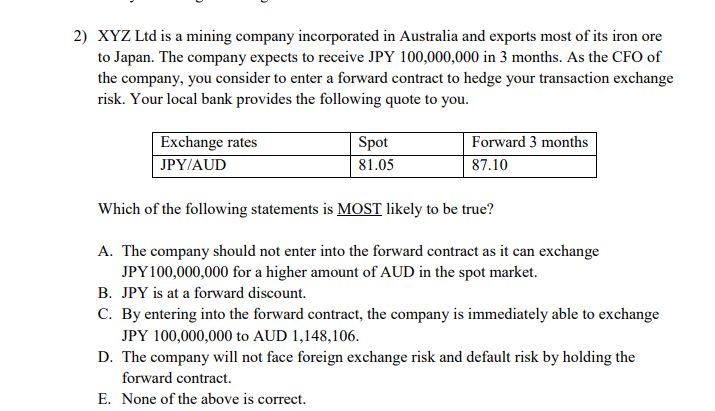

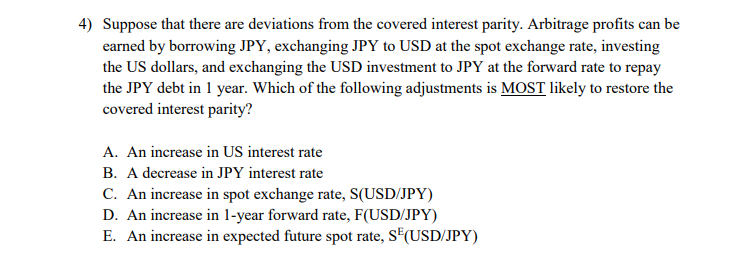

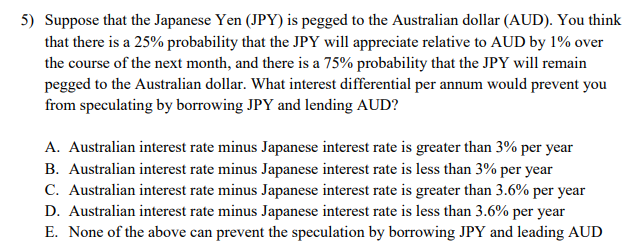

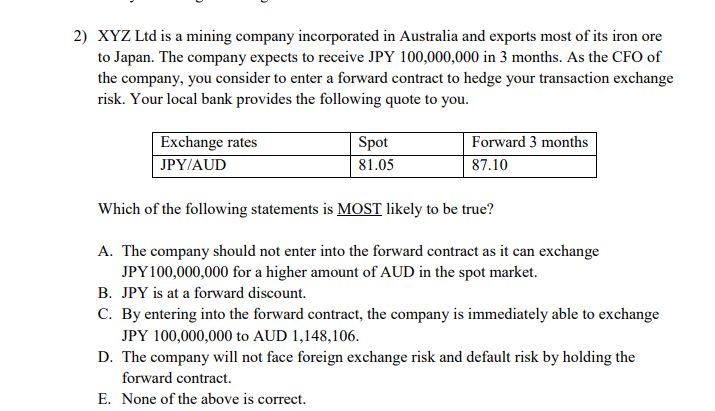

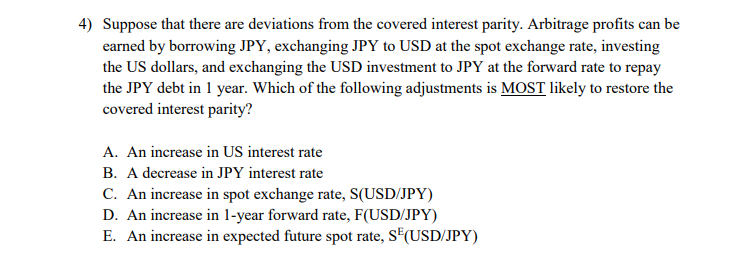

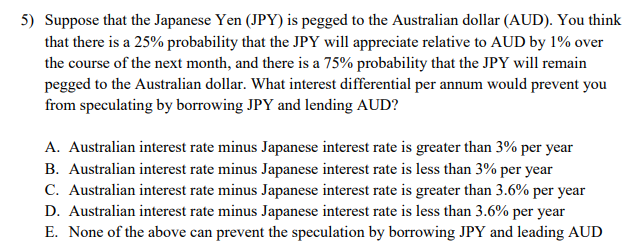

2) XYZ Ltd is a mining company incorporated in Australia and exports most of its iron ore to Japan. The company expects to receive JPY 100,000,000 in 3 months. As the CFO of the company, you consider to enter a forward contract to hedge your transaction exchange risk. Your local bank provides the following quote to you. Exchange rates JPY/AUD Spot 81.05 Forward 3 months 87.10 Which of the following statements is MOST likely to be true? A. The company should not enter into the forward contract as it can exchange JPY100,000,000 for a higher amount of AUD in the spot market. B. JPY is at a forward discount. C. By entering into the forward contract, the company is immediately able to exchange JPY 100,000,000 to AUD 1,148,106. D. The company will not face foreign exchange risk and default risk by holding the forward contract. E. None of the above is correct. 4) Suppose that there are deviations from the covered interest parity. Arbitrage profits can be earned by borrowing JPY, exchanging JPY to USD at the spot exchange rate, investing the US dollars, and exchanging the USD investment to JPY at the forward rate to repay the JPY debt in 1 year. Which of the following adjustments is MOST likely to restore the covered interest parity? A. An increase in US interest rate B. A decrease in JPY interest rate C. An increase in spot exchange rate, S(USD/JPY) D. An increase in 1-year forward rate, F(USD/JPY) E. An increase in expected future spot rate, SF(USD/JPY) 5) Suppose that the Japanese Yen (JPY) is pegged to the Australian dollar (AUD). You think that there is a 25% probability that the JPY will appreciate relative to AUD by 1% over the course of the next month, and there is a 75% probability that the JPY will remain pegged to the Australian dollar. What interest differential per annum would prevent you from speculating by borrowing JPY and lending AUD? A. Australian interest rate minus Japanese interest rate is greater than 3% per year B. Australian interest rate minus Japanese interest rate is less than 3% per year C. Australian interest rate minus Japanese interest rate is greater than 3.6% per year D. Australian interest rate minus Japanese interest rate is less than 3.6% per year E. None of the above can prevent the speculation by borrowing JPY and leading AUD