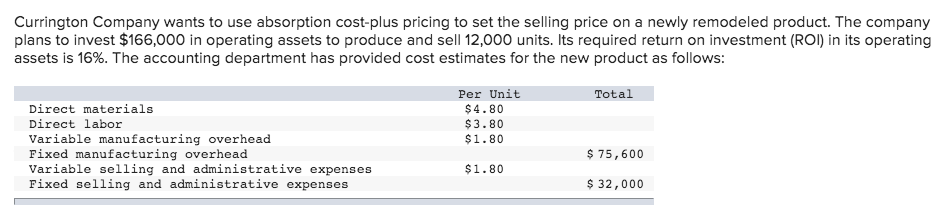

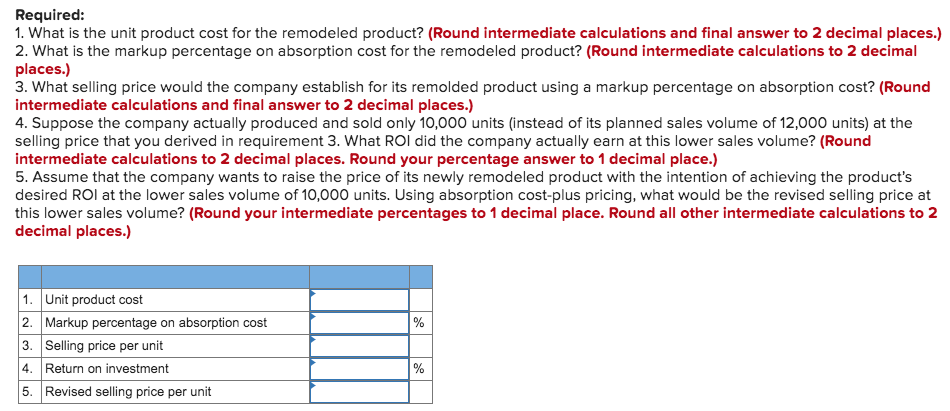

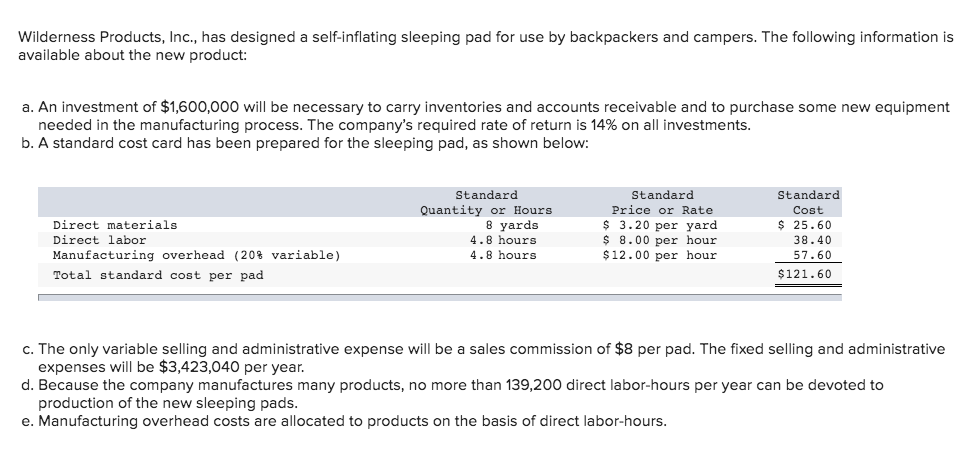

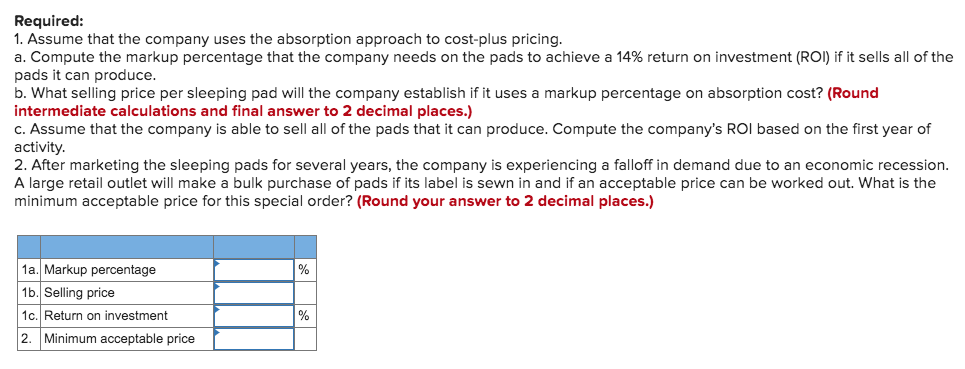

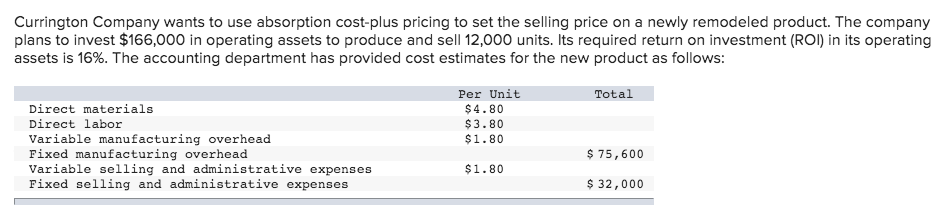

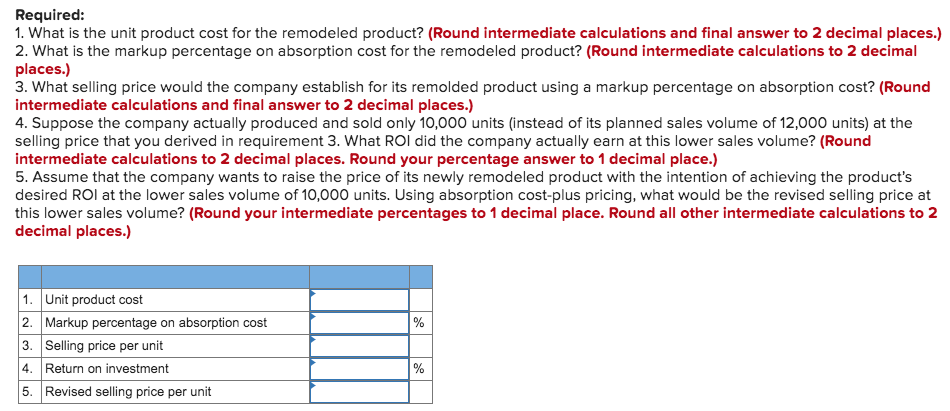

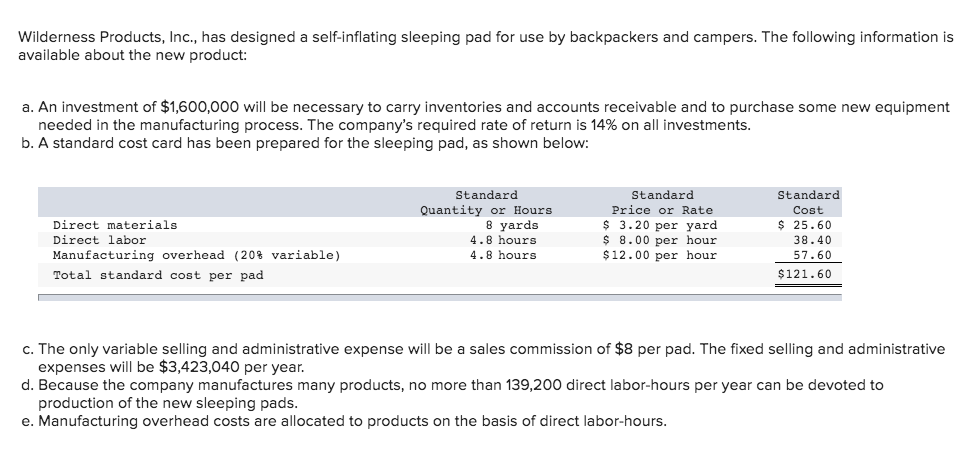

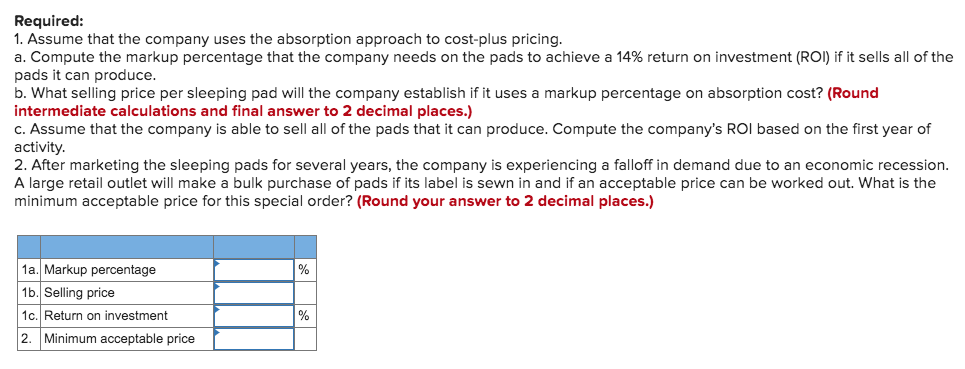

Wilderness Products, Inc., has designed a self-inflating sleeping pad for use by backpackers and campers. The following information is available about the new product: a. An investment of $1,600,000 will be necessary to carry inventories and accounts receivable and to purchase some new equipment needed in the manufacturing process. The company's required rate of return is 14% on all investments. b. A standard cost card has been prepared for the sleeping pad, as shown below: Direct materials Direct labor Manufacturing overhead (20% variable) Total standard cost per pad Standard Quantity or Hours 8 yards 4.8 hours 4.8 hours Standard Price or Rate $ 3.20 per yard $ 8.00 per hour $12.00 per hour Standard Cost $ 25.60 38.40 57.60 $121.60 c. The only variable selling and