Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 X, Y and Z support their mom who lives in Nursing Home. X pays 60% of her living expenses Y pays 30% of the

| 2 | X, Y and Z support their mom who lives in Nursing Home. X pays 60% of her living expenses | |||||||

| Y pays 30% of the expenses and Z pays 10% of the expenes. Any of X,Y and Z can claim | ||||||||

| her mom as a dependednt | ||||||||

| a | TRUE | |||||||

| b | FALSE | |||||||

| 3 | X and Y are married. They want to file separate returns. X wants to use standard deduction | |||||||

| while Y wants to use itemized deductions. | ||||||||

| a | TRUE | |||||||

| b | FALSE | |||||||

| 4 | X borrowes money to buy mortgage bonds issued by City of Houson. He paid $15,000 | |||||||

| interest in 2022 to buy these bonds. He can deductt $15,000 as an itemized deductio | ||||||||

| on his tax return | ||||||||

| a | TRUE | |||||||

| b | FALSE | |||||||

| 5 | To qualify for foreign eaned income exclusion, you must stay and work in foreign country | |||||||

| for 325 days | ||||||||

| a | TRUE | |||||||

| b | FALSE | |||||||

| 6 | John rented his home in Houston during Super Bowl for eight days in 2022 and eaned $12,000 | |||||||

| He must report income on his tax return for 2022 | ||||||||

| a | TRUE | |||||||

| b | FALSE | |||||||

| 7 | On March 1, 2022 John prepaid rent expenses on his rented office for one year ending on | |||||||

| Feb 28, 2023. On his tax reurn for 2023, he can deduct rent expense for two months | ||||||||

| a | TRUE | |||||||

| b | FALSE | |||||||

| 8 | Certain personal expenses may be dedutible for tax purpose | |||||||

| a | TRUE | |||||||

| b | FALSE | |||||||

| M/C | ||||||||

| 9 | QBI deductions are | |||||||

| a | Deduction for AGI | |||||||

| b | Deduction from AGI | |||||||

| c | Not deductible | |||||||

| d | None of the above | |||||||

| 10 | Investment interest expenses are | |||||||

| a | Deduction from AGI | |||||||

| b | Deduction for AGI | |||||||

| c | Not deductible | |||||||

| d | None of the above |

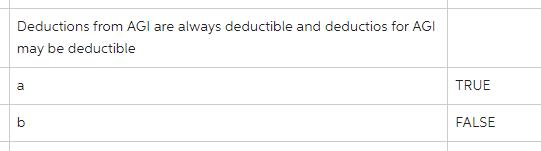

Deductions from AGI are always deductible and deductios for AGI may be deductible a b TRUE FALSE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 b False Deductions from AGI are not always deductible Deductions for AGI may be deducti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started