Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. You are assigned to evaluate the proposed acquisition of an equipment, which has a base priceof $1,550,000, for supporting a 2 -year expansion project.

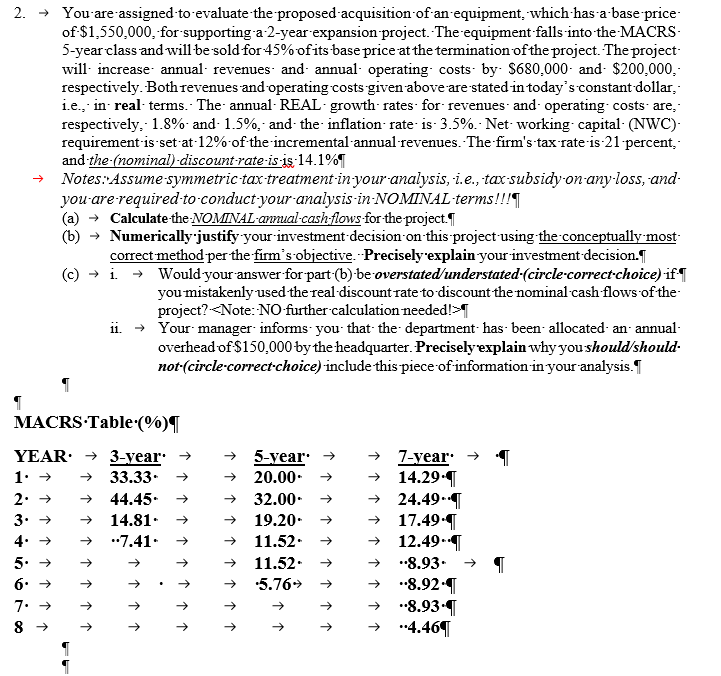

2. You are assigned to evaluate the proposed acquisition of an equipment, which has a base priceof $1,550,000, for supporting a 2 -year expansion project. The equipment falls into the MACRS 5 -year class and will be sold for 45% of its base price at the termination of the project. The projectwill increase annual revenues and annual operating costs by $680,000 and $200,000. respectively. Both revenues and operating costs given above are stated in today's constant dollar; i.e., in real- terms. The annual-REAL-growth - rates for revenues and operating costs are, respectively, 1.8% and 1.5%, and the inflation rate is 3.5%. Net working capital (NWC). requirement is set at 12% of the incremental annual revenues. The firm's tax rate is 21 percent. and the (nominal) -discount -rate-is-is 14.1% - Notes: Assume symmetric-tax-treatment in your analysis, i.e., tax subsidy on any-loss, andyou-are-required-to-conduct-your-analysis-in-NOMINAL-terms!!! (a) Calculate-the NOMINAL-ammal-cash-flows for the project. 1 (b) Numerically justify your - investment-decision -on this project using the conceptually mostcorrect method per the firm's objective. - Precisely explain your investment decision. (c) i. Would your answer for part-(b) be overstated understated ( circle correct choice) if you mistakenly used the real discount rate to discount the nominal cash flows of the project? F ii. Your-manager-informs-you- that the- department has been allocated an- annualoverhead of $150,000 by the headquarter. Precisely explain why you should/should . not (circle -correct.choice) include this piece of information in your analysis. MACRSTable(\%) \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline YEAR & & 3-year. & & & 5-year. & & & 7-year \\ \hline 1. & & 33.33. & & & 20.00 & & & 14.299 \\ \hline 2. & & 44.45 & & & 32.00 & & & 24.49T \\ \hline 3. & & 14.81* & & & 19.20 . & & & 17.49T \\ \hline 4. & & 7.41 & & & 11.52 & & & 12.49 \\ \hline 5. & & & & & 11.52 & & & .8.93 \\ \hline 6 & & & & & 5.76 & & & 8.929 \\ \hline 7. & & & & & & & & 8.939 \\ \hline 8 & & & & & & & & 4.469 \\ \hline \end{tabular}

2. You are assigned to evaluate the proposed acquisition of an equipment, which has a base priceof $1,550,000, for supporting a 2 -year expansion project. The equipment falls into the MACRS 5 -year class and will be sold for 45% of its base price at the termination of the project. The projectwill increase annual revenues and annual operating costs by $680,000 and $200,000. respectively. Both revenues and operating costs given above are stated in today's constant dollar; i.e., in real- terms. The annual-REAL-growth - rates for revenues and operating costs are, respectively, 1.8% and 1.5%, and the inflation rate is 3.5%. Net working capital (NWC). requirement is set at 12% of the incremental annual revenues. The firm's tax rate is 21 percent. and the (nominal) -discount -rate-is-is 14.1% - Notes: Assume symmetric-tax-treatment in your analysis, i.e., tax subsidy on any-loss, andyou-are-required-to-conduct-your-analysis-in-NOMINAL-terms!!! (a) Calculate-the NOMINAL-ammal-cash-flows for the project. 1 (b) Numerically justify your - investment-decision -on this project using the conceptually mostcorrect method per the firm's objective. - Precisely explain your investment decision. (c) i. Would your answer for part-(b) be overstated understated ( circle correct choice) if you mistakenly used the real discount rate to discount the nominal cash flows of the project? F ii. Your-manager-informs-you- that the- department has been allocated an- annualoverhead of $150,000 by the headquarter. Precisely explain why you should/should . not (circle -correct.choice) include this piece of information in your analysis. MACRSTable(\%) \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline YEAR & & 3-year. & & & 5-year. & & & 7-year \\ \hline 1. & & 33.33. & & & 20.00 & & & 14.299 \\ \hline 2. & & 44.45 & & & 32.00 & & & 24.49T \\ \hline 3. & & 14.81* & & & 19.20 . & & & 17.49T \\ \hline 4. & & 7.41 & & & 11.52 & & & 12.49 \\ \hline 5. & & & & & 11.52 & & & .8.93 \\ \hline 6 & & & & & 5.76 & & & 8.929 \\ \hline 7. & & & & & & & & 8.939 \\ \hline 8 & & & & & & & & 4.469 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started