Question

2. You are considering buying a vacation house as an investment property and want to estimate its value. For simplicity, assume all cash flows

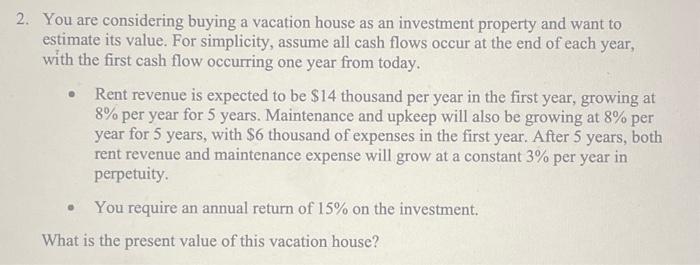

2. You are considering buying a vacation house as an investment property and want to estimate its value. For simplicity, assume all cash flows occur at the end of each year, with the first cash flow occurring one year from today. Rent revenue is expected to be $14 thousand per year in the first year, growing at 8% per year for 5 years. Maintenance and upkeep will also be growing at 8% per year for 5 years, with $6 thousand of expenses in the first year. After 5 years, both rent revenue and maintenance expense will grow at a constant 3% per year in perpetuity. You require an annual return of 15% on the investment. What is the present value of this vacation house?

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Calculating the Present Value of the Vacation House To determine the present valuewe need to conside...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

3rd edition

1119372933, 978-1119372936

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App