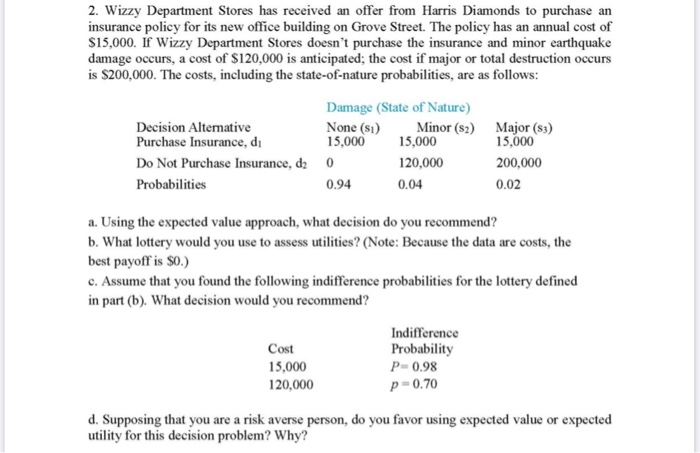

2. Wizzy Department Stores has received an offer from Harris Diamonds to purchase an insurance policy for its new office building on Grove Street. The policy has an annual cost of $15,000. If Wizzy Department Stores doesn't purchase the insurance and minor earthquake damage occurs, a cost of $120,000 is anticipated; the cost if major or total destruction occurs is $200,000. The costs, including the state-of-nature probabilities, are as follows: Damage (State of Nature) Decision Alternative None (81) Minor (82) Major (83) Purchase Insurance, di 15,000 15,000 15,000 Do Not Purchase Insurance, dz 0 120,000 200,000 Probabilities 0.94 0.04 0.02 a. Using the expected value approach, what decision do you recommend? b. What lottery would you use to assess utilities? (Note: Because the data are costs, the best payoff is $0.) c. Assume that you found the following indifference probabilities for the lottery defined in part (b). What decision would you recommend? Indifference Cost Probability 15,000 P-0.98 120,000 p=0.70 d. Supposing that you are a risk averse person, do you favor using expected value or expected utility for this decision problem? Why? 2. Wizzy Department Stores has received an offer from Harris Diamonds to purchase an insurance policy for its new office building on Grove Street. The policy has an annual cost of $15,000. If Wizzy Department Stores doesn't purchase the insurance and minor earthquake damage occurs, a cost of $120,000 is anticipated; the cost if major or total destruction occurs is $200,000. The costs, including the state-of-nature probabilities, are as follows: Damage (State of Nature) Decision Alternative None (81) Minor (82) Major (83) Purchase Insurance, di 15,000 15,000 15,000 Do Not Purchase Insurance, dz 0 120,000 200,000 Probabilities 0.94 0.04 0.02 a. Using the expected value approach, what decision do you recommend? b. What lottery would you use to assess utilities? (Note: Because the data are costs, the best payoff is $0.) c. Assume that you found the following indifference probabilities for the lottery defined in part (b). What decision would you recommend? Indifference Cost Probability 15,000 P-0.98 120,000 p=0.70 d. Supposing that you are a risk averse person, do you favor using expected value or expected utility for this decision problem? Why