administrative expense will be a sales commission of $8 per pad. The fixed selling and administrative expenses will be $3,423,040 per year. d. Because the company manufactures many products, no more than 139,200 direct labor-hours per year can be devoted to production of the new sleeping pads. e. Manufacturing overhead costs are allocated to products on the basis of direct labor-hours. Currington Company wants to use absorption cost-plus pricing to set the selling price on a newly remodeled product. The company plans to invest $166,000 in operating assets to produce and sell 12,000 units. Its required return on investment (ROI) in its operating assets is 16%. The accounting department has provided cost estimates for the new product as follows: Total Per Unit $4.80 $3.80 $1.80 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $ 75,600 $1.80 $ 32,000 Required: 1. What is the unit product cost for the remodeled product? (Round intermediate calculations and final answer to 2 decimal places.) 2. What is the markup percentage on absorption cost for the remodeled product? (Round intermediate calculations to 2 decimal places.) 3. What selling price would the company establish for its remolded product using a markup percentage on absorption cost? (Round intermediate calculations and final answer to 2 decimal places.) 4. Suppose the company actually produced and sold only 10,000 units (instead of its planned sales volume of 12,000 units) at the selling price that you derived in requirement 3. What ROI did the company actually earn at this lower sales volume? (Round intermediate calculations to 2 decimal places. Round your percentage answer to 1 decimal place.) 5. Assume that the company wants to raise the price of its newly remodeled product with the intention of achieving the product's desired ROI at the lower sales volume of 10,000 units. Using absorption cost-plus pricing, what would be the revised selling price at this lower sales volume? (Round your intermediate percentages to 1 decimal place. Round all other intermediate calculations to 2 decimal places.) 1. Unit product cost 2. Markup percentage on absorption cost 3. Selling price per unit Return on investment 5. Revised selling price per unit

2.

2